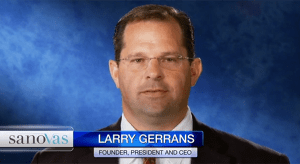

Sanovas Inc., a life science holding company that is accelerating the development and commercialization of next-generation micro-invasive diagnostics, devices and drug delivery technologies, through its spin-off companies, has raised $30+ million to fund its operations, 2/3 of which has come from a pioneering funding model conceived by CEO Larry Gerrans.

The unique “social finance” model engineered by Gerrans, which incorporates a self-directed IRA protocol, is documented in a research paper published last week in the University of California Berkeley’s Fung Institute’s “Crowdfunding Research Blog,” Crowdfunding Case Study: How to Build a $500 Million Biotech in Silicon Valley Without Silicon Valley – The Gerrans Chronicle, by Richard Swart, PhD, Research Director for the Fund Institute’s Program for Innovation in Entrepreneurial and Social Finance at the University of California, Berkeley.

The unique “social finance” model engineered by Gerrans, which incorporates a self-directed IRA protocol, is documented in a research paper published last week in the University of California Berkeley’s Fung Institute’s “Crowdfunding Research Blog,” Crowdfunding Case Study: How to Build a $500 Million Biotech in Silicon Valley Without Silicon Valley – The Gerrans Chronicle, by Richard Swart, PhD, Research Director for the Fund Institute’s Program for Innovation in Entrepreneurial and Social Finance at the University of California, Berkeley.

Swart and Gerrans will share the model and discuss the possibilities for “Innovation Capital” in the Life Sciences at “OneMedForum 2015,” a satellite conference taking place concurrent to the JP Morgan Life Science Investment Conference in San Francisco on Monday (January 12th).

The innovative finance model has helped Sanovas originate over 100 multi-national patents and develop a vast portfolio of cutting edge technologies. It has also enabled the organization to diversify its assets across a number of companies it is spinning out. One of which highlights a joint venture with Mayo Clinic and another is being conducted with physicians affiliated with Harvard Medical School.

The innovative finance model has helped Sanovas originate over 100 multi-national patents and develop a vast portfolio of cutting edge technologies. It has also enabled the organization to diversify its assets across a number of companies it is spinning out. One of which highlights a joint venture with Mayo Clinic and another is being conducted with physicians affiliated with Harvard Medical School.

The basis of the model uses investment proceeds derived from self directed individual retirement accounts to fund the businesses from start up through commercialization. The case study heralds the impact the model may have on innovation capital, crowdfunding and retirement savings in the U.S.

To view the complete study, click here.

Have a crowdfunding offering you'd like to share? Submit an offering for consideration using our Submit a Tip form and we may share it on our site!