The Peer-to-Peer Lending Industry in Thailand

Peer-to-peer lending, which is also known as social lending or crowdlending, has drastically increased in the recent years in many countries around the world. The total volume of peer-to-peer lending activities has been growing rapidly. A good example is or the volume of peer-to-peer lending activities in U.K. which has doubled every year in the last four years.

Peer-to-peer lending may be used in many ways if it is properly regulated by the responsible authorities. This is one of the reasons that lead to the issuance of the consultation paper to regulate peer-to-peer lending industry by the Bank of Thailand.

Due to the current economic situation, economically disadvantaged people and small and emerging enterprises (SMEs) in Thailand normally face difficulties in accessing finance from the banks or traditional financial institutions. This incentivizes the increasing number of informal loans outside the established financial institutional system which may be illegal: Specifically; the problem of informal loans that are currently estimated at more than 5 trillion baht, impacting around 8 million households in Thailand.

SMEs are a very important in the context of economic development for Thailand. Statistics provided by the Thai Securities and Exchange Commission indicate that SMEs are the most significant source of employment and job growth in Thailand. SMEs in Thailand also accounted for 37.1% of GDP. Additionally, on the export side, SMEs accounted for 28.4% of the total amount of exports from Thailand. The most difficult issue for Thai SMEs is that they have difficulty in borrowing money from traditional banks or financial institutions. In other words, the cost of getting bank a loan in Thailand is rather high.

The challenge of accessing finance for Thai people and SMEs is one of the main motivators for proposing a regulatory framework for alternative finance in Thailand. Policy makers have recognized the important economic need to boost SME growth and job creation.

Simultaneously officials are concerned about the risk for abuse and the need for both investor protection rules and guidelines for borrowers. The Bank of Thailand has also expressed concern that peer-to-peer lending may also affect the monetary stability of Thailand in the near future.

Regulatory Framework for P2p Lending Industry in Thailand.

The Financial Institution Business Act B.E. 2551 (2008) is the main legal basis for operating a P2P lending business in Thailand. In general, to operate a peer to peer lending business through online services in Thailand the Financial Institution Business Act B.E. 2551 (2008) requires the lenders to operate the business in the form of a public limited company, licensed by the Ministery with the recommendation of the Bank of Thailand in accordance with section 9 of the act. However, the Bank of Thailand noticed this obstacle and issued the regulations to facilitate “Nano-finance” business in Thailand. There are three regulations which were issued to facilitate the “Nano-finance” business as follows;

(1) Notification of Ministry of Finance regarding type of business in accordance with section 5 of the Declaration of the Revolutionary Council (No. 58).

(2) Notification of Ministry of Finance regarding the financial institution and applicable interest rate (No.13) 2015.

(3) Notification of the Bank of Thailand SorNorChor 1/2015 regarding rule procedures and conditions for operating “Nano-finance” business for non-bank institution.

However, the “Nano Finance” regulations still not sufficient to regulate the P2P lending activity due to the unique characteristic of P2P lending industry itself.

Accordingly, the Bank of Thailand has recently issued a consultation paper for the regulatory framework of P2P lending industry requesting comments.

The Legislative Effort to Regulate P2P Lending Industry

The Bank of Thailand issued the consultation paper regarding a regulatory framework to regulate peer-to-peer lending on the 30th September 2016. In brief, this consultation paper includes the duties that peer-to-peer lending platforms must perform including disclosure requirements of a peer-to-peer lending platforms, the regulation related to agreements between a lender and borrower, and qualifications for becoming a peer-to-peer lending operator for a non-financial institution. There is also, a qualification for lenders/investors and borrowers incorporated in the consultation paper.

The Bank of Thailand issued the consultation paper regarding a regulatory framework to regulate peer-to-peer lending on the 30th September 2016. In brief, this consultation paper includes the duties that peer-to-peer lending platforms must perform including disclosure requirements of a peer-to-peer lending platforms, the regulation related to agreements between a lender and borrower, and qualifications for becoming a peer-to-peer lending operator for a non-financial institution. There is also, a qualification for lenders/investors and borrowers incorporated in the consultation paper.

