Compilation vs. Review vs. Audit for offerings of more than $500,000?

Efforts to influence the final proposed rule for Financial Disclosure (Section 4A(b)(1)(D)), requires “a description of the financial condition of the issuer,” in which regulators have requested comments from the public for the Final Proposed Crowdfunding Rules released on October 23, 2013. Industry pioneers, like Ryan Feit, CEO of SeedInvest, and myself, are exploring options for the industry to consider including a cost benefit analysis of the proposed rules. We will soon provide comment letters with recommendations to the Securities and Exchange Commission (SEC) by the pending deadline, February 3, 2014.

Efforts to influence the final proposed rule for Financial Disclosure (Section 4A(b)(1)(D)), requires “a description of the financial condition of the issuer,” in which regulators have requested comments from the public for the Final Proposed Crowdfunding Rules released on October 23, 2013. Industry pioneers, like Ryan Feit, CEO of SeedInvest, and myself, are exploring options for the industry to consider including a cost benefit analysis of the proposed rules. We will soon provide comment letters with recommendations to the Securities and Exchange Commission (SEC) by the pending deadline, February 3, 2014.

As regulators prepare for fresh skirmishes with the industry over the proposed rule, which seeks issuers offering more than $500,000 (or such other amount as the Commission may establish) are required to file with the Commission, provide to investors and the relevant intermediary and make available to potential investors audited financial statements. We all understand the importance of creating robust investor protection standards for the crowdfunding industry while improving capital formation and job creation.

As regulators prepare for fresh skirmishes with the industry over the proposed rule, which seeks issuers offering more than $500,000 (or such other amount as the Commission may establish) are required to file with the Commission, provide to investors and the relevant intermediary and make available to potential investors audited financial statements. We all understand the importance of creating robust investor protection standards for the crowdfunding industry while improving capital formation and job creation.

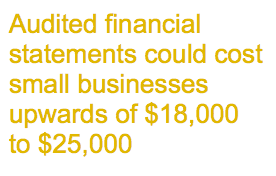

However, the expense associated for a start-up company seeking funding of more than $500,000 to have audited financial statements is burdensome.

However, the expense associated for a start-up company seeking funding of more than $500,000 to have audited financial statements is burdensome.

At the recent 2013 – SEC Small Business Forum for Capital Formation held on November 21, Phillip Laycock, an Audit Partner from leading accounting firm Grassi & Co. acknowledged, “audited financial statements could cost small businesses upwards of $18,000 to $25,000.”

It must be said that too little credit has been given to regulators for their efforts to impose a simple and commonsense approach in the proposed rules. These regulations will establish a framework of tiered financial disclosure requirements based on aggregate target offering amounts and all other offerings made in reliance on Section 4(a)(6) within the preceding 12-month period, for example:

Issuers offering $100,000 or less are required to file with the Commission, provide to investors and the relevant intermediary and make available to potential investors income tax returns filed by the issuer for most of the recently completed year (if any) and financial statements that are certified by the principal executive to be true and complete in all material respects;

Issuers offering $100,000 or less are required to file with the Commission, provide to investors and the relevant intermediary and make available to potential investors income tax returns filed by the issuer for most of the recently completed year (if any) and financial statements that are certified by the principal executive to be true and complete in all material respects;- Issuers offering more than $100,000, but not more than $500,000, are required to file with the Commission, provide to investors and the relevant intermediary and make available to potential investors financial statements reviewed by a public a accountant that is independent of the issuer.

While great on the way of the approach, there is no prescribed content or format for information; the Commission has set forth principles for disclosures. This level of financial disclosure for raises of more than $500,000 seem brutal for small business. Many startups have very limited financial resources and will have to absorb a significant expense prior to raising capital using crowdfunding. The expense in the first year is coupled with the ongoing burden of providing audited financials to shareholders in the following years.

Based on guidelines from the American Institute of Certified Public Accountants (AICPA) there are three options to be considered when trying to ensure the level of assurance obtained for investor protections when raising capital and remain in compliance with United States GAAP: Compilation, Review and Audited financial statements.

Based on guidelines from the American Institute of Certified Public Accountants (AICPA) there are three options to be considered when trying to ensure the level of assurance obtained for investor protections when raising capital and remain in compliance with United States GAAP: Compilation, Review and Audited financial statements.

Compiled financial statements represent the most basic level of service CPAs provide with respect to financial statements. Reviewed financial statements provide the user with the comfort that, based on the review, the accountant is not aware of any material modifications that should be made to the financial statements for the statements to be in conformity with the applicable financial reporting framework. Audited financial statements provide the user with the auditor’s opinion that the financial statements are presented fairly, in all material respects, in conformity with the applicable financial reporting framework.

Of the three accounting options available to issuers, it is important for us all to stay mindful that the burgeoning crowdfunding industry will proliferate based on supply and demand of quality investment opportunities by issuers listed on registered intermediary platforms. At the same time investor protection is paramount to ensuring a safer financial system that will remain within our grasp while striking a healthy balance in the approach to garner sufficient financial disclosure.

Of the three accounting options available to issuers, it is important for us all to stay mindful that the burgeoning crowdfunding industry will proliferate based on supply and demand of quality investment opportunities by issuers listed on registered intermediary platforms. At the same time investor protection is paramount to ensuring a safer financial system that will remain within our grasp while striking a healthy balance in the approach to garner sufficient financial disclosure.

Recent steps forward by the SEC to publish the final proposed rules show what can be done if the industry provides comments that will steer the commission’s rule making process. That means vision, unity and commitment. Therefore caution baked into the final proposed rules for audited financial statements is understandable for issuers seeking more that $500,000.

Can the industry develop into a healthy marketplace by extending the Review of financial statements process for offerings of less than $1 Million? It is an option worth exploring as the USA readies to open the securities based crowdfunding industry in 2014.

________________________________________

Kim Wales is the Founder of Wales Capital, a strategic advisory firm focusing on the JOBS Act and CrowdBureau, the “Morningstar” to the crowdfunding industry and privately held companies. She is an Executive Board Member of CFIRA, the industry’s advocacy organization, and CF50 – the first global crowdfunding think tank. Kim is frequently consulted for her overall knowledge of the finance industry and regulatory implications for crowdfunding.

______________________

[scribd id=191692541 key=key-vz0u3fehws4c7f2ynxv mode=scroll]