Consultant group Kearney is out with a warning for retail banks that costs must be reduced or profitability in the coming years may evaporate. According to a study by the firm, retail banks must reduce costs by €35-€45 billion (£25-£32 billion) within the next 3 to 5 years to regain profitability. To reduce costs banks must transform their operating model.

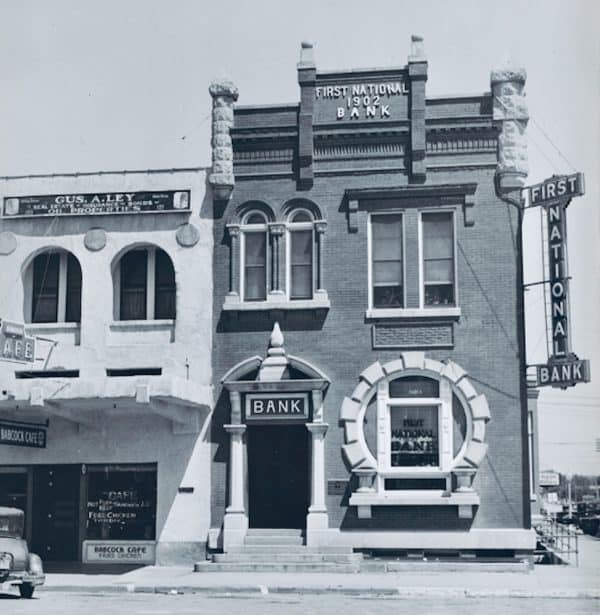

Kearney’s European Retail Banking Radar is an annual review of the pan-European banking market. The study tracks 92 retail banks in 22 European markets, comprised of 50 banks in Western Europe and 42 banks in Eastern Europe. This year’s study takes the impact of COVID under consideration as the health crisis has fueled the migration from brick and mortar banking to more sensible digital financial services.

Kearny says that banks have not made significant improvements in the “cost-to-income ratio” or “CIR” in the last 12 years. Even while banks have been reducing headcount and physical locations, and income per employee has increased, these moves have simply not been enough, states Kearney.

While regional differences do exist with some banks fairing better, Kearney states that “revenue generation becoming increasingly difficult in countries such as the UK” – a top financial services jurisdiction.

The rising cost of talent is having an impact as well as banks must spend more on information technology on top of increasing wages for existing staff. The cost of IT has risen by 80% since 2015 as banks’ retail divisions continue to invest in Fintech.

Simon Kent, Partner and Global Head of Financial Services at Kearney, states that to achieve profitability retail banks “must be radical and bold.

“…applying yesterday’s logic to today’s problems will hold them back,” says Kent. “The main challenge from cost optimisation efforts to date is that any financial gain from a declining headcount has been offset by a changing employee mix and wage inflation.”

As should be painfully obvious, banks must become more focused on digital services with tech at the top of its list of objectives.

Kent notes that bank management “must also be unflinching in their efforts to reshape their businesses.”

Meanwhile, underperforming businesses must be jettisoned, says Kent.

While the future may be obvious the question remains can old finance change fast enough or is the need to support what works today too great to undermine future viability.