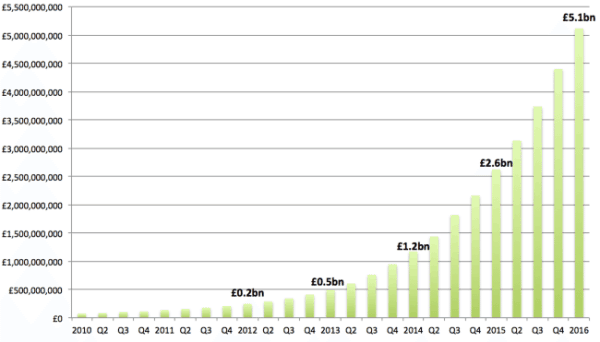

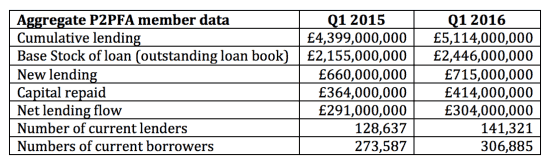

The UK Peer to Peer Funding Association has released its most recent quarterly numbers for the P2P lending industry. According to their tally, member platforms generated £715 million in Q1 of 2016 with quarter on quarter growth continuing its upward march. In the same quarter of 2015, member platforms claimed new lending of £660 million. The P2PFA qualified their numbers as indicative of the “mainstreaming of peer to peer lending.”

The P2PFA stated that new lending has increased significantly continuing the trend of past years. P2PFA members have now lent £5.1 billion in cumulative lending since 2010.

P2PFA Chair Christine Farnish commented on the release;

P2PFA Chair Christine Farnish commented on the release;

“The growth in peer-to-peer finance is impressive, and demonstrates the considerable momentum now behind the sector. Peer-to-Peer lending is now a mainstream and established part of the UK’s financial landscape. With peer-to-peer loans now eligible for tax-free investments through the personal savings allowance and with the new innovative finance ISAs regime, we expect further significant growth in the future. This is great news for investors and borrowers alike.”

Earlier this month the Innovative Finance or IF ISA became actionable opening up the new asset class to individuals saving for retirement. While many of the larger P2P platforms have not yet been qualified by the FCA – this is expected to change soon. Allowing P2P assets in ISAs creates a new, sizeable channel of funds for the growing industry.

Earlier this month the Innovative Finance or IF ISA became actionable opening up the new asset class to individuals saving for retirement. While many of the larger P2P platforms have not yet been qualified by the FCA – this is expected to change soon. Allowing P2P assets in ISAs creates a new, sizeable channel of funds for the growing industry.

Kevin Caley, Chairman of ThinCats said the industry had gone from “Fintech fantasy” to established industry in only a decade.

“With £715 million of new loans approved in the last three months alone, it’s clear that the peer-to-peer sector has truly made its mark and is giving traditional lenders a real run for their money. The pace of growth has been consistent, with volumes almost doubling year on year, and this is just the start of it,” stated Kaley. “We expect this growth to snowball, as more platforms receive FCA approval for the innovative finance ISA.”

“We had known for several months that March would be a big month for loans, ever since the Chancellor announced plans to charge extra stamp duty tax on landlords and developers’ purchases after April 1,” stated Faes. “It’s fantastic to see P2PFA members collectively deliver such consistently strong origination volumes. Christine is right when she says marketplace lending is becoming an established part of the UK’s financial services. Demand for our loans is there and appetite from the man on the street to the major institutions to invest across our platforms is surging, as their confidence in us grows.”

Kaley said it was inevitable that hurdles would be encountered along the way but P2PFA members have “built robust models”, setting high standards to manage industry growth.

“I have no doubt that the peer-to-peer sector will soon sit alongside other mainstream asset classes, and continue to deliver great results for investors and borrowers alike,” affirmed Kaley.

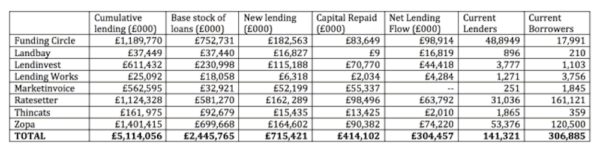

The P2PFA demands adherence to a list of best practices for member platforms. Current members include; Funding Circle, Landbay, Lending Works, LendInvest, RateSetter, Zopa, Thincats, and MarketInvoice. The member platforms represent over 90% of the UK peer to peer lending market.