IOHK and Oasis Pro have entered a partnership to create an alternative trading system that will use blockchain or distributed ledger technology (DLT) to open up participation “in primary bond markets to developing countries.”

IOHK and Oasis Pro have entered a partnership to create an alternative trading system that will use blockchain or distributed ledger technology (DLT) to open up participation “in primary bond markets to developing countries.”

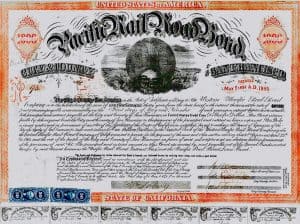

The two firms are teaming up to implement a bond issuance platform. Oasis Pro is the parent firm of Oasis Pro Markets, which currently runs a multi-asset alternative trading system, known as OATSPRO, in the US. This enables secondary trading of public and private multi-asset digital securities.

The Oasis Pro tech facilitates “digital cash” for digital securities transactions, and by using the Cardano (ADA) blockchain to remove the requirement for intermediaries like banking institutions from the process, trading fees should be cut by 50%. The combined platform offers a viable and secure financing alternative for governments of developing countries.

With reductions in foreign aid and overall investment, many governments are currently struggling to gain access to capital. By integrating OATSPRO tech with users of Cardano’s ADA digital currency – with a market cap of $70 billion – a new source of foreign investment “can be tapped for crucial infrastructure projects,” the announcement noted.

John O’Connor, Director of African Operations at IO Global, stated:

“At IO Global, our mission is to build systems which widen and democratize access to vital financial and social services, for both governments and citizens alike. This was the drive for our partnership with the Ethiopian Ministry of Education this year to bring provable educational credentials to students and teachers across the country, and is the same for our work with Oasis. Systems like the one Oasis is developing are essential to bridge the growing global investment gap and give developing nations the tools to level the playing field and invest in critical infrastructure.”

Pat LaVecchia, CEO at Oasis, remarked:

“Developing nations often lack the access to overseas capital that other nations have. We want to ensure that this changes. IO Global’s vision to democratize opportunity aligns closely with our desire to ensure access to financial markets for developing nations, and this partnership represents a key step in enabling greater accessibility to international capital markets for those that require it.”