Tokenization, the process of making an asset digital typically by leveraging blockchain technology, is predicted to hit $16 trillion by 2030, according to a report by ADDX and Boston Consulting Group (BCG).

The report, “Relevance of on-chain asset tokenization in ‘crypto winter’” is available here.

ADDX is a regulated digital securities platform and private securities exchange based in Singapore offering services across Asia.

According to the report, this anticipated growth is being driven in part by the crypto winter as capital is now focusing on “more viable blockchain use cases.” This, along with growing demand for tokenization as more investors seek access to provide markets. Tokenization, or digital assets lower barriers for certain assets, while reducing minimums required and overall cost.

ADDX states that assets being fractionalized on platforms can reduce minimum investment sizes from millions of dollars to just thousands of dollars. Previously investments of this kind were only available to institutions. As well, these investments can be ‘borderless’, allowing investors around the world to invest in markets they were previously unable to access.

ADDX adds that, historically, many of the world’s assets have been held in illiquid formats, with estimates of the share of illiquid assets at more than 50% of overall assets. Illiquid assets face challenges such as imperfect price discovery and trading discounts compared to liquid assets. Tokenization can facilitate liquidity by making it easier for the assets to be distributed and traded among investors.

Tokenization is expected to be leveraged in assets like real estate, equities, bonds, investment funds and more – like esoterics such as assets not typically turned into securities.

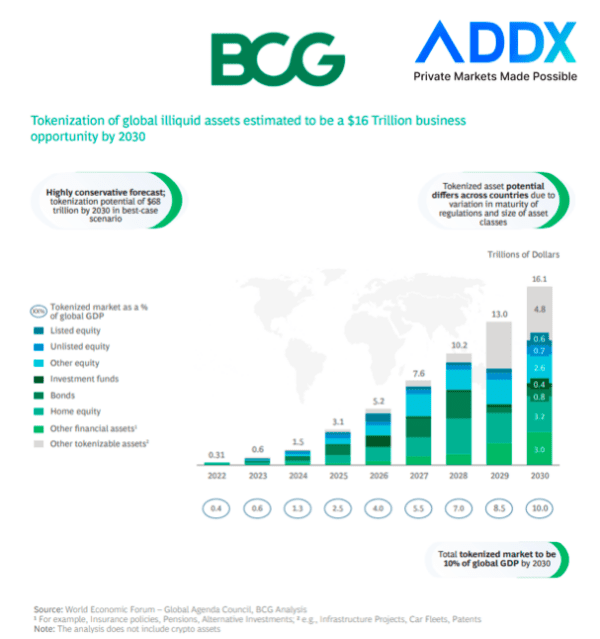

Growth is expected to increase by 50X between 2022 and 2030, from US $310 billion to US $16.1 trillion, with tokenized assets expected to make up 10% of global GDP by the end of the decade. The report suggests that financial institutions consider finding ways to pilot and deploy asset tokenization projects by upgrading existing business models, rather than looking to replace them.

Oi-Yee Choo, CEO, of ADDX, explained that asset prices can only rise to their true economic value if the barriers can be lowered.

“For years, the technology for overcoming those barriers was expensive and therefore available only on public exchanges. Blockchain changes the game because it can be applied cost effectively to private markets and alternative assets, where investors are fewer in number, albeit wealthier, and products are more bespoke. The result should set our hearts racing: assets can be liquid for both public and private markets. The potential economic benefits are considerable. Recognizing assets for what they are truly worth should translate into more investments and better capital allocation, which will in turn generate economic growth and jobs. The real winner here is the real economy.”

Sumit Kumar, Managing Director and Partner, BCG South East Asia, said the crypto winter has tightened the purse strings for the overall blockchain sector.

“Some Web3 companies will be adversely impacted. But projects that can demonstrate inherent value, scalability and the potential to enhance the traditional financial ecosystem could actually benefit against this new backdrop. Our analysis shows asset tokenization projects could emerge strongly. They are more likely to demonstrate viability in this capital-constrained environment and are therefore better positioned to attract the attention of investors, who continue to have a significant store of dry powder to deploy. This report projects that even using a conservative methodology, asset tokenization would be a US$16.1 trillion business opportunity by 2030. In a best-case scenario, that estimate goes up to US$68 trillion.”

ADDX currently serves accredited investors from 39 countries including Asia Pacific, Europe, and the Americas (but not the US). The company has raised $120 million and has listed 40 different deals to date.