Tink, a Sweden-based fintech that provides APIs to create next-generation banking services, announced earlier this week it has formed a new partnership with payments technology provider Tribe. According to Tink, the partnership will enable Tribe to combine its issuer and acquirer services, with payment initiation services (PIS), and account information services (AIS), all powered by Tink.

“Through Tribe’s technology platform, its UK customers now have seamless access to traditional payment methods alongside open banking payments – with AIS services to follow. Through its issuer and acquirer processing platform, ISAAC, Tribe uses the latest technology to enable banks, fintechs and acquirers to choose the payments modules that suit them.”

Speaking about the partnership, Alex Reddish, Chief Commercial Officer at Tribe, stated:

“We’re committed to delivering the very best solutions, through inhouse development and key partnerships, to help our clients deliver innovative payments propositions. Tribe was the first issuer processor to have launched initial compliance APIs for fintechs to harness the power of Open Banking without developing their own APIs and we’re keen to continue investing in further Open Banking functionality.”

Rafa Plantier, Head of UK & Ireland at Tink, concluded:

“The advancements in mobile payments in recent years, combined with the strong development of open banking infrastructure and regulation, makes it more compelling for payment providers to adopt open banking payments. Our aim is to be the backbone of payments services providers across Europe, to enable inclusive, streamlined, fast-settlement, low-cost payments solutions.”

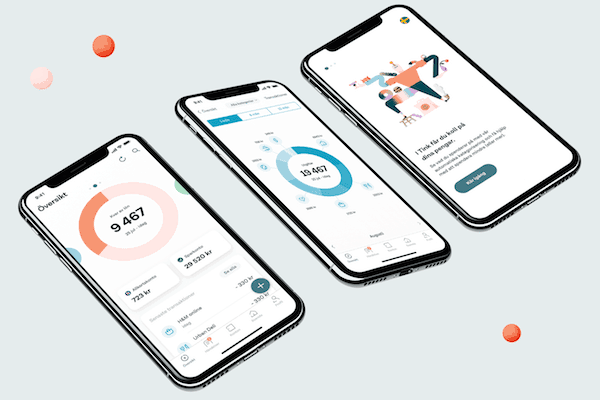

As previously reported, Tink is on a mission to make banking “better” by creating technology to improve customer experience and bring more financial clarity.

“Today, we are an FSA-regulated partner to big banks, fintech unicorns and even small startups. Our 150 employees serve 9 European markets out of two offices. And our API offers one access point to financial data from across Europe – as well as the ability to offer insights and actionable advice – whether it’s through our full-service enterprise offering or our self-service platform for developers.”

The partnership with Tribe comes less than six months after Tink announced it raised €85 million through its latest investment round, which was co-led by Eurozea Growth and Dawn Capital with participation from PayPal Ventures, HMI Capital, Heartcore, ABN AMRO Ventures, Poste Italiane and BNP Paribas’ venture arm, Opera Tech Ventures. Tink also reported that during 2020 it made three major acquisitions, as part of its strategy to invest in intelligent data-services based on open banking.