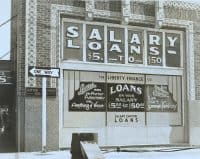

Sub-prime Consumer Credit Market Appears to Be Improving But Worsening Macroeconomic Environment Could Reverse Trend – Report

Varun Surapaneni from Neuberger Berman notes that the percentage of past-due loans “to riskier consumers has begun to flatten, while newly issued paper is carrying higher interest rates.” In an update titled, A Turning Point in Sub-Prime Credit, Varun writes that “after a challenging period… Read More

Read more in: Global, Fintech, General News | Tagged credit, loans, neuberger berman, research, subprime