The California Department of Business Oversight (DBO) has issued a summary report of aggregate data provided by the companies that responded to the DBO’s online survey sent to 14 marketplace lenders engaged in online consumer and/or small business lending (or other types of financing such as merchant cash advances). The firms that responded include key lenders Affirm, Avant, Bond Street, CAN Capital, Fundbox, Funding Circle, Kabbage, LendingClub, OnDeck, PayPal, Prosper, SoFi and Square. The only company that did not respond was CircleBack. The survey sought information on loans made between January 1, 2010, and June 30, 2015, such as number of loans, annual percentage rates (APR), delinquencies, and investor information, noted the release.

The California Department of Business Oversight (DBO) has issued a summary report of aggregate data provided by the companies that responded to the DBO’s online survey sent to 14 marketplace lenders engaged in online consumer and/or small business lending (or other types of financing such as merchant cash advances). The firms that responded include key lenders Affirm, Avant, Bond Street, CAN Capital, Fundbox, Funding Circle, Kabbage, LendingClub, OnDeck, PayPal, Prosper, SoFi and Square. The only company that did not respond was CircleBack. The survey sought information on loans made between January 1, 2010, and June 30, 2015, such as number of loans, annual percentage rates (APR), delinquencies, and investor information, noted the release.

In December 2015, the DBO announced that it was launching an inquiry into the marketplace lending industry and was sending the survey as part of that inquiry. Consistent with the DBO’s announcement, the report states that the DBO’s inquiry “aims to assess how the state’s regulatory regime is working, and should work, with respect to the industry.” However, the report also contains the more ominous statement that “the inquiry’s objective is to determine whether market participants are fully complying with state lending and securities law.” The report does not address these issues in greater depth, and instead simply summarizes the aggregate data provided by respondents.

Highlights of the aggregate data reported by the DBO (which was based on responses from 13 of the 14 companies to whom the survey was sent) include the following:

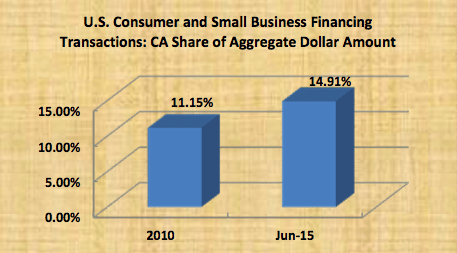

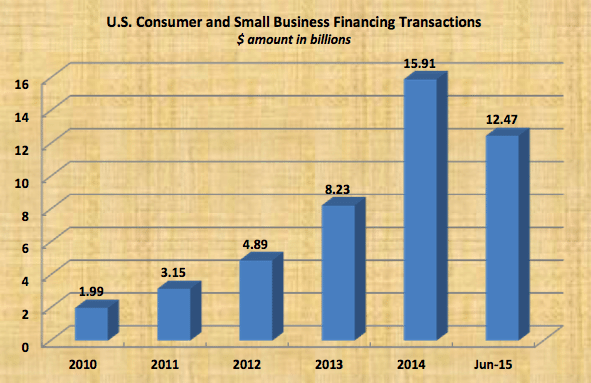

- From 2010 to 2014, the total dollar amount of the companies’ consumer and small business transactions increased nationally from $1.99 billion to $15.91 billion, representing an increase of 699.5 percent.

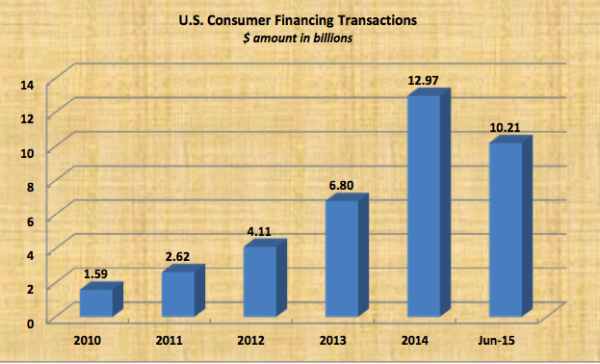

- From 2010 to 2014, the dollar amount of the companies’ consumer financing transactions grew nationally by 715.7 percent, from $1.59 billion to $12.97 billion.

- From 2010 to 2014, the dollar amount of the companies’ small business financing transactions increased nationally by 629.5 percent, from $403 million to $2.94 billion. The number of small business financing transactions grew nationally from 12,868 in 2010 to 240,277 in 2014, an increase of 1,767 percent.

- The companies’ median APR for consumer financing transactions in the first half of 2015 ranged nationally from 5.74 to 34.01 percent. Over the entire period of 2010 through the first half of 2015, median APRs generally declined nationally. All consumer transactions fell in the APR range of 40 percent and under before 2013 but in 2013 and 2014, loans were reported in higher APR ranges, including some at 81 percent or higher.

- The companies’ median APR for small business transactions in the first half of 2015 ranged nationally from 15.5 to 51.8 percent. The national high median APR declined from 74 percent in 2010 to 51.8 percent in the first half of 2015. In 2014 through the first half of 2015, the majority of transactions nationally had APRs of 11 to 30 percent, with some companies reporting that the majority of their loans had APRs ranging nationally from 41 to 101 percent or higher.

- At the end of the first half of 2015, the companies’ delinquent consumer financing transactions nationally ranged in number from 0.03 to 17.94 percent of total outstanding transactions and in dollar amount from 0.03 to 20.24 percent of total outstanding dollar amount.

- At the end of the first half of 2015, the companies’ delinquent small business transactions nationally ranged in number from 0.36 to 8.96 percent of total outstanding transactions and in dollar amount from 0.89 to 7.31 percent of total outstanding dollar amount. (These delinquency rates were lower than the rates in prior years.)

The survey also asked respondents to provide information about their business models and platforms. In the report, the DBO states that it will analyze such information and may send companies follow-up requests for documents and information.

The enormous growth in marketplace lending indicated by the survey data is likely to result in even greater scrutiny of marketplace lenders by federal and state regulators. In July 2015, the U.S. Department of the Treasury issued a request for information regarding online marketplace lending. In February 2016, the Federal Deposit Insurance Corporation published an article highlighting the risks for banks that partner with marketplace lenders, and in March 2016, the Consumer Financial Protection Bureau (CFPB) announced that it is taking complaints about marketplace lenders. According to the release, in addition to California, state regulators in Maryland and Pennsylvania have begun to look more closely at marketplace lending.

The enormous growth in marketplace lending indicated by the survey data is likely to result in even greater scrutiny of marketplace lenders by federal and state regulators. In July 2015, the U.S. Department of the Treasury issued a request for information regarding online marketplace lending. In February 2016, the Federal Deposit Insurance Corporation published an article highlighting the risks for banks that partner with marketplace lenders, and in March 2016, the Consumer Financial Protection Bureau (CFPB) announced that it is taking complaints about marketplace lenders. According to the release, in addition to California, state regulators in Maryland and Pennsylvania have begun to look more closely at marketplace lending.

The report is embedded below.

[scribd id=308884004 key=key-2zzXPpuuzcBYLRMtdTRN mode=scroll]