Neuroprofiler is a French startup whose online application uses the latest advances in behavioral finance to help investors determine their psychological investment profile. The company’s ambition is to provide financial services with suitability testing tools that are not only fully compliant, but also add value to the customer experience through their ease of use and the actionable insights they deliver.

The Growing Need for Suitability Testing

In most countries, for investor protection, the regulator requires that firms providing financial investment advice to retail investors conduct an appropriateness and suitability test to ensure that the products they recommend match the risk profile and the financial situation of their customer. In Europe, the revised Financial Instruments Directive (MiFID II) that will come into force in January 2018 strengthens this suitability testing requirement.

In most countries, for investor protection, the regulator requires that firms providing financial investment advice to retail investors conduct an appropriateness and suitability test to ensure that the products they recommend match the risk profile and the financial situation of their customer. In Europe, the revised Financial Instruments Directive (MiFID II) that will come into force in January 2018 strengthens this suitability testing requirement.

For the time being, online self-service marketplaces such as crowdlending and crowdfunding platforms are generally required to do only light suitability checks. Typically, they must inform retail investors of the potential risks of their investment and ask them to certify that they understand these risks and can financially afford to take them. However, we can anticipate requirements to be strengthened. A case in point is the French regulation which gives to equity crowdfunding platforms the status of financial advisors (Conseil en Investissement Participatif, i.e. crowdinvesting advisors) and, as such, requires them to conduct “a test of the suitability of their offering to the investor’s profile.”

Regulation aside, every investment platform which intends to stay in business and grow should be keen to make sure that its customers make investments that truly match their risk preference and their needs.

Renewing the Concept of Suitability Testing

Existing suitability tests are mostly done through static verbal questionnaires, often not even online. Next to questions checking the investors’ knowledge of financial products, these tests ask them to self-assess their risk-taking behavior using simple methods such as ratings and word association. These rudimentary methods fall short of uncovering the true “risk tolerance and ability to bear losses” that the regulator requires be investigated. In fact, research shows that only 10% of existing tests are based on scientific research and only 50% are compliant.

By contrast, Neuroprofiler’s suitability testing:

- Complies with MiFID suitability testing requirements.

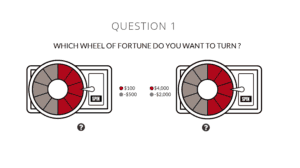

Provides an online gaming experience. The test uses gamification to retain the investor’s attention and avoid the tedium of a standard survey. Customers are asked to make a series of choices which each contrast two financial risk/reward options. The options are represented in a graphic format that makes it easy to intuitively grasp the probabilities of financial gain/loss for each option. The test process thereby more closely reflects an actual decision-making process than a verbal self-assessment could ever do.

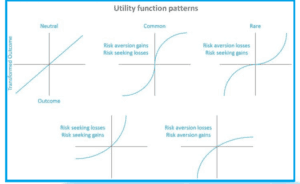

Provides an online gaming experience. The test uses gamification to retain the investor’s attention and avoid the tedium of a standard survey. Customers are asked to make a series of choices which each contrast two financial risk/reward options. The options are represented in a graphic format that makes it easy to intuitively grasp the probabilities of financial gain/loss for each option. The test process thereby more closely reflects an actual decision-making process than a verbal self-assessment could ever do.- Quickly reveals a customer’s unique utility functions: The test evaluates a customer’s risk profile along three dimensions: appetite for gains, loss aversion, and optimism. Using a Bayesian predictive model, each choice made by the customer determines the next options presented to her so that a small number of turns are necessary to determine the customer’s unique risk profile among thousands of possibilities. As risk profiles are not static and can be strongly influenced by changes in the customer’s situation or in the economic environment, customers are encouraged to take it time and again.

- Provides insightful explanations: Beyond satisfying legal requirements, the test also aims at helping investors and their advisors gain deeper insights into the customer’s preference. Results measure the customer’s profile against average responses taken from large historical samples and the evaluation is explained in a transparent way. This could mean, for example, helping a customer realize a stronger loss aversion than what he was aware of so that he can make a more conscious and more satisfying investment decision.

The Behavioral Finance Theory Underlying Neuroprofiler’s Model

Nobel Prize winner Daniel Kahneman’s Prospect Theory reveals that investors do not make rational decisions based on the maximization of economic value predicted by standard economic theories. The apparent irrationality observed in their decisions can be explained by cognitive biases, which are psychological perception biases and heuristics that the brain uses to make quick intuitive decisions.

