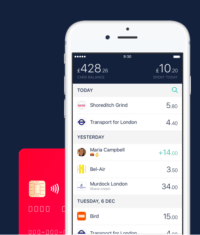

European Digital Bank N26 Appoints Mayur Kamat to Key Executive Role

Digital bank N26 recently announced the appointment of Mayur Kamat as its new Chief Product Officer. Mayur is said to have “a proven track record leading product teams and building new solutions at some of the world’s biggest technology companies.” He reportedly brings with him… Read More

Read more in: Fintech, General News, Global | Tagged banking, berlin, digital bank, germany, mayur kamat, n26, new appointments