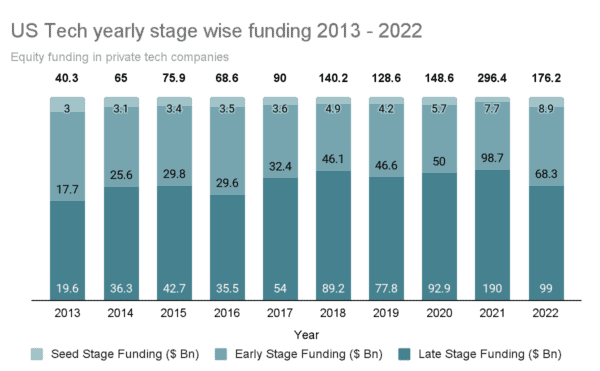

Funding into US startups has dropped by a precipitous 40%, according to a new report. In 2021, startups raised $296 billion. During 2022, this number has declined to $176 billion, a dramatic decline for a key sector of the economy.

Entrepreneurship and small businesses are key drivers of economic growth and prosperity. Giga high inflation and rapidly rising interest rates are taking a toll on the innovation sector, with no end in sight for the stalling economy. According to Tracxn, a SaaS market intelligence platform, the drop in capital for startups has been driven by a 48% decline in late-stage investments to $99 billion during 2022 from $190 billion in 2021. The Traxcn Geo Annual Report: US Tech 2022 states there was a significant drop of 45% in the number of $100 million+ funding rounds, to 444 rounds in 2022 MTD from 808 rounds in 2021.

Funding hit an all-time high in Q4 of 2021 at $80.2 billion, but after that, it was all downhill. In Q3 of 2022, startups raised a mere $31.4 billion – 61% lower than the peak in Q4 2021.

One bright light in the report is that seed-stage investments saw growth of 15% in funding from $7.7 billion in 2021 to $8.9 billion in 2022. Additionally, 2022 is above 2020 – but who knows what 2023 will bring as many observers are predicting a challenging recession.

The best-performing sectors during 2021 were Enterprise Applications, Fintech, and Life Sciences.

The total funding raised by the Enterprise Applications sector in 2022 was $82.7 billion, which is higher than the amounts raised by the Fintech, Life Sciences, and HealthTech sectors combined.

AutoTech investments declined the most sinking by 62.8% to $7.72 billion in 2022 from $20.8 billion in 2021. This is followed by Insurtech, which recorded a decline of 61.2% from $7.58 billion in 2021 compared to $2.94 billion in 2022.

The report says that crypto is struggling with significant drops but blockchain firms did well in 2022, with only a small drop of 4% in overall funding in 2022 versus the same period last year.

The number of new Unicorns [firms valued at $1B +] created lowered by 56% to only 131 companies in 2022 from 297 in 2021. The number of Decacorns that emerged in 2022 has also declined by 82.3% from 17 companies in 2021 to just three this year.

Unsurprisingly, the number of IPOs tanked by 85% to 45 this year from 317 last year.

In spite of high taxes and profound problems, the Bay area remained the top investment hub with San Francisco attracting total investment of $29.8 billion in 2022, higher than the amounts raised by New York City at $19.2 billion and Boston at $6.3 billion.