CI has once again reviewed the roster of FINRA-regulated funding portals to gauge the growth or decline of these platforms that provide online capital formation. Funding Portals were created under the JOBS Act of 2012 and typically list securities under Regulation Crowdfunding (Reg CF). This securities exemption allows firms to raise up to $5 million by soliciting both accredited and non-accredited investors.

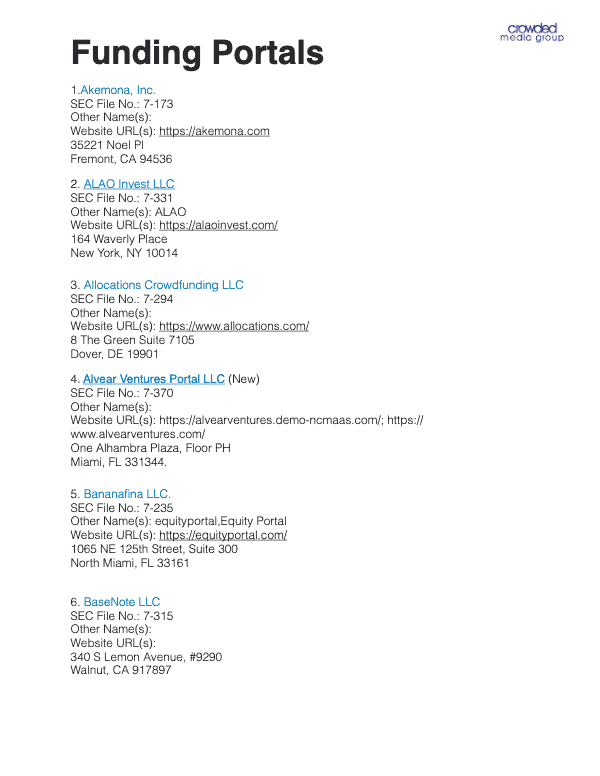

The last time CI reviewed the list of FINRA-regulated Funding Portals was at the end of December 2022. Today, the list has grown with five new additions. In total there are 83 Funding Portals that are ostensibly active.

First is the Miami-based Alvear Ventures Portal, which is yet to launch but states on its home page that it is the future of SME capital markets. The CEO of Alvear is listed as Stuart Linslow Fort.

BigCrowd is based in New Jersey and is another entry into the real estate sector. BigCrowd is described as “a commercial, multifamily property and asset management company specializing in the acquisition of income-producing investment opportunities that leverage favorable tax treatment and long term capital growth for our esteemed clientele.” Amit Raut is listed as the CEO of BigCrowd. The platform has yet to list its first securities offering.

Caravan Funds is based in Silver Spring, Maryland, and is another real estate investment platform. Caravan Funds was founded by CEO Adil Faisal. There is a single property listing on the platform

The Dentist Fund is not yet live with a password-protected website. Based in Texas, Timothy Michael McNamara is listed as the manager.

GigaStar Market is the last new platform that has made the FINRA list. GigaStar aims to offer a marketplace for creators and fans. GigaStar states that it will offer Channel Revenue Tokens (CRTs) which represent the rights to revenue share securities offered under Regulation Crowdfunding. Each CRT is said to digitally represents rights to a percentage of a YouTube channel’s potential future revenue. GigaStar has a single securities offering listed on the platform. Hazam Dawani is listed as CEO.

Reg CF continues to be dominated by a handful of funding portals as well as several broker dealers which may also sell securities under Reg CF.

For the past 30 days, the following platforms have dominated the Form-C filings with the SEC:

- Wefunder Portal LLC – 34

- StartEngine Capital, LLC – 22

- OpenDeal Portal LLC (Republic) – 15

- MainVest, Inc. – 10

- Honeycomb Portal LLC – 10

- SMBX, Inc. – 8

- NetCapital Funding Portal Inc. – 4

- DEALMAKER SECURITIES LLC – 3

- Silicon Prairie Online LLC – 3

- NETSHARES FINANCIAL SERVICES LLC – 2

DealMaker is a broker-dealer that is a relatively new entrant in the Reg CF sector that has grown rapidly.

Most platforms also provide services to Reg A+ issuers as well, and many also provide securities under Reg D, so success under Reg CF does not necessarily indicate overall success in raising capital online.

As has been previously reported, online capital formation has been impacted by the challenging economic environment, yet some believe that investment crowdfunding will benefit as venture capital hits the pause button.

On another note, some industry insiders are pushing for Congress to increase the funding cap from the current $5 million to $10 million or perhaps $20 million.

The list of FINRA-regulated Funding Portals may be downloaded here.