As the Marketplace Lending industry begins to mature, awareness is growing across the population. More and more consumers realize they may be able to save time, and money, by doing a greater portion of their banking online. Lending Club, the largest Marketplace Lending platform in the US, is a bit of a benchmark for the industry. The very first online lending platform to publicly trade shares in a hugely successful offering last year, this event was labeled a “watershed” moment in the online lending sector.

As a growing number of consumers are discovering the benefits of marketplace lending (also called P2P Lending), regulators and policymakers have taken notice as well. With a total addressable market measured in the trillions, this interest will continue to grow.

As a growing number of consumers are discovering the benefits of marketplace lending (also called P2P Lending), regulators and policymakers have taken notice as well. With a total addressable market measured in the trillions, this interest will continue to grow.

This past week many diverse lending platforms submitted comments in response to the Department of Treasury’s “Request for Information.” This RFI has been described by Treasury as simply fact finding – and not driven by a need to incorporate new rules.

As direct lending platforms play a larger role in providing credit to both consumers and businesses, it is natural for government officials to engage with market participants. Of course there remains a lingering concern that additional rules may, at some point, materialize. Driven either by entrenched legacy banking, seeking to create barriers to new competition, or by government regulators, it is imperative that Marketplace Lending platforms maintain an established line of communication to advocate and educate on their behalf.

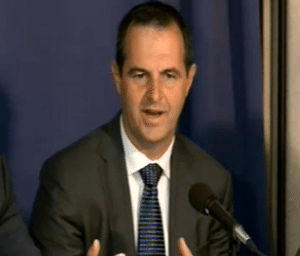

Last week Crowdfund Insider had the opportunity to speak with Lending Club CEO Renaud Laplanche about his viewpoint on the fast-evolving industry. Laplanche explained he did not believe it was Treasury’s intent to bring in new regulation but was truly an “exercise in understanding Marketplace Lending.”

Last week Crowdfund Insider had the opportunity to speak with Lending Club CEO Renaud Laplanche about his viewpoint on the fast-evolving industry. Laplanche explained he did not believe it was Treasury’s intent to bring in new regulation but was truly an “exercise in understanding Marketplace Lending.”

Laplanche said the federal officials want to “first understand the benefit of Marketplace Lending and whether it makes credit more available or more affordable and secondly, to make sure they [Treasury] are certain the regulatory framework provides for the safe work of the industry which is to say … making sure regulations don’t get in the way.”

That being said, as Lending Club outlined in their comment letter, Laplanche is of the belief there are certain areas where additional regulation may be even more protective of consumers and investors. Laplanche noted that Treasury does not have rule-making authority, but they can make recommendations. He also understands any information provided by Treasury may be shared with other regulatory agencies.

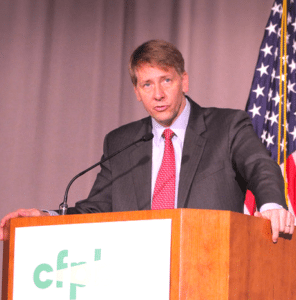

Asked about the CFPB, an agency that has recently been in the news as gunning for PayDay lenders and the so-called “PayDay debt traps“. Laplanche said he has not heard anything that indicates the CFPB has taken a special interest in Marketplace Lending. In fact, Laplanche had a meeting with Richard Cordray several months back. He stated that Cordray did not hint any interest in further regulation of lending platforms like Lending Club. Laplanche said the Cordray has described Marketplace Lenders as “consumer friendly”.

Asked about the CFPB, an agency that has recently been in the news as gunning for PayDay lenders and the so-called “PayDay debt traps“. Laplanche said he has not heard anything that indicates the CFPB has taken a special interest in Marketplace Lending. In fact, Laplanche had a meeting with Richard Cordray several months back. He stated that Cordray did not hint any interest in further regulation of lending platforms like Lending Club. Laplanche said the Cordray has described Marketplace Lenders as “consumer friendly”.