Nobel Prize winner Daniel Kahneman’s Prospect Theory reveals that investors do not make rational decisions based on the maximization of economic value predicted by standard economic theories. The apparent irrationality observed in their decisions can be explained by cognitive biases, which are psychological perception biases and heuristics that the brain uses to make quick intuitive decisions.

In terms of financial decisions, a most common cognitive bias is loss aversion. This bias causes losses to hurt disproportionately more than gains feel good. Loss aversion leads people under threat of making a loss to take more risks than usual… and gamblers to dig themselves into a deeper hole.

Another common bias is the distortion of probabilities which makes many of us overestimate small risks and underestimate big ones. When facing a small risk, say under 20% probability, we focused on it rather than on the 80% chance of avoiding it; when the risk is very high, at a 90%+ probability, we take comfort in that it’s not 100% certain. In the middle, around a probability of 50%, we’re very insensitive to variations of plus or minus 20% of probability that would upset us otherwise. Very irrational!

Such cognitive biases are modeled in Prospect Theory by an inverse S-shape probability weighting function and a S-shape utility function.

For an illustrated description of cognitive biases and more detailed description of Prospect Theory, visit Neuroprofiler’s blog.

Why the time is right for Neuroprofiler

Behavioral finance became accepted by economists from the 80s on. Daniel Khaneman received the Nobel Prize in 2002. However, the theory is only now finding its way into FinTech implementations such as robo advisors and suitability testing. According to Tiphaine Saltini, the co-founder and CEO of Neuroprofiler, three factors explain why.

Behavioral finance became accepted by economists from the 80s on. Daniel Khaneman received the Nobel Prize in 2002. However, the theory is only now finding its way into FinTech implementations such as robo advisors and suitability testing. According to Tiphaine Saltini, the co-founder and CEO of Neuroprofiler, three factors explain why.

- Access to big data: Traditionally, financial behaviorists were relying on experiments with students. Now, researchers have access to big data, i.e. larger and more diversified sets of data from historical trading records or social media records which enable to reach.

- Ubiquity of digital interfaces: Financial services firms can now ask every customer to take a test via a PC, a tablet or a mobile phone.

- Machine learning: Over the past decades, new methodologies have enabled Neuroprofiler to take the risk assessment process out of the lab and make it shorter and more tractable.

Currently Under Test at a French bank

Neuroprofiler required more than three years of research by its co-founders Tiphaine Saltini and Julien Revelle.

The Neuroprofiler application is currently used as a pilot at a subsidiary of BPCE, one the French top 10 banks.

Soon, the company will make a high-performance cloud-based software-as-service version of its application openly accessible online from its Web site. The founders hope that this online version will entice more banks, insurers, financial advisors, and, why not, crowdfunding platforms, to try it.

To leave the final word to Tiphaine:

To leave the final word to Tiphaine:

“What our suitability testing solution offers to financial services firms is not only more relevant risk profile results, it is also a better customer experience, easier, more fun and more educational ‒ with, not to forget, better compliance with the KYC requirements imposed by MiFID. We know that major financial institutions are eager to experiment with FinTech solutions. We make it easy for them to adopt our solution by providing an integration API.”

Therese Torris, PhD, is a Senior Contributor to Crowdfund Insider. She is an entrepreneur and consultant in eFinance and eCommerce based in Paris. She has covered crowdfunding and P2P lending since the early days when Zopa was created in the United Kingdom. She was a director of research and consulting at Gartner Group Europe, Senior VP at Forrester Research and Content VP at Twenga. She publishes a French personal finance blog, Le Blog Finance Pratique.

Therese Torris, PhD, is a Senior Contributor to Crowdfund Insider. She is an entrepreneur and consultant in eFinance and eCommerce based in Paris. She has covered crowdfunding and P2P lending since the early days when Zopa was created in the United Kingdom. She was a director of research and consulting at Gartner Group Europe, Senior VP at Forrester Research and Content VP at Twenga. She publishes a French personal finance blog, Le Blog Finance Pratique.

Provides an online gaming experience. The test uses gamification to retain the investor’s attention and avoid the tedium of a standard survey. Customers are asked to make a series of choices which each contrast two financial risk/reward options. The options are represented in a graphic format that makes it easy to intuitively grasp the probabilities of financial gain/loss for each option. The test process thereby more closely reflects an actual decision-making process than a verbal self-assessment could ever do.

Provides an online gaming experience. The test uses gamification to retain the investor’s attention and avoid the tedium of a standard survey. Customers are asked to make a series of choices which each contrast two financial risk/reward options. The options are represented in a graphic format that makes it easy to intuitively grasp the probabilities of financial gain/loss for each option. The test process thereby more closely reflects an actual decision-making process than a verbal self-assessment could ever do.