Remitly, an independent mobile remittance company in the US, announced its receipt of $38 million in new equity and debt financing from IFC, a member of the World Bank Group, and Silicon Valley Bank. The financing will aid in the company’s expansion to deliver international fund transfers quickly and at a low cost to consumers, according to the platform.

“Remitly is driving important innovation in the peer to peer global payments arena,” indicated Silicon Valley Bank Market Manager Minh Le. “It is our pleasure to play a part in supporting Remitly’s growth during this exciting time of expansion.”

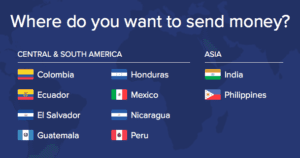

Concurrently, Remitly also announced its expansion into seven countries throughout Central and South America, where international remittances greatly contribute to the regional economy.

As the global economy becomes more connected, global citizens are looking for new ways to transfer money internationally– a flow of funds that topped $600 billion last year. Historically, the remittance process has been slow, expensive, and lacked transparency – leaving customers in the dark not knowing when their recipient will receive the money. Remitly’s proprietary global transfer network, enabled by its industry-leading mobile app, makes sending money faster, easier, more transparent, and less costly.

“Today’s announcement adds to the momentum around Remitly’s expanding global mission,” explained Remitly CEO Matt Oppenheimer. “We are especially pleased to be backed by IFC and the World Bank Group who for many years have actively worked towards trust and transparency around global remittances – the two core values at the heart of our business.”

According to the platform, success in Mexico set the stage for expansion into Central and South America. Remitly’s entry into Mexico last year makes further Latin American expansion a natural next step. Latin Americans living in the US are responsible for sending over $17 billion in annual remittance volume to the seven countries Remitly is expanding into, and those on the receiving end boast the largest smartphone consumption rate of any other demographic group.

“Remitly’s mission is perfectly aligned with IFC’s long-standing objective of helping the private sector find solutions that benefit the world’s poor,” clarified IFC Leader Fintech Investments Latin America and Africa Kai Schmitz. “Transfers by migrants to their home countries is a proven way to improve the lives of families and support emerging market economies. The World Bank is actively working with the G20 and other partners to increase choice for senders and lower the cost of remittances. Remitly is a great example how technology can be used to achieve these objectives.”

The seven new countries that Remitly now serves are Guatemala, Honduras, El Salvador, and Nicaragua in Central America, along with Colombia, Ecuador, and Peru in South America. For those receiving a Remitly money transfer, the company has built a network of more than 8,000 partners including major banks and popular retailers in the region that can facilitate cash pickup and direct deposits into bank accounts. Remitly also has a dedicated customer service center in Nicaragua to better serve Spanish-speaking customers in their native language.

The seven new countries that Remitly now serves are Guatemala, Honduras, El Salvador, and Nicaragua in Central America, along with Colombia, Ecuador, and Peru in South America. For those receiving a Remitly money transfer, the company has built a network of more than 8,000 partners including major banks and popular retailers in the region that can facilitate cash pickup and direct deposits into bank accounts. Remitly also has a dedicated customer service center in Nicaragua to better serve Spanish-speaking customers in their native language.

Headquartered in Seattle, with additional offices in the Philippines and Nicaragua, Remitly is backed by Stripes Group, DFJ, DN Capital, QED Investors, Trilogy Equity Partners, Bezos Expeditions, Founders’ Co-Op, International Finance Corp., and TomorrowVentures.

“We plan to aggressively grow and expand our services across the world in 2018 in an effort to fix the broken remittance system and give the billions of dollars in transfer and service fees previously pocketed by antiquated remittance companies back to immigrant workers,” shared Oppenheimer with Crowdfund Insider via email.

“Remitly is driving important innovation in the peer to peer global payments arena,” indicated Silicon Valley Bank Market Manager

“Remitly is driving important innovation in the peer to peer global payments arena,” indicated Silicon Valley Bank Market Manager  “Today’s announcement adds to the momentum around Remitly’s expanding global mission,” explained Remitly CEO

“Today’s announcement adds to the momentum around Remitly’s expanding global mission,” explained Remitly CEO  “Remitly’s mission is perfectly aligned with IFC’s long-standing objective of helping the private sector find solutions that benefit the world’s poor,” clarified IFC Leader Fintech Investments Latin America and Africa

“Remitly’s mission is perfectly aligned with IFC’s long-standing objective of helping the private sector find solutions that benefit the world’s poor,” clarified IFC Leader Fintech Investments Latin America and Africa