“I believe the use of the internet, platforms and websites — and all of the access and transparency that this enables — will become the New Normal for ALL securities transactions, and not just those directly impacted by the JOBS act, but for public offerings as well.”

DJ Paul has been a long term advocate and participant in the alternative finance sector. A founding member of the Crowdfund Intermediary Regulatory Advocate (CFIRA) and current co-Chair of the organization, DJ has helped to chart much of the course for the industry. He was instrumental in coordinating the very first meeting with the SEC and industry stakeholders following the signing of the JOBS Act in 2012. In the ensuing years he has become a regular speaker on internet finance, promoting greater access to capital for SMEs while firmly believing in providing broader investment opportunity for all. In recent years, DJ has been active on the SEC Advisory Committee on Small and Emerging Companies (ACSEC), an important communication vehicle between SMEs and the Commission. While his roots are in traditional finance, having completed tours at both Banque Paribas and Cowen & Company, DJ has also broadened his accomplishments into filmmaking having produced award winning films. DJ currently is the principle at DJP&Co, a financial consulting firm which specializes in the various aspects of investment crowdfunding.

CFIRA, as an entity, has been consistently engaged with elected officials on Capital Hill and with various key players within the SEC. Much of what has been accomplished within internet finance in the United States involved the actions of CFIRA members. The interview of DJ is part of an exclusive series coordinated with the 2015 Americas Alternative Finance Benchmarking Survey. CFIRA has added its name to support the initiative which is a joint venture of The Centre for Alternative Finance at University of Cambridge Judge Business School and the Polsky Center for Entrepreneurship and Innovation team at Chicago Booth School of Business. The survey is the first comprehensive assessment of disruptive finance which includes crowdfunding, peer-to-peer / marketplace lending and other forms of alternative finance across North, South and Central America.

CFIRA, as an entity, has been consistently engaged with elected officials on Capital Hill and with various key players within the SEC. Much of what has been accomplished within internet finance in the United States involved the actions of CFIRA members. The interview of DJ is part of an exclusive series coordinated with the 2015 Americas Alternative Finance Benchmarking Survey. CFIRA has added its name to support the initiative which is a joint venture of The Centre for Alternative Finance at University of Cambridge Judge Business School and the Polsky Center for Entrepreneurship and Innovation team at Chicago Booth School of Business. The survey is the first comprehensive assessment of disruptive finance which includes crowdfunding, peer-to-peer / marketplace lending and other forms of alternative finance across North, South and Central America.

Recently Crowdfund Insider spoke with DJ to hear his thoughts on recent events within the crowdfunding industry as 2016 queues up to be a banner year in the world of internet finance.

Crowdfund Insider: How may the research by the University of Cambridge / Chicago University benefit the industry?

Crowdfund Insider: How may the research by the University of Cambridge / Chicago University benefit the industry?

DJ Paul: Data and metrics are crucial to the industry, particularly because it is in it infancy — and still has many detractors and nay-sayers who are gunning for its failure. Any data that supports or demonstrates the efficacy of crowdfunding both as a tool for capital formation (particularly for businesses and communities which are underserved) and data which demonstrates wealth creation for the middle classes is vital to refute those who would seek to malign crowdfunding as a legitimate tool.

Crowdfund Insider: Why is crowdfunding and other new forms of finance so important economically?

DJ Paul: See above. CF has the potential to increase and provide access to capital to small and emerging companies that are underserved or not served at all by traditional investors and lenders. Any reasonable metrics clearly demonstrate that it is small businesses (and not large corporations) which do the most new hiring in any economy — but particularly economies emerging from recessions. So supporting capital formation for small business really is the “most first” way of creating private sector jobs, lowering unemployment, and thereby supporting the broader economy.

Crowdfund Insider: CFIRA has played a leading role in industry advocacy. How is the organization evolving and adapting as the industry becomes more established?

