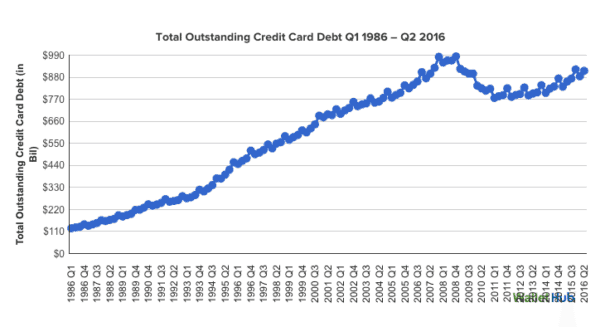

WalletHub has published their Credit Card Debt Study that shows a dramatic increase in household indebtedness – specifically in credit card debt. According to the report, US consumers cranked up on credit during Q2 of 2016 generating $34.4 billion in debt. This is the largest Q2 accumulation since 1986, according to the report. Credit card debt is now on track to hurdle $1 trillion in outstanding balances by the end of 2016 with average debt balances moving up to $8500 per household. The authors called the situation “perilous” and stated;

“Q2 2016 also appears strikingly similar to Q2 2007, which ended less than six months prior to the start of the Great Recession.”

The report said “we are flirting with financial disaster” coming on the heels of last year’s record increase in credit card debt of $71 billion and last quarter’s record-low first-quarter pay down of $27.5 billion. Consumers may be reverting to bad habits.

The rising consumer debt level fueled by credit card utilizing shows the potential for consumer online lenders including big marketplace lending platforms Prosper and Lending Club. The demand for consumer credit remains robust but the utilization of typically high-interest rate credit cards may drive demand for online lenders that service debt consolidation sectors. While the marketplace lending industry has been hammered by recent events that clipped their funding channel – there remains a compelling need for their services.