The Bank of Mum and Dad United or BOMADU is the newest entry into the neobank sector of Fintech in the UK.According to a release, BOMADU is targeting first-time buyers overcome the home deposit challenge.

BOMADU is currently raising seed funding on Seedrs, its first crowdfunding round. According to the offering page, BOMADU is aiming to raise up to £200,003 at a pre-money valuation of £2.7 million for a 6.9% equity stake.

The securities offering is SEIS eligible and approved for both the Seedrs Nominee structure as well as its Secondary Market.

As it stands today, BOMADU has raised over £87,000 from 29 individual investors.

BOMADU explains that it wants to assist individuals who “can’t turn to the bank of mum and dad to raise the funds needed for a deposit.”

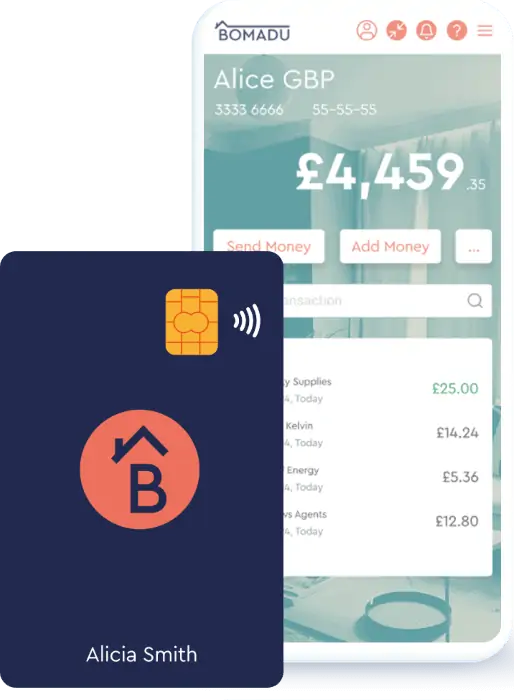

BOMADU seeks to bridge the equity wealth gap and the ethnicity gap in home ownership with a range of solutions including a current account, savings features, and a “first-of-its-kind, 100% first home deposit loan.”

BOMADU is a Barclays Eagle Labs start-up which also has backing from Fintech Wales,

Ian Tyler, former Group Head of Capital at RBS and Tesco Bank and now the Chairman of BOMADU described BOMADU as a great example of a people-driven business.

“We recognise that only a very few fortunate people can realistically expect financial help from their parents when buying a home. It can be impossible to save enough when also paying rent and navigating increases in the cost of living. We are on a socially-driven mission to help millions of young first-time buyers fulfil their ownership dreams quickly and responsibly.”

Have a crowdfunding offering you'd like to share? Submit an offering for consideration using our Submit a Tip form and we may share it on our site!