Kind words from industry observers are not always the case. This past September, the New York Times published an article called “Pitfalls for the Unwary Borrower Out on the Frontier of Banking“. I don’t know if I would call Marketplace Lending the frontier of banking, but the article did come across as rather slanted. The author cherry-picked several borrowers who had clearly abused the loan taking process. The spin appeared to indicate irresponsible borrowing is the norm – not the exception (It was interesting that many of the reader comments appeared rather surprised at the anti-Marketplace Lending spin too). I asked Laplanche for his opinion on the NYT copy and he stated;

“We made our comments to Michael [the NYT reporter] and told him we thought the article was misleading. It was selectively taking facts adhering to a narrative he wanted to promote. We are one of the financial services companies that has the highest customer service satisfaction. We measure the net promoter score (NPS) and we register in the 70s. The last measurement we measured was 78. It is one of the higheset NPS across all types of products. Certainly in the financial services where the average is in the 20s”

Laplanche described the article as not very balanced. He clarified that 96% of their borrowers are current on their loans. As for historical default rates they line up with traditional consumer bank loans.

One area that Laplanche wants to clarify is the definition of Marketplace Lending. As stated in his RFI comment letter, Balance Sheet Lending and Marketplace Lending are not quite the same.

“We were not trying to bear any judgement nor saying one is better than the other,” affirms Laplanche. Certainly the dynamics are different. I wanted to make sure there is an understanding that there are all kinds of players and many of them are very good at blurring the line as to how they operate and where the capital comes from. Using the securitization market to refinance themselves is one type of dynamic and is not the way lending club nor prosper operates.”

“Lending Club, Prosper, Funding Circle are truly a two-sided marketplace with borrowers on one side and investors on the other. The investors are more active in deciding which loans get funded. If they don’t like the interest rates and they don’t select these loans they will not get funded. So it’s pretty different on who decides on the credit quality on the origination.”

Asked if there was a risk of some platforms getting grouped together with the broader online lending sector (as not all may be as scrupulous). Laplanche believes that could occur.

Asked if there was a risk of some platforms getting grouped together with the broader online lending sector (as not all may be as scrupulous). Laplanche believes that could occur.

“I think that is right, we are at risk to being grouped with some other platforms that operate differently. There is certainly a lot of excitement in the space and a lot of new players including some smaller companies that are trying to grow very fast and might be taking shortcuts and risks that we would be uncomfortable taking. From that standpoint, I think it is important to establish best practices across the industry that also have some level of regulatory oversight and monitoring.”

As the Marketplace Lending industry is fairly new, industry participants as of yet have no defined trade group to represent their interests on Capitol Hill. In the UK, the founding country of P2P lending, the Peer to Peer Finance Association (P2PFA) has played a vital role in messaging and regulation. Should platforms band together to communicate as one?

“I think that is a really good idea,” stated Laplanche “What we have done with the Small Business Borrower Bill of Rights is a step in that direction. Rather than try to create a generic trade association, we decided to tackle one issue at a time. By doing this we test the alignment of interests based on different industry players … Actions speak louder than words. Essentially [we are] establishing best practices around transparency and customer friendliness and responsible credit. Seeing who would be signing the deal was one way to create some selection criteria as to who we would want to join forces with. I think the small business piece was necessary and important so now we will move on and tackle the next issue. In a short period of time, we will be having these conversations with industry players and really see who is aligned with us in terms of values. Then we will be able to make a more informed decision as to who should be a member of that more traditional trade association.”

So what are the next steps in the Treasury process? What is the net result of the RFI?

So what are the next steps in the Treasury process? What is the net result of the RFI?

“I think they are going to have some reading to do,” says Laplanche. With over 50 participants and rather long comments, it will probably take some time for Treasury to digest it all. Laplanche does not know if we should expect any concrete steps to be rendered from the exercise, especially with a Presidential election taking place in the coming months.

Laplanche closes by emphasizing a significant difference between traditional finance and online lending. Transparency. A very meaningful characteristic of Marketplace Lending. While some pundits have labeled marketplace lending as shadow banking, nothing could be further from the truth.

“Transparency in the industry is very differentiated from more traditional banks. Our ability to embrace transparency of data, track records, performance as an industry is really important.”

In this statement, Laplanche is clearly right.