The Swiss Financial Market Supervisory Authority FINMA has ordered protective measures regarding Sberbank AG, one of the Russian banks targeted with sanctions.

Switzerland has joined the economic sanctions along with the EU and other nations to apply pressure to Russia following its unprovoked war with Ukraine. Earlier today, Switzerland added more sanctions including halting transactions with the Russian central bank.

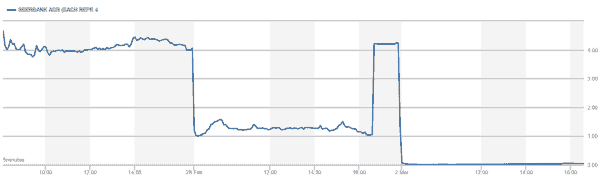

Sberbank, the parent company of the Swiss operation, is the largest bank in Russia and operates around the world. Shares in Sberbank trade on the London Stock Exchange where its value has dropped by around 99% since sanctions were announced.

FINMA said it has ordered a deferral of the bank’s obligations from deposits until 2 May 2022 as it is subject to a “wide-ranging ban on payments and transactions with immediate effect.”

To quote FINMA:

“Due to the effects of Russia’s military intervention in Ukraine and heightened international sanctions, Sberbank (Switzerland) AG is at risk of facing liquidity problems. To protect creditors, FINMA has ordered protective measures. More precisely, FINMA is postponing with immediate effect the due date for the bank’s obligations from deposits by sixty days to 2 May 2022 (deferral). Furthermore, without FINMA’s approval the bank may not make any payments or transactions that are not necessary for its operations as a bank. The bank has decided not to engage in any new business until further notice and is largely restructuring and reducing its business activities. FINMA will appoint an investigating agent to monitor, in particular, the bank’s financial stability, ensure the equal treatment of creditors and check that the bank has an appropriate organisational structure in place.”

Sberbank AG in Switzerland is a subsidiary of Sberbank Russia and does not serve retail clients and specialises in commodity trade finance serving around 70 customers.