What we do know about the Brexit is that uncertainty equals risk. And additional risk compels investors to become more cautious in their actions. With so many unknowns regarding the ramifications of the Brexit decision, it is going to take some time to sort things out. But a recent report from Pitchbook reviewing Brexit related data stated;

What we do know about the Brexit is that uncertainty equals risk. And additional risk compels investors to become more cautious in their actions. With so many unknowns regarding the ramifications of the Brexit decision, it is going to take some time to sort things out. But a recent report from Pitchbook reviewing Brexit related data stated;

“the UK & Ireland saw completed [VC] financings in 2Q fall to a level unseen since the middle of 2011 as the vote loomed ominously. Proportionally, that region’s share of overall VC activity declined to the lowest level in five years.”

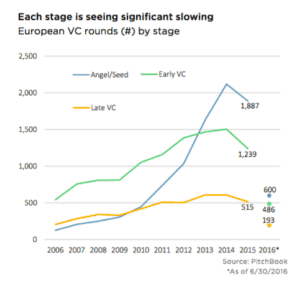

The author agrees that Brexit fallout will take some time to “unspool”. But any data indicative of fleeing investment or slowing entrepreneurial growth is cause for concern. Pitchbook data shows overall early stage European VC rounds slowing significantly. Conversely, while the number of European VC deals are slowing the “money continues to flow”. One region that showed an increase is the DACH (Germany, Austria, Switzerland) which saw a “surge” from Q1 to Q2. So is everyone fleeing to Berlin? Not yet. But the Pitchbook authors state;

“[Germany & Austria and] its known regulatory and legal frameworks, access to talent and location could encourage foreign VCs to hunt for opportunities there rather than in London.”

The UK, of course, will not sit idly by and watch continental Europe siphon all its talent away – especially in the Fintech sector which has been a banner sector for the Brits. Last week, the new Chancellor stated;

The UK, of course, will not sit idly by and watch continental Europe siphon all its talent away – especially in the Fintech sector which has been a banner sector for the Brits. Last week, the new Chancellor stated;

“The government is determined to help the UK FinTech sector to innovate and grow and to ensure that Britain remains the location of choice for FinTech start-ups.”

In an interview with Finance Magnates, the Liam Maxwell, the National Technology Adviser to the UK Government, defended London’s position as an innovation hub;

“London is indeed a key global financial centre, and also an important fintech centre. There is no reason for that to change…A tech company is all about making quick decisions, understanding the regulation, generating trust and linking with other communities. London has all these things, and more than any other city in Europe.”

While the scramble is on to triage the geopolitical aftershocks, expect the UK to announce further initiatives to defend their role in the world. Fintech has become a vital economic sector in the UK, employing over 60,000 individual while adding £6.6 billion in revenue to the UK economy.

While the scramble is on to triage the geopolitical aftershocks, expect the UK to announce further initiatives to defend their role in the world. Fintech has become a vital economic sector in the UK, employing over 60,000 individual while adding £6.6 billion in revenue to the UK economy.