Following a Call for Input (CFI) that sought feedback on the promotion of consumer investments, the UK Financial Conduct Authority (FCA) has published its proposal designed to safeguard retail investors. The proposals in the Discussion Paper (DP) may impact new asset classes such as investment crowdfunding, crypto-assets, and peer-to-peer lending.

Sheldon Mills, Executive Director, Consumers and Competition at the FCA said they want to create a consumer investment market that works well for the millions of people who may benefit from it:

“We are concerned that too often consumers are investing in high-risk investments they don’t understand and can lead to significant and unexpected losses. We have already taken action by banning the mass-marketing of speculative mini-bonds. We continue to address harm in this market through our ongoing supervisory and enforcement action but recognise more needs to be done. Our latest proposals would further reduce the risk of people taking on inappropriate, high-risk investments that don’t meet their needs.”

The feedback to the DP may guide the rules the FCA plans to consult on later in the year.

The proposals target three different areas deemed to be high risk.

- The classification of high-risk investments: The FCA’s classification of investments determines the level of marketing restrictions that applies to that investment. The FCA is seeking views on whether more types of investments should be subject to marketing restrictions and what marketing restrictions should apply, for example for equity shares and Peer-to-Peer agreements.

- Further segmenting the high-risk investments market: The FCA is concerned that despite its existing marketing restrictions, too many consumers are still investing in inappropriate high-risk investments which do not meet their needs. Therefore, the FCA plans to strengthen its rules to further segment high-risk investments from other investments and is seeking views on how best to achieve this. The FCA is considering what improvements could be made to risk warnings, which are often perceived as white noise to many investors and often do not convey the genuine possibility of an investment loss. Other suggestions in the paper include requiring consumers to watch educational videos or to pass an online test to demonstrate sufficient knowledge about financial products. This could help prevent consumers from simply clicking through and accessing high-risk investments that they do not understand.

- The approval of financial promotions: Firms which approve financial promotions for unauthorised persons play a key role in ensuring those promotions meet the standards we expect. The FCA is seeking views on whether there should be more requirements for these firms to monitor a financial promotion on an ongoing basis, after approval, to ensure it remains clear, fair and not misleading.

The DP applies to the following list:

- consumers and consumer organisations

- authorised firms which approve financial promotions for unauthorised persons (section 21 approvers), whether for high-risk investments or otherwise

- issuers of non-mainstream pooled investments, speculative illiquid securities and non-readily realisable securities

- investment-based crowdfunding (IBCF) platforms and other intermediaries distributing investments to consumers

- peer-to-peer (P2P) platforms

- trade bodies for the IBCF and P2P sectors

- issuers of listed or exchange-traded securities, and trade bodies for these issuers

- investment companies, and trade bodies for this sector

- issuers of other types of investments

- firms operating in the cryptoassets market

- financial advisers

The FCA notes that higher-risk investments may cause consumers to lose money. The regulator believes that:

“…retail investors’ needs can and should be met by straightforward, mass-market investments. However, we recognise that higher-risk investments can have a place in a well-functioning consumer investment market for those consumers who understand the risks and can absorb potential losses.”

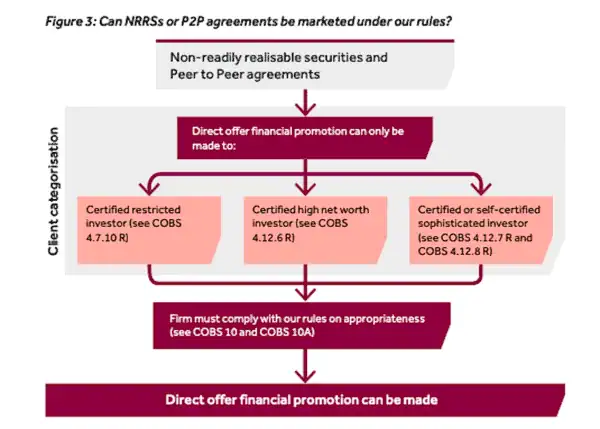

Riskier or “non‐readily realisable securities (NRRSs)” include unlisted and non-exchange traded shares or bonds like securities sold via a crowdfunding platform or P2P lending agreements via a P2P platform. These securities must already adhere to certain promotional standards while potential investors must self certify as to their specific qualification to participate in such an investment.

Regarding crypto-assets the DP states:

“In January 2021, the Government consulted on its approach to cryptoasset regulation, which proposes to establish a future regime on stablecoins used for payments and includes a call for evidence on investment and wholesale uses of these technologies. Alongside this, in July 2020, the Treasury consulted on the promotion of cryptoassets. The Treasury proposed bringing some cryptoassets into the scope of the financial promotion regime, to enhance consumer protection. The issues discussed in this paper may be relevant to promotions for cryptoassets to the extent they are brought within the scope of the financial promotion regime.”

While all investments hold a degree of risk, moves by the FCA could diminish investing in these new asset classes. There is always a balance between investor protection, access to opportunity, and the role of government in making decisions for individual consumers. Political pressure, frequently accompanied by anecdotal investor losses, may dramatically influence policy too.

The FCA is inviting feedback on its discussion paper by 1 July 2021. The FCA intends to consult on rule changes later this year. The FCA expects to publish a full response alongside the next steps on its wider consumer investments strategy at some point in 2021.

The FCA Discussion Paper is available below.