Stockflare, an online investment advisor, quickly surpassed its £300,000 equity crowdfunding goal on Crowdcube and closed overfunded at over £442,000. According to the listing page, 288 investors participated in the round that took just two weeks to fund.

Crowdcube reports the equity crowdfunding was “underpinned” by one of the first investments from the London Co-Investment Fund (LCIF) that increased its investment from £75,000 to £100,000 in the midst of the capital raise.

The LCIF was founded and is managed by Funding London and Capital Enterprise. It has raised £25 million from the Mayor of London’s Growing Places Fund to invest in high growth tech, science and digital startups in London. According to report from 2014, LCIF is committed to invest over £80 million in London startups during the next few years. Stockflare is one of the first FinTech startups to gain investment from LCIF, and the first to do so via Crowdcube.

The LCIF was founded and is managed by Funding London and Capital Enterprise. It has raised £25 million from the Mayor of London’s Growing Places Fund to invest in high growth tech, science and digital startups in London. According to report from 2014, LCIF is committed to invest over £80 million in London startups during the next few years. Stockflare is one of the first FinTech startups to gain investment from LCIF, and the first to do so via Crowdcube.

John Spindler, Co-founder of the LCIF, and CEO of Capital Enterprise said, “In our first 9 months, the London Co-Investment Fund has backed over 20 start-ups in partnership with some of the UK’s leading venture capital firms. We look forward to welcoming Stockflare to the LCIF family and help them expand their team here in London”.

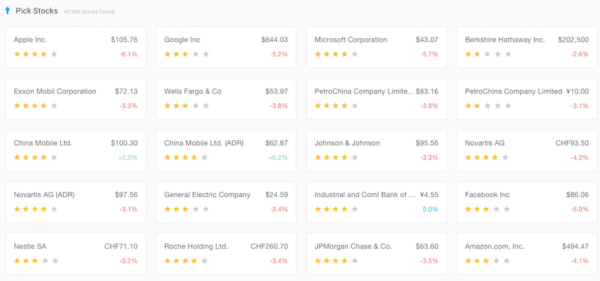

Stockflare provides free investment advice to users and claims over 10,000 active, monthly users. Its mission is to make it easier than ever for private investors to find the stocks that are right for them, by providing extensive analysis that can be readily understood and used by investors of any experience level. Stockflare is pre-revenue and is said to “admire Amazon” and their approach to helping people find what they are looking for. Stockflare may get into the asset management business. The Stockflare site differentiates by presenting a visually intuitive presentation of stocks – in stark contrast to present day internet trading platforms. The business model is said to partner with low-cost brokerage firms in key markets, including the UK and the USA. These partners’ services will integrate directly into Stockflare’s website, so users can open accounts and manage their investments via Stockflare. Stockflare’s first brokerage service will launch in the autumn, enabling anyone in the world to open a US brokerage account.

Shane Leonard, founder and CEO of Stockflare explained the concept came from watching small investors pay high fees for mediocre returns.

Shane Leonard, founder and CEO of Stockflare explained the concept came from watching small investors pay high fees for mediocre returns.

“Unfortunately, most fund managers fall short of their benchmark, consistently,” said Leondard. “Through my experience working in equity markets I knew that with the right tools, most investors can look after their investments as well as the professionals would, but at a fraction of the cost. Stockflare delivers those tools to small investors around the world for free.”

Have a crowdfunding offering you'd like to share? Submit an offering for consideration using our Submit a Tip form and we may share it on our site!