As the U.S. is making major efforts to implement the JOBS Act, the European Union seems to be only capable of analyzing the developments, as J.D. Alois’ article “EC Releases Communication on Long Term Financing Including Crowdfunding” shows.

As the U.S. is making major efforts to implement the JOBS Act, the European Union seems to be only capable of analyzing the developments, as J.D. Alois’ article “EC Releases Communication on Long Term Financing Including Crowdfunding” shows.

The most important conclusion was that the European Union should monitor, rather than develop and implement legislation. This apparently passive attitude can be seen as a sign of a broken and incoherent view on crowdfunding, but the opposite is true. There are several reasons why developing European legislation requires monitoring as a first, valuable step.

Implementing legislation can actually break up crowdfunding growth

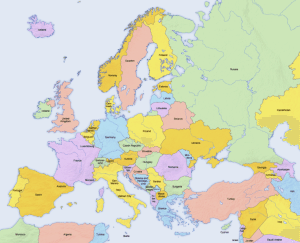

Europe is a diversified continent in terms of legislation. Some countries, such as Belgium and the Netherlands, work with a Twin-Peaks model meaning one party supervises the stability of the financial system (DNB) and the other party (AFM) supervises financial behavior (saving, investing, insuring, lending, etc.).

Europe is a diversified continent in terms of legislation. Some countries, such as Belgium and the Netherlands, work with a Twin-Peaks model meaning one party supervises the stability of the financial system (DNB) and the other party (AFM) supervises financial behavior (saving, investing, insuring, lending, etc.).

In some countries however, each financial product belongs to a sector (pensions, accountants, etc.) that has its own regulator. In such countries it is often hard to decide where crowdfunding belongs. Should lending via the crowd be regulated differently from equity-crowdfunding, for example, or is all crowdfunding equal?

As result, it is difficult for the European Union to develop and implement one set of rules that affects all European countries and systems. The risk exists that if Europe would force its countries to implement crowdfunding rules on a micro-scale, crowdfunding growth would actually be damaged, or worse, fully destroyed.

The reason for this scattered legal landscape is of course that all the separate countries already came into existence before the current European Union did. Though legislation could break crowdfunding development in the European Union, European directives are preparing to set standards that all the members will have to meet while at the same time, leaving them free to implement legislation to their own understanding.

The reason for this scattered legal landscape is of course that all the separate countries already came into existence before the current European Union did. Though legislation could break crowdfunding development in the European Union, European directives are preparing to set standards that all the members will have to meet while at the same time, leaving them free to implement legislation to their own understanding.

Local legislation in place poses a problem however..

Implementing European legislation at a local scale sounds like a great solution. However, in most cases legislation is already in place in order to regulate financial markets and products. Adjusting these in order to suffice European crowdfunding standards might create a stir across a country’s entire financial system.

It would not just be a case of setting up crowdfunding regulations: it would mean that countries might have to restructure their entire financial system. Countries are not willing to do that as long as crowdfunding does not yet contribute as much to the economy as most industries do, because the investment might possibly not pay off or be wrong due to unforeseen developments.

Differing legal entities across Europe

Different countries work with different legal entities for their companies. As a campaign manager at Symbid I know we often get requests from entrepreneurs across borders, who we can’t help if they do not establish a Dutch Limited Liability company first. A very strange fact if you consider the entrepreneur might only be some 60 miles away.

In many cases, crowdfunding platforms can only service companies from their own country. Why? If the platform would want to extend the structure across Europe, they would face an increased risk of fraud. Even if they would be able to counter act this possible threat with a solid due diligence process, like some platforms already have in place, they would be liable for European legislation, while the entire legal structure was based on their homeland’s legislation in the first place. European legislation in this case might either have some holes as there is no regulation available for the structure, or might work against the platform. That is not a risk a crowdfunding platform wants to take for its investors or its entrepreneurs.

In many cases, crowdfunding platforms can only service companies from their own country. Why? If the platform would want to extend the structure across Europe, they would face an increased risk of fraud. Even if they would be able to counter act this possible threat with a solid due diligence process, like some platforms already have in place, they would be liable for European legislation, while the entire legal structure was based on their homeland’s legislation in the first place. European legislation in this case might either have some holes as there is no regulation available for the structure, or might work against the platform. That is not a risk a crowdfunding platform wants to take for its investors or its entrepreneurs.

Next step to actually developing legislation

Next step to actually developing legislation

The overall goal of course is to have European legislation work for all 28 countries, which is a challenging task to complete. A first step is indeed to monitor the crowdfunding developments across Europe in different countries. It will soon become clearer what structures work and which do not work. Rather than risking a downfall of the entire would-be pan-European crowdfunding legislative system, the European Union is avoiding the “all eggs in one basket”- strategy; something every good investor understands!

______________________________

Ludwine Dekker has been coaching entrepreneurs in executing their digital fund raising for three years. As a digital marketing specialist, she specializes in entrepreneurship, technology and fund-raising. As a campaign manager at Symbid she strategically manages the entrepreneur’s campaigns and requirements, organizes pitch events, frequently writes for several platforms, and gives workshops.

Ludwine Dekker has been coaching entrepreneurs in executing their digital fund raising for three years. As a digital marketing specialist, she specializes in entrepreneurship, technology and fund-raising. As a campaign manager at Symbid she strategically manages the entrepreneur’s campaigns and requirements, organizes pitch events, frequently writes for several platforms, and gives workshops.