Embedded Banking: OMB Bank Joins Treasury Prime Bank Network

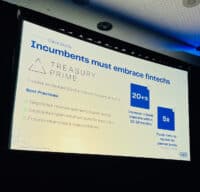

Treasury Prime, an embedded banking software company, announced that OMB Bank has joined the Treasury Prime Bank Network to offer innovative embedded banking solutions to customers in the fintech space. The partnership marks the latest addition to Treasury Prime’s -bank network, which now totals more… Read More

Read more in: Fintech | Tagged embedded banking, financial services, fintech adoption, treasury prime