DJ Paul: CFIRA began as a very loose affiliation of like-minded individuals — not a professional “lobbyist” among them — who were all working to get the JOBS Act of 2012 passed. Once Obama signed it into law, these individuals and others came together to work with the SEC and other regulatory bodies to help shape and define  the broad strokes which Congress passed as law. I do not think any other group has worked more closely with the SEC to promote the Title 3 rules than CFIRA. Now that the rules have finally been promulgated, CFIRA continues to work with the SEC to fine tune the rules before they become live in mid-May of 2016. But equally important as the Title 3 crowdfunding industry truly begins to do business, CFIRA has generated and circulated both to its members and the broader industry a list of Best Practices. While CFIRA does not currently intend to be a policing organization officially, we do intend to condemn bad practices and bad actors who seek to malign the industry utilizing fraud, greed or just irresponsible business practices.

the broad strokes which Congress passed as law. I do not think any other group has worked more closely with the SEC to promote the Title 3 rules than CFIRA. Now that the rules have finally been promulgated, CFIRA continues to work with the SEC to fine tune the rules before they become live in mid-May of 2016. But equally important as the Title 3 crowdfunding industry truly begins to do business, CFIRA has generated and circulated both to its members and the broader industry a list of Best Practices. While CFIRA does not currently intend to be a policing organization officially, we do intend to condemn bad practices and bad actors who seek to malign the industry utilizing fraud, greed or just irresponsible business practices.

Crowdfund Insider: How do you feel the industry has grown since the signing of the JOBS Act? What about global growth?

DJ Paul: I cannot speak to global growth, as that is not my specialty. But I can certainly say that since the signing of the JOBS act in the spring of 2012, the proliferation and ubiquity of “crowdfunding” as both a topic of discussion and as a means to raise capital has grown exponentially in the past 3 1/2 years.

DJ Paul: I cannot speak to global growth, as that is not my specialty. But I can certainly say that since the signing of the JOBS act in the spring of 2012, the proliferation and ubiquity of “crowdfunding” as both a topic of discussion and as a means to raise capital has grown exponentially in the past 3 1/2 years.

As for the growth of the industry in the US, I think that we have seen a growth in the numbers of platforms utilizing 506(c) from Title 2 of the JOBS act in the last 20 months. And we will continue to see that grow, and perhaps become the standard for private placements in the US over time. As for the impact of Title 4 and Regulation A+, I think it is too early to tell what the impact will be on emerging companies as it has only been active for several months at this point.

Crowdfund Insider: Which sectors do you think will become the biggest beneficiaries of internet finance and access to capital?

DJ Paul: I think all sectors have the potential to benefit, of course, from Mom-and-Pa small businesses, to tech start-ups and of course, to Real Estate, which has really taken off as the leading sector to benefit from the JOBS act. As Title 4 becomes more familiar and utilized, I think we will see more emerging companies going public earlier in their lifecycles — much as they did in the 70’s and 80’s and into the 90’s. This is good for investors. And as Title 3 comes on line this spring, I anticipate a proliferation of fundraising across many and varied sectors.

Crowdfund Insider: What are your thoughts on the final rules for Title III? What about Regulation A+?

Crowdfund Insider: What are your thoughts on the final rules for Title III? What about Regulation A+?

DJ Paul: The process of working with the SEC to get laws from Congress to actual, promulgated rules by the SEC is a long and complicated one, fraught with both opposing philosophical goals as well as politics. So given that obvious backdrop, I would say that we are pleased overall with the results. Broadly, we appreciate the SEC’s efforts and support the final rules for both Title III and Reg A+. Did we get everything we wanted? Of course not. But that’s politics. And it ain’t bean bag.

Crowdfund Insider: You have advocated on behalf of redefining the definition of an Accredited Investor. Can you please explain why this is so important and how you would like to see it changed?

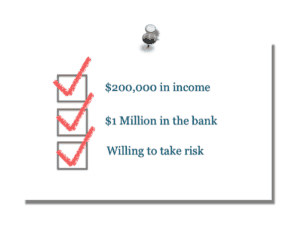

DJ Paul: The current Accredited investor standard has been in place since 1982 and it is limited to individuals or couples with high net worth or annual income. Meaning that one has to be rich in order to invest in these securities.

