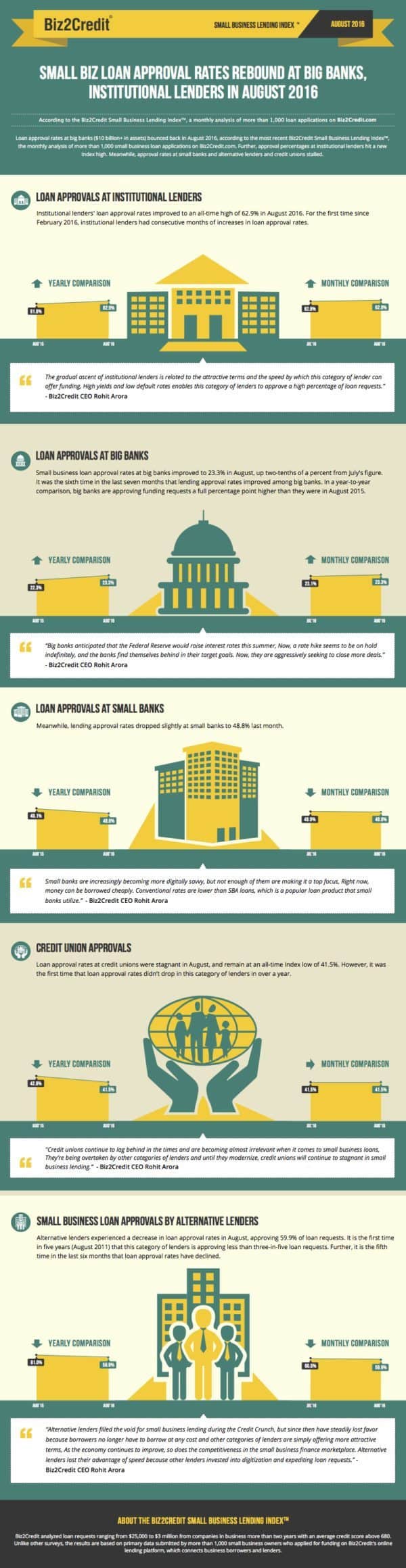

Small business loan approval rates at larger banks, institutions with $10 billion or more in assets, bounced back in August, according to the most recent Biz2Credit Small Business Lending Index. Further, approval percentages at institutional lenders hit a new Index high. Meanwhile, approval rates at small banks and alternative lenders and credit unions stalled.

Small business loan approval rates at larger banks, institutions with $10 billion or more in assets, bounced back in August, according to the most recent Biz2Credit Small Business Lending Index. Further, approval percentages at institutional lenders hit a new Index high. Meanwhile, approval rates at small banks and alternative lenders and credit unions stalled.

According to the report, loan approval rates increased to 23.3% in August – an increase of two-tenths of a percent from July’s number. Biz2Credit says this was the 6th time in the last 7 months that approval rates improved regarding larger banks. The year over year comparison indicated a 100 basis point increase.

“Big banks anticipated that the Federal Reserve would raise interest rates this summer,” said Rohit Arora, CEO and co-founder of Biz2Credit. “Now, a rate hike seems to be on hold indefinitely, and the banks find themselves behind in their target goals. They are aggressively seeking to close more deals.”

The report also stated that institutional lenders loan approval rates hit an all time high of 62.9% in August. Arora explained that this gradual ascent was due to the speed at which these lenders can deliver funding. “High yields and low default rates enables this category of lenders to approve a high percentage of loan requests,” said Arora.

On the opposite side, the numbers for small bank lending dipped a bit to 48.8% for lending approvals.

“Small banks are increasingly becoming more digitally savvy, but not enough of them are making it a top focus,” said Arora. “Right now, money can be borrowed cheaply. Conventional rates are lower than SBA loans, which is a popular loan product that small banks utilize.”

Alternative lenders saw a decrease in loan approval rates in August to 59.9% of requests. Biz2Credit said this was the first time in 5 years approvals dropped below 60%.

Alternative lenders saw a decrease in loan approval rates in August to 59.9% of requests. Biz2Credit said this was the first time in 5 years approvals dropped below 60%.

“Alternative lenders filled the void for small business lending during the Credit Crunch, but since then have steadily lost favor because borrowers no longer have to borrow at any cost and other categories of lenders are simply offering more attractive terms,” stated Arora. “As the economy continues to improve, so does the competitiveness in the small business finance marketplace. Alternative lenders lost their advantage of speed because other lenders invested into digitization and expediting loan requests.”

Loan approval rates at credit unions were stagnant in August, and remain at an all-time Index low of 41.5%. However, it was the first time that loan approval rates didn’t drop in this category of lenders in over a year.

Arora said Credit Unions are lagging behind and are “almost irrelevant” when it comes to small business loans.

“They’re being overtaken by other categories of lenders and until they modernize, credit unions will continue to stagnant in small business lending.”