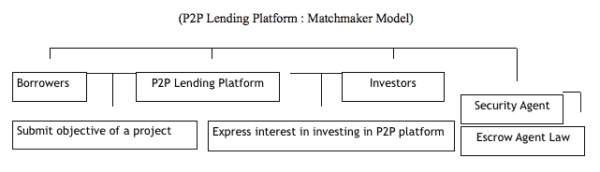

In Thailand, peer-to-peer lending may be separated into three main types; matchmaker, credit lender and a notary model. It should be noted that the consultation paper issued by the Bank of Thailand only focuses on the first type of peer-to-peer lending which is the matchmaker model. Also, in the case of debt crowdfunding (and equity crowdfunding) this has not been included in the proposed regulations in the consultation paper.

In specific, the matchmaker can be clarified as the following diagram;

From the characteristics of P2P Lending, the matchmaker model, there are many issues that need to be taken into consideration. For example, the consumer protection aspects, the good governance of P2P lending platforms, the prevention of cyber risks etc.

The consultation paper includes various issues such as;

(1) Guideline related to IT infrastructure of P2P lending platforms to prevent cyber risks.

(2) Disclosure duties of P2P lending platforms, specifically, a P2P lending platform shall disclose any related information of a service provider, loan and any complaint.

(3) The requirements for being a P2P lending platform.

(4) The qualification of an investor and borrower.

(5) Restrictions regarding the advertisement of platform.

(6) The regulation for a non-financial institution operator.

The significant issues of interest are as follows;

The significant issues of interest are as follows;

(a) For anyone who is interested in investing money in P2P lending platform, there is a limitation on the amount of investment which has been proposed as provided in the consultation paper;

(b) For anyone who wishes to operate a P2P lending platform in Thailand, there are duties and requirements which need to be considered such as;

(2.1) The duty to prepare IT infrastructure to prevent any cyber risks such as a track record for submitting to the Bank of Thailand.

(2.2) The duty to prepare the Business Continuity Management (BCM).

(2.3) The duty to handle a customer complaint regarding P2P operation.

(2.4) The duty to follow any instruction specified by the Bank of Thailand.

(2.5) The duty to provide a manual for the investors and borrowers with the details specified in the consultation paper, for instance, credit rating information. In specific, the platform shall provide an extensive disclosure regarding the principles and operations of the platform.

(c) For anyone who wishes to borrow money from the platform, there is information which must be considered such as;

(3.1) Investor disclosure : the investor suitability assessment. However, for the information related to the client suitability assessment, the Bank of Thailand still asks for the public’s opinion in the consultation paper regarding the details of which should be provided in the “the client suitability assessment”, indicative of some uncertainty.

Conclusion

The issuance of the consultation paper reflects the significant role of P2P lending industry for the Thai economy in the forthcoming years. Appropriate regulations can balance the interest of investors, P2P lending operators and borrowers. As I believe, the appropriate regulation of P2P lending platforms can be used in many ways to enhance the capacity of Thai SMEs and thus enhance the economic stability of the entire country. Access to capital, away from informal loans, has the potential to benefit both borrower and investor and thus further develop the Thai economy in the years to come.

Pawee Jenweeranon (นักศึกษาที่ 名古屋大学) is currently a lawyer/ legal consultant of Benkersy Legal (benkersylegal.com). He is a graduate student in the Master of Law (Comparative Law) at Nagoya University, Japan. This is the leading programs in doctoral education, supported by the Japan Society for the Promotion of Science (JSPS), with funding from Japan’s Ministry of Education. Pawee previously received a Master of Law at the Thammasat University in Bangkok, Thailand. He has worked for the Senate Banking Committee of Thailand, the Supreme Court of Thailand and was a legal official of the National Anti-Corruption Commission of Thailand. His research interests include internet finance law and patent law in the IT industry.

Pawee Jenweeranon (นักศึกษาที่ 名古屋大学) is currently a lawyer/ legal consultant of Benkersy Legal (benkersylegal.com). He is a graduate student in the Master of Law (Comparative Law) at Nagoya University, Japan. This is the leading programs in doctoral education, supported by the Japan Society for the Promotion of Science (JSPS), with funding from Japan’s Ministry of Education. Pawee previously received a Master of Law at the Thammasat University in Bangkok, Thailand. He has worked for the Senate Banking Committee of Thailand, the Supreme Court of Thailand and was a legal official of the National Anti-Corruption Commission of Thailand. His research interests include internet finance law and patent law in the IT industry.