But the idea that wealth in itself is somehow a proxy for sophistication (which is really the proper test for someones suitability for investing) has always been deeply flawed. And I would say that it is also deeply un-American. We don’t want to limit investment to people who are already rich. We want to expand the definition to include people who are smart and sophisticated, regardless of their current wealth. Investing in these securities is exactly HOW many people become and expand their wealth. We need to make these investments more broadly available. So Expanding the definition of Accredited Investors to include demonstrably smart, or sophisticated, or credentialled individuals could expand the currently very limited pool of investors by 5 to ten fold. More money is currently raised annually in the Private Placement market than in ALL the public IPO’s by 400-500%. So expanding this base of investors could be the most transformative change in securities laws, and have the most positive impact on the economy than perhaps all of the provisions of the JOBS Act combined.

But the idea that wealth in itself is somehow a proxy for sophistication (which is really the proper test for someones suitability for investing) has always been deeply flawed. And I would say that it is also deeply un-American. We don’t want to limit investment to people who are already rich. We want to expand the definition to include people who are smart and sophisticated, regardless of their current wealth. Investing in these securities is exactly HOW many people become and expand their wealth. We need to make these investments more broadly available. So Expanding the definition of Accredited Investors to include demonstrably smart, or sophisticated, or credentialled individuals could expand the currently very limited pool of investors by 5 to ten fold. More money is currently raised annually in the Private Placement market than in ALL the public IPO’s by 400-500%. So expanding this base of investors could be the most transformative change in securities laws, and have the most positive impact on the economy than perhaps all of the provisions of the JOBS Act combined.

Crowdfund Insider: You have been a member of the SEC ACSEC group. How has this experience influenced your opinion of the regulatory environment and the rule-making process?

DJ Paul: I have actually had a truly positive experience during my time serving on the SEC ACSEC Committee. I believe the committee has worked very hard to consider some rather difficult and pertinent issues, and has made some substantive recommendations to the Chair and the Commission. Now, if the question is whether I would like the process of our recommendations being enacted to move more quickly, then the answer is a qualified “yes”. But I understand that the wheels of government and bureaucracy move slowly but consistently forward. And understanding that, not being impatient with the process is crucial.

DJ Paul: I have actually had a truly positive experience during my time serving on the SEC ACSEC Committee. I believe the committee has worked very hard to consider some rather difficult and pertinent issues, and has made some substantive recommendations to the Chair and the Commission. Now, if the question is whether I would like the process of our recommendations being enacted to move more quickly, then the answer is a qualified “yes”. But I understand that the wheels of government and bureaucracy move slowly but consistently forward. And understanding that, not being impatient with the process is crucial.

Crowdfund Insider: The financial industry is highly regulated in the US – at both the state and federal level. Are you concerned about over-zealous regulators?

DJ Paul: This is a complicated question because there are so many different regulatory bodies involved in the securities industry. At the SEC level, I think they do a fine job, with the caveat that they are horribly underfunded, and consistently given new and complicated reforms to enact, but rarely a consummate increase in budget in order to implement these mandates.

At the state level, it varies greatly from state to state. Some states are easier to do securities work in than others. Broadly, however, I do believe the states main role is to check and prosecute actual fraud — and not attempt to duplicate the work of the SEC at the state level, nor to evaluate the actual merit of a given offering. That is beyond the role of state government. Individuals should be permitted to invest their money as they see fit, as long as they are being protected from fraud and Bad Actors.

At the state level, it varies greatly from state to state. Some states are easier to do securities work in than others. Broadly, however, I do believe the states main role is to check and prosecute actual fraud — and not attempt to duplicate the work of the SEC at the state level, nor to evaluate the actual merit of a given offering. That is beyond the role of state government. Individuals should be permitted to invest their money as they see fit, as long as they are being protected from fraud and Bad Actors.

However, I do believe that FINRA, which is the industry’s only SRO (Self-Regulating Organization) is deeply in need of reform and additional oversight. We are talking about a private institution here, not a government agency. And yet it wields power consummate with a government agency — but without the oversight and accountability which must always accompany such power. Examples of the abuse of this power by FINRA are legion. This issue is very important to me and it’s utterly crucial to the ability of small companies to have access to the unfettered assistance of smaller broker-dealers who seek to help these companies raise capital.

