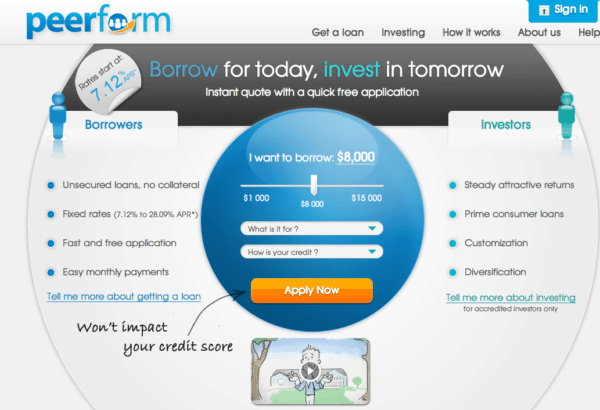

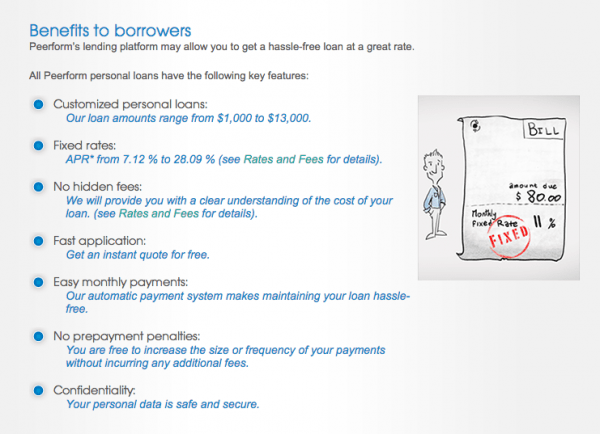

Peerform, a P2P lending platform, targets those “who really need a loan, the best chance to get the money they need to help improve their lives.” By utilizing a variety of technologies, such as Peerform’s unique algorithm, Peerform is able to ascertain “creditworthiness” and lend to borrowers who have a Credit Score as low as 600 (and above). “We also focus on giving borrowers the lowest possible APR to ensure they get the best deal by using special technology for our investors,” according to Peerform CMO Paul Vesely. Since co-founding Peerform, Mikael Rapaport has served as the P2P lender’s CEO. In addition to Rapaport, Gregg Schoenberg serves as the Board’s Executive Chairman, Abigael Saal as CTO, Catheryn Robinson as Head of Business Development and Ari Afilalo as General Counsel.

Peerform, a P2P lending platform, targets those “who really need a loan, the best chance to get the money they need to help improve their lives.” By utilizing a variety of technologies, such as Peerform’s unique algorithm, Peerform is able to ascertain “creditworthiness” and lend to borrowers who have a Credit Score as low as 600 (and above). “We also focus on giving borrowers the lowest possible APR to ensure they get the best deal by using special technology for our investors,” according to Peerform CMO Paul Vesely. Since co-founding Peerform, Mikael Rapaport has served as the P2P lender’s CEO. In addition to Rapaport, Gregg Schoenberg serves as the Board’s Executive Chairman, Abigael Saal as CTO, Catheryn Robinson as Head of Business Development and Ari Afilalo as General Counsel.

Peerform’s Gregg Schoenberg joined Peerform’s board of directors in 2012. Schoenberg, an alum of Washington University in St. Louis and Cornell’s MBA program, founded Wescott Capital, an investment and advisory firm based in New York. He was previously the head of equities and a member of the executive committee for Natixis North America and also worked in the capital markets department of SG Cowen in New York and served in the Washington DC offices of Senator Bill Bradley and the Atlantic Richfield Corporation.

Peerform’s Gregg Schoenberg joined Peerform’s board of directors in 2012. Schoenberg, an alum of Washington University in St. Louis and Cornell’s MBA program, founded Wescott Capital, an investment and advisory firm based in New York. He was previously the head of equities and a member of the executive committee for Natixis North America and also worked in the capital markets department of SG Cowen in New York and served in the Washington DC offices of Senator Bill Bradley and the Atlantic Richfield Corporation.

I caught up with Peerform Board Member Gregg Schoenberg via email to discuss Peerform’s team, target demographic, services and P2P lending:

Erin: Please describe the Peerform team, including its Board and investors.

Gregg: The team is comprised of Financial Services veterans, technology professionals and others  committed to reinventing how credit is priced and distributed in the U.S. I am honored to serve as the Chairman of the Board, which also includes our CEO and co-founder, Mikael Rapaport, and representatives from our equity backers.

committed to reinventing how credit is priced and distributed in the U.S. I am honored to serve as the Chairman of the Board, which also includes our CEO and co-founder, Mikael Rapaport, and representatives from our equity backers.

Erin: What role(s) have you played in the formation of the platform? What role(s) do you currently play at Peerform, and what role(s) will you play going forward?

