Private equity deals have declined by 36% during the month of July when compared to the same month last year. This is according to S&P Global Market Intelligence which reports 828 private equity deals in July 2023 versus 1290 deals July 2022.

The global economy has been roiled by sticky inflation and rising interest rates. A lot of private capital is sitting on the sidelines, waiting out the turmoil, earning a decent return at the same time. The report notes that the value of deals, which include acquisitions of companies, minority stakes as well as rounds of funding, went up 10% on an annual basis to $44.26 billion from $40.2 billion. So there is money around contingent upon the perceived deal quality.

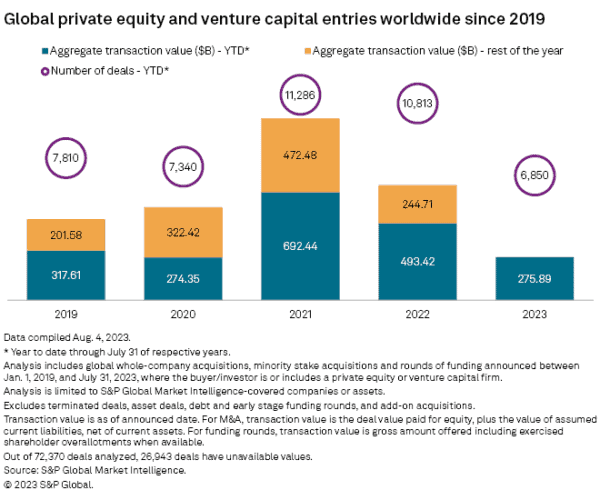

For the year up until July 31, 2023, global PE deals dropped by 44%. In round numbers, this means during 2023 there were 6850 deals valued at $275.89 billion in comparison to almost 11,000 deals valued at $493.42 billion.

The Asia-Pacific region led the charge with 336 deals followed by Europe and the UK with 237 deals, followed by the US and Canada, which booked 216 deals.

Financial services led with $14.48 billion, followed by Tech, Media, and Telco at $13.95 billion.