Sway, a new payments platform that dodges costly card transactions, is preparing to raise money in a securities offering listed on Seedrs. While not live yet, Sway is taking emails for “priority access” when the offering is available.

Sway was launched based on the idea that in-person transactions see the merchant charged a fee for each purchase. Sway states that every year in Europe, over £48 billion is wasted on card transaction fees. Sway is a method for merchants to be “less dependent on cards” while benefiting from instant settlement, minus the cost of accepting card transaction fees. All receipts become digital.

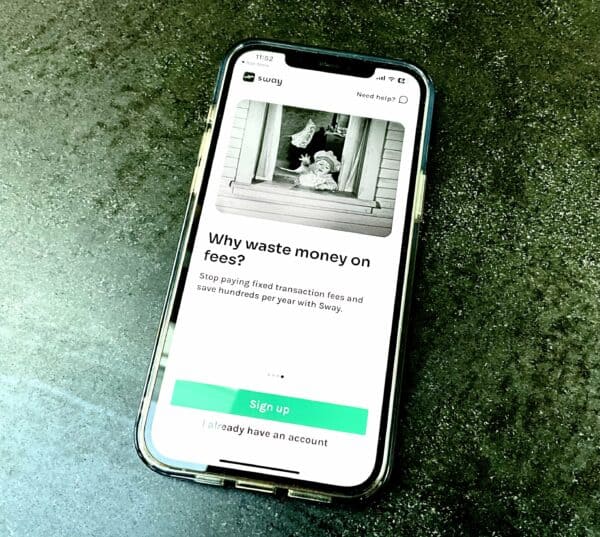

To use Sway, all you need is your smartphone and their app. You connect your bank to the app, and then Sway can generate a QR Code for each transaction. Sway is contract free so there is no commitment for the service.

Sway states that small businesses taking card payments spend around £4200 a year on average for card processing transactions. Sway offers its service starting at £5 per month – far cheaper than a swipe of the card, which typically has a fee of 1.5% to 3.5% on transactions. The Premium version, which incorporates additional features like the ability to accept tips, is £15 per month.

So the merchant wins with Sway, and the bank or card issuer loses, aided by the UK’s push for open banking services. The concept is interesting enough to make card issuers uncomfortable. It will be interesting to learn more about the company, as well as the details of the securities offering when the pitch goes live on Seedrs.

Have a crowdfunding offering you'd like to share? Submit an offering for consideration using our Submit a Tip form and we may share it on our site!