The UK’s largest investment crowdfunding platform by total amount raised will be closing its most recent self-crowdfunding round in less than 24 hours. The offer currently stands overfunded at £6.95 million on an initial goal of £5 million. The offer page indicates that so far 3480 investors have participated in this most recent round. Pre-money valuation was pegged at £65 million.

The UK’s largest investment crowdfunding platform by total amount raised will be closing its most recent self-crowdfunding round in less than 24 hours. The offer currently stands overfunded at £6.95 million on an initial goal of £5 million. The offer page indicates that so far 3480 investors have participated in this most recent round. Pre-money valuation was pegged at £65 million.

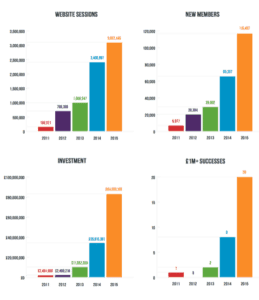

Due to the size of the funding round, Crowdcube had to file a prospectus (embedded below). The prospectus indicated Crowdcube was willing to raise up to £12 million by issuing new shares. Crowdcube has helped to fund over 350 different businesses for a total of over £160 million – 39 crowdfunding rounds were £1 million or more. Crowdcube is now the most active equity investor in the UK.

So the bigger question is what will Crowdcube do with the new funds and is it a good investment?

Expected uses for the capital infusion are outlined in the prospectus (embedded below). Crowdcube’s vision for the future is not just about matching smaller investor with a promising early stage company, it is about creating an entirely new financial ecosystem where money is invested, managed, monitored while generating returns for investors. This is for both smaller retail types and larger institutional money. Crowdcube wants to push further into the investment banking / VC world by providing access to capital to “later stage businesses, often VC-backed, that are more advanced and potentially able to deliver returns to investors more quickly.” The founders are keenly aware that investor satisfaction is paramount for platform success. Crowdcube will soon be offering a series of new software applications including a secondary market for Crowdcube purchased shares and shareholder management applications to keep funded companies engaged and committed to the platform longer. Soon it will not be much of a leap for Crowdcube to push deeper into other online offerings now promoted by traditional financial firms. Crowdcube intends on offering a “wide scope of financial services and investment opportunities including: offering IPOs to retail and institutional investors; managing a nominee; managing funds; and advising on investments.”

So is it a good investment? That question can only be answered over time. Execution and platform growth, while managing new services is key to driving shareholder value.

At a monthly operating cost of £740,000, Crowdcube has graduated from small to medium. It may soon be rather large. From a team of just 3 founders back in 2011, when the platform funded 13 pitches (and 894 investments) Crowdcube now has a team nearing one hundred and over 285,000 “members”. This number is expected to top half a million at some point next year.

Have a crowdfunding offering you'd like to share? Submit an offering for consideration using our Submit a Tip form and we may share it on our site!