Crowdfund Insider: How do you see traditional finance like banks adapting to the new era of internet finance?

DJ Paul: I am perhaps one of the few people who do not believe that this new fin-tech ‘disruption’ will cause the downfall, or even much of a stutter-step, for the Big Banks. This is not the first time that new technology has been introduced to big finance. And while sometimes slow to adapt, the banks always seem to make the transition eventually, co-opting and improving on the innovations. I believe that the banks will adapt, and more quickly than most of the industry players anticipate. Wall Street is nothing if not resilient.

DJ Paul: I am perhaps one of the few people who do not believe that this new fin-tech ‘disruption’ will cause the downfall, or even much of a stutter-step, for the Big Banks. This is not the first time that new technology has been introduced to big finance. And while sometimes slow to adapt, the banks always seem to make the transition eventually, co-opting and improving on the innovations. I believe that the banks will adapt, and more quickly than most of the industry players anticipate. Wall Street is nothing if not resilient.

Crowdfund Insider: Where do you see the Fintech / Investment Crowdfunding industry in the next 5 to 10 years?

DJ Paul: Well, my cracked crystal ball does not predict that far into the future. But broadly, I believe the use of the internet, platforms and websites — and all of the access and transparency that this enables — will become the New Normal for ALL securities transactions, and not just those directly impacted by the JOBS act, but for public offerings as well.

Due to a positive response, the Survey’s deadline has been extended until Friday, January 15.

Main benchmarking survey link:

-

https://www.surveymonkey.com/r/AltFinAmericas

- For Spanish version: https://es.surveymonkey.com/r/AltFin_Spanish

- For Portuguese version: https://pt.surveymonkey.com/r/AltFin_Portuguese

- For Canadian Platforms: https://www.surveymonkey.com/r/AltFin_Canada

The study is supported by the Inter-American Development Bank (IDB), Business Development Bank of Canada (BDC), KPMG and a number of leading industry research partners.

Crowdfund Insider has joined with The University of Cambridge, University of Chicago Booth School of Business to be the exclusive media partner on this benchmarking research. This interview is one of a series that includes multiple, in-depth interviews with international thought leaders and alternative finance industry pioneers from the collaborating associations.

Crowdfund Insider has joined with The University of Cambridge, University of Chicago Booth School of Business to be the exclusive media partner on this benchmarking research. This interview is one of a series that includes multiple, in-depth interviews with international thought leaders and alternative finance industry pioneers from the collaborating associations.

For benchmarking research inquiries please contact:

Dr. Robert Rosenberg, Chicago Booth School of Business (Robert.Rosenberg@ChicagoBooth.edu)

Tania Ziegler, Cambridge Centre for Alternative Finance, Cambridge Judge Business School (tz285@cam.ac.uk)

About the University of Cambridge, the University Chicago and Crowdfund Capital Advisors

University of Cambridge

This research is led by the Cambridge Centre for Alternative Finance, Cambridge Judge Business School. The Cambridge Centre for Alternative Finance is an international, interdisciplinary, academic research institute, dedicated to the study of alternative finance, which includes financial channels and instruments that emerge outside of the traditional financial system (i.e. regulated banks and capital markets).

Examples of alternative finance channels are online ‘marketplaces’ such as equity and rewards-based crowdfunding, peer-to-peer consumer/business lending, and third-party payment platforms. Alternative instruments include SME mini-bonds, private placements and other ‘shadow banking’ mechanisms, as well as social impact bonds and community shares used by non-profit enterprises and alternative currencies. The mission of the University of Cambridge is to contribute to society through the pursuit of education, learning and research at the highest international levels of excellence.

University of Chicago Booth School of Business

The University of Chicago Booth School of Business is consistently ranked among the top five business schools in the world. The school’s faculty includes renowned scholars and its graduates occupy key positions in the US and worldwide. The Chicago Approach to Management Education is distinguished by how it leverages fundamental knowledge, its rigor, and its practical application to business challenges.

The school offers full and part-time MBA programs, a PhD program, open enrollment executive education and custom corporate education with campuses in Chicago, London, and Hong Kong.