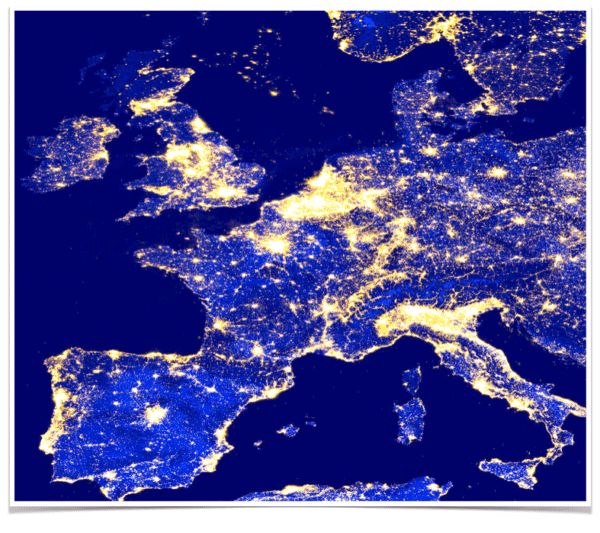

Finitive, a fintech platform that connects institutional investors with alternative lending investments, announced on Monday it has appointed Andrew Holgate to lead its European initiatives as the Managing Director – Head of Europe.

According to Finitive, Holgate brings 20 years of operational and lending experience in both traditional and alternative finance, including roles at GE Capital, Euler Hermes and RBS Group. He co-founded peer-to-peer lending platform Assetz Capital and most recently founded Equitivo, a fintech consultancy and advisory business. Speaking about his new position, Holgate stated:

“Finitive’s mission to make private credit transactions fast and accessible through technology and proprietary data is revolutionary, and is a welcome and much-needed addition to the European market. The Finitive platform vastly shortens the time it takes to for borrowers and investors to find each other. I’m thrilled to bring my experience and lending knowledge to the Finitive team.”

Finitive founder and CEO, Jon Barlow, added:

“Andrew’s experience and relationships in the European lending and fintech markets will support Finitive’s objective to expand its platform to more borrowers globally. European fintechs will benefit from partnering with Finitive to gain efficient access to the 650+ institutional investors on our platform that are actively allocating to private credit.”

As previously reported, Finitive claims to be the leading data-driven private credit marketplace. The U.S.-based tech-enabled platform stated it provides institutional investors with direct access to private credit transactions.

“Institutional investors can access a multi-trillion-dollar market of private credit opportunities across multiple asset classes and structures, including specialty finance, online lending, marketplace lending, and private credit funds. Borrowers gain efficient access to capital via a global network of investors who are actively allocating to private credit.”

The expansion into Europe announcement comes just days after Finitive announced it received an investment from Sterling Bancorp (NYSE:STL). Finitive noted it will use the investment funds to accelerate the growth of its automated platform for facilitating private credit transactions. The company did not disclose the investment’s total funds.

“The investment reflects Sterling’s strategic commitment to partnering with innovative fintech companies that can accelerate the expansion of Sterling’s digital offerings while delivering long-term growth”

The company did not reveal the investment’s amount.