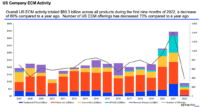

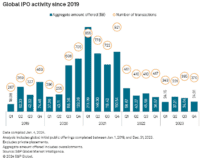

Global IPO Activity Worst Since 2019

IPO [initial public offering] activity was dismal in 2023. You have to go back to 2019, which was just before the COVID crisis disrupted the world, to find a worse year. A total of 1,429 IPOs were launched globally in 2023 a nearly 16% drop… Read More

Read more in: General News, Featured Headlines, Global | Tagged global ipos, ipos, research, s&p