Marqeta, a modern card issuer, is expected to trade on the Nasdaq this week under the ticker symbol MQ. The most recent S-1 filed with the Securities and Exchange Commission (SEC) indicates that Marqeta is seeking to raise $1.25 billion at a per-share price of up to $24.

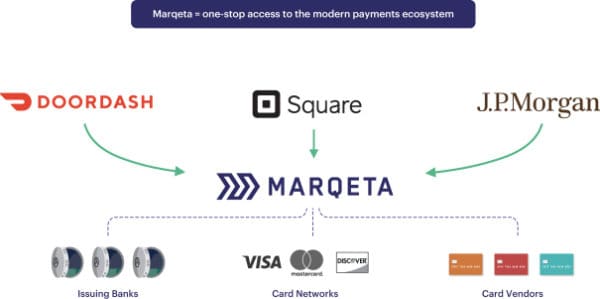

Powered by APIs that streamlines the card issuance and management process updating an existing process that has been in place for decades to accommodate the digitization of finance and the rise of Fintech.

To quote the company:

“Our modern architecture allows for flexibility, a high degree of configurability, and accelerated product development, democratizing access to card-issuing technology. Marqeta’s open APIs provide instant access to our highly scalable, cloud-based, and configurable payment infrastructure that enables our Customers to launch and manage their own card programs, issue cards to their customers or end-users, and authorize and settle payments transactions. Our business is supported by our first-mover advantage and a deep moat of technology, customer, and industry expertise.”

Marqeta has emerged as a top Fintech that most recently raised capital in 2020 at a valuation of $4.3 billion. The IPO will value the firm at quite a bit more at around $12.4 billion.

As was previously reported, Marqeta is not without competition. While benefiting from an early mover advantage the market is too big to be left alone and other companies are providing similar services. Perhaps the most challenging aspect of the company is that it currently depends on Square for about 70% of its revenue.