Gregg: I didn’t play a role in the company’s formation as I was still a Wall Street banker back then. However, I am actively engaged now in helping the platform gain momentum with accredited lenders. Going forward, I want to play a part in helping the company institutionalize and manage its growth.

Erin: Please described Peerform’s targeted client and its value add proposition.

Gregg: Our borrower clients include both prime and near prime borrowers who deserve to be given credit. Many of these borrowers appreciate that while we take into account their FICO score, we also look closely at a number of other factors in determining their offered interest rate. With respect to our lending clients, we are targeting accredited individuals and institutions that appreciate our approach to analyzing borrower creditworthiness, our vigilance against fraud and our aspiration to bring differentiated lending products and services to market.

Erin: How does Peerform fill a needed niche in the P2P lending market?

Gregg: We aren’t cool kids from Silicon Valley. We are New York-based Financial Services veterans. In  our careers, we have navigated down credit cycles and lived to talk about them. Ultimately, the P2P or marketplace lending sector is part of the Financial Services world. That’s where we live.

our careers, we have navigated down credit cycles and lived to talk about them. Ultimately, the P2P or marketplace lending sector is part of the Financial Services world. That’s where we live.

Erin: How many customers is Peerform currently servicing? Please share the loan range amount and who some of your current customers are.

Gregg: Our customers are borrowers from nearly half of all U.S. states including California, Texas and Illinois. Today, we loan out a maximum of $15,000 and a minimum of $1,000. We will likely expand our loan maximum in the not-too-distant future. We are serving an increasing number of borrowers and lenders since we re-launched our lending activities in April 2014, but can’t provide an exact figure as we are in the middle of financing round. Currently, we offer whole loan and fractional loans to lending clients. As we grow, we want to emphasize our whole loan offering because the borrower can access funds more quickly when just one entity is on the other side of a loan.

Erin: What sets Peerform apart from its P2P competitors? Explain how what sets Peerform apart will not become a liability.

Gregg: We are especially focused on serving “near-prime” borrowers with FICO scores in the mid-600 range, as opposed to what we call the “Tiffany Borrower” segment comprised of individuals with more pristine FICO grades north of 700. The Tiffany Borrowers are the primary target of some of our well known competitors. We believe that many of our borrower targets are just as creditworthy as those in the Tiffany segment of the market—they just don’t do as well on the conventional approach to borrower risk measurement used. Some have criticized us for going against the grain of the marketplace lending sector by relying less on FICO as the main determinant of creditworthiness. If that’s a liability, it’s one that we’ll  gladly claim.

gladly claim.

Erin: How have you and will you engage investors in the platform?

Gregg: We pride ourselves on being a “white-glove” platform. Our head of business development, Catheryn Robinson, our COO, Ari Hutt, CEO Mikael Rapaport and I spend a lot of time soliciting feedback from lending partners to make sure that we are continually improving our offering to them.

Erin: How does Peerform’s unique algorithm create a platform layer to facilitate P2P lending?

Gregg: Essentially, we look at a borrowers FICO score alongside other factors to determine the statistically probability of a borrower default. This approach is in contrast to a decision-tree approach in which FICO is the main gatekeeper for determining whether or not a borrower merits additional consideration.

Erin: Please describe the services Peerform offers. Is there fully automated trading? How fast are the transactions? What is the average transaction size?

Gregg: Yes, we do have an API that can be utilized by our whole loan investors. That being said, we are  not planning to allow high speed investors from gaining a special advantage on our platform by co-locating their servers near ours. We feature loans on our platform during business hours as soon as they are approved.

not planning to allow high speed investors from gaining a special advantage on our platform by co-locating their servers near ours. We feature loans on our platform during business hours as soon as they are approved.

Erin: What is Peerform’s fee structure for services? How much revenue is Peerform generating?

Gregg: We take the standard origination and servicing fees seen in the industry. Our revenue is growing at a brisk pace alongside our rising monthly loan volumes.

Erin: Please explain Peerform’s “whole loan lending program.”

Gregg: The whole loan program pairs one borrower with one lender. Because the loan is not syndicated, it can be filled more quickly than a fractional loan. A whole loan is also not viewed as a security by the SEC and can be easily serviced by a third-party if, for some reason, the owner of the loan doesn’t want Peerform to service it.

Erin: How is the “Loan Analyzer” integral to Peerform’s platform?

Gregg: It’s the engine behind how we assess a borrower’s creditworthiness. It is, therefore, quite  important.

important.

Erin: What are your thoughts on the next two or three years for P2P lending? How and where will Peerform further expand? Where do you see Peerform in five years? Ten years?

Gregg: It’s going to be an exciting time for both Peerform and for the industry at large. We see Peerform as playing the role of a high-value, niche player. We don’t aspire to be massive. Rather, we want to remain nimble enough to offer differentiated loan products and services that push the boundaries of this exciting industry. The QE-fueled rise of marketplace lending may not last forever, but if we can stay different, we expect to be one of the long-term winners in the space.

___________________________________________________________