This is a common theme of discussion at CrowdfundInsider. The forthcoming launch of Crowdfunding scheduled for 2013 and how exactly this will impact the funding of Entrepreneurs and Economic growth. This movement without a doubt has the potential to disrupt traditional forms of finance for small firms and start ups.

But let’s step back a minute and look at the global economic landscape for perspective. The mighty United States economy is grudgingly coming back to life after the financial shock of past years. The economic juggernaut of China powers onward. At a much smaller pace than previous but still moving forward at an acceptable velocity of around 7% growth (depending on which economic view you subscribe). The Chinese are working to stimulate domestic demand to stimulate growth.

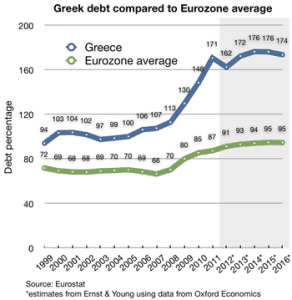

Europe, on the other hand,` is off the rails. The once admirable dream of a United States of Europe is slowly collapsing into a shamble of sclerotic bureaucratic half efforts. Greece’s path is one of Austerity or Poverty. The correct path is to devalue but that means departing the Euro which leads to poverty. Spain suffers a crushing unemployment rate of over 23%. The rate of unemployment rate for the youth is an unfathomable 54%! France, at the heart of Europe, strives to address their woes by applying a tax rate of draconian levels which have forced the wealthy to flea and the creative entrepreneurial class to rise in protest (Dieu merci!). Thank you Les Pigeons! It should be clear to all, the deep systemic reform necessary for Europe to raise themselves from their self destructive path of economic decline. Culture change within private organizations is difficult, in national cultures it is nearly impossible. The industrious and responsible Germans are in stark contrast to their neighbors in the south.

Europe, on the other hand,` is off the rails. The once admirable dream of a United States of Europe is slowly collapsing into a shamble of sclerotic bureaucratic half efforts. Greece’s path is one of Austerity or Poverty. The correct path is to devalue but that means departing the Euro which leads to poverty. Spain suffers a crushing unemployment rate of over 23%. The rate of unemployment rate for the youth is an unfathomable 54%! France, at the heart of Europe, strives to address their woes by applying a tax rate of draconian levels which have forced the wealthy to flea and the creative entrepreneurial class to rise in protest (Dieu merci!). Thank you Les Pigeons! It should be clear to all, the deep systemic reform necessary for Europe to raise themselves from their self destructive path of economic decline. Culture change within private organizations is difficult, in national cultures it is nearly impossible. The industrious and responsible Germans are in stark contrast to their neighbors in the south.

In the United States we have been blessed with a different approach. We acknowledge the fruits of labour and determination and endure periods of economic decline with almost a stoic chagrin of impatience. As industries decline, labour shifts in painful layoffs and re-allocation yet we understand, in the end, we all benefit by allowing markets to work as they should. Entrepreneurs are embraced in the United States. Their calling is a higher path – one that is recognized as fraught with risk but possible high reward with wealth and fulfillment. Now we are on the cusp of an era of new economic growth. One which may benefit with the efficiencies of a new form of capital allocation called Crowdfunding. Capital allocation via Venture Capitalists, Angel Investors and their ilk have been great for funding some of the most emblematic companies in the United States. This process is also incredibly inefficient. As published on this site previously “Zombie Capital” may be todays status quo. Traditional funding is largely dominated in specific geographies and limited by traditional techniques. Crowdfunding has the potential to bring the efficiencies of a wider market to bear – on the funding of businesses and projects that have merit outside the emotional confines of Silicon Valley VCs.

In the United States we have been blessed with a different approach. We acknowledge the fruits of labour and determination and endure periods of economic decline with almost a stoic chagrin of impatience. As industries decline, labour shifts in painful layoffs and re-allocation yet we understand, in the end, we all benefit by allowing markets to work as they should. Entrepreneurs are embraced in the United States. Their calling is a higher path – one that is recognized as fraught with risk but possible high reward with wealth and fulfillment. Now we are on the cusp of an era of new economic growth. One which may benefit with the efficiencies of a new form of capital allocation called Crowdfunding. Capital allocation via Venture Capitalists, Angel Investors and their ilk have been great for funding some of the most emblematic companies in the United States. This process is also incredibly inefficient. As published on this site previously “Zombie Capital” may be todays status quo. Traditional funding is largely dominated in specific geographies and limited by traditional techniques. Crowdfunding has the potential to bring the efficiencies of a wider market to bear – on the funding of businesses and projects that have merit outside the emotional confines of Silicon Valley VCs.

In 2013, Crowdfunding is presently scheduled to commence within the United States. Regulators have much to do – saddled with inconclusive legislation signed by the current administration. Well intentioned regulators and bureaucracies searching for justification can, at times, create insuperable hurdles. Let’s all hope, for the good of us, that Crowdfunding does not end up being “Strangled in its cradle“.