With a new SPAC launched seemingly every day and IPOs popping left and right, it might seem like the public markets are the place to be. Although following that path to liquidity might make sense for some companies, that’s just not the case for most companies. Rather, recent analysis of Refinitiv data from Deloitte reveals the truth: traditional M&A represents the exit route most frequently traveled by tech startups.

All of the major tech companies – all also formerly VC-backed – from Amazon and Apple to Google and Facebook have become prolific acquirers. Of course, they’ve also come under intense antitrust scrutiny over the past several years for it. But their approach includes allocating capital to garden variety corporate development strategies like purchasing smaller companies to improve the scope or scale of the enterprise, pick up their IP, or execute ‘acquihires.’

The result is one of the strongest exit environments in recent memory, with the capital secured by founders in these liquidity events forming a vital component of the company formation and job creation lifecycle in the US over the long term.

Sure, a founder or early engineering hire with vested or exercised shares can simply cash out at exit and then stick the money under a mattress, into an ETF, or back Bitcoin. But many founders and others with a significant windfall become startup funders in their own right, per my company’s data.

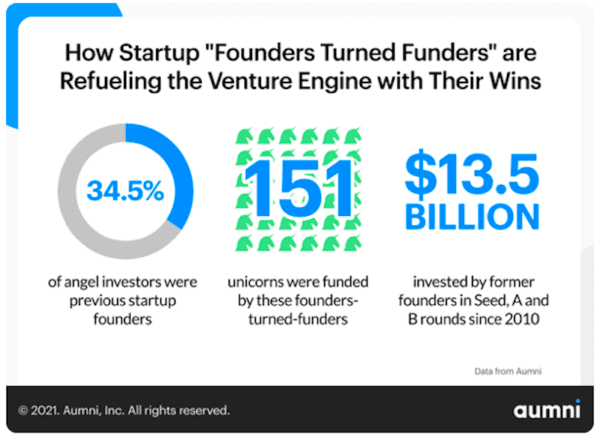

Indeed, my company has found that 34.5% of angel investors previously founded a startup company. Of them, some 22.5% experienced a liquidity event in their company. All told, $13.5 billion has been raised in aggregate by Seed, A, and B companies that former founders have invested in since 2010.

That’s a lot of cash, some of which goes to hiring people to work at these startups. In 2020, it’s estimated that there were over 3 million new jobs created through startup businesses. Moreover, these founders-turned-funders have an eye for scale. Our data reflects an investment track record for these founders turned angel investors of backing 151 startups that have become unicorns.

That’s a lot of cash, some of which goes to hiring people to work at these startups. In 2020, it’s estimated that there were over 3 million new jobs created through startup businesses. Moreover, these founders-turned-funders have an eye for scale. Our data reflects an investment track record for these founders turned angel investors of backing 151 startups that have become unicorns.

The data are absolutely clear on this point: former founders form the backbone of funding for startups at their most nascent phases of development and can thus make a considerable impact on the future of innovation long after they’ve ceased to be entrepreneurs in their own right.

Moreover, former founders that become funders come equipped with an existing network of investors and operations experience to share. And the venture ecosystem favors those with operations experience. The public markets do too. As a proxy, SPACs helmed by those with it or not, per McKinsey, perform divergently in favor of those with ops-experienced leadership.

With more money making its way to emerging startup ecosystems across the country in places like Denver, Minneapolis, and Salt Lake City since the start of the pandemic, the strong exit environment has fostered the development of innovation hubs across the heartland of the US—not just near so-called coastal elites.

Startups based in the states of Texas, Illinois, Pennsylvania, and Colorado—to pick just a handful of the top ten performers this year—have all surpassed their totals for VC raised last year through just the third quarter of this year, per the latest PitchBook-NVCA Venture Monitor.

There’s little, though, that larger investors might do to step up and fill an angel-sized hole should one form in the market if former founders no longer recycle as much capital back into startups. Put simply, the economics of writing small checks out of larger funds cannot provide sufficient rates of return. And supplying companies with larger checks wouldn’t pencil out at the earliest phases of company formation.

Although seed rounds have grown considerably over the past five years, the median lead check size at this stage remains relatively modest. Since 2016, the median lead investor has gone from cutting a roughly $1 million check to one that’s now $1.7 million—an increase of nearly 75%. Over the same period, the median stake taken by lead investors as a share of the round has gone from 48.5% to 52.4% at present. In short, seed stage investors are taking a slightly larger stake for a lot more cash. Just not by the standards of Series A and beyond. For example, the median lead check size at Series A stands at $6.4 million YTD.

The founders-turned-funders dynamic is substantial and vital to the private capital ecosystem. Capital is being recycled from one company to the next as success is gained in the marketplace. Were it not for early-stage investments, these companies won’t be able to exist.

Adam Putz, PhD, is Director of Research for Aumni’s, a private markets data and analytics provider. Prior to taking this role, Adam was an analyst at PitchBook. His work has been cited by the Chartered Alternative Investment Analyst Association and CNBC.