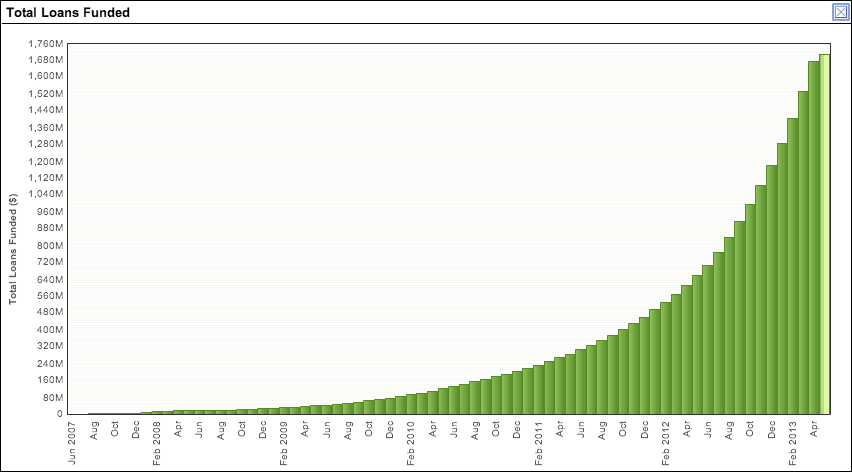

As we reported last week, Google has led a $125 million investment round in Lending Club. This round placed a value of $1.55 billion on the Silicon Valley based peer-to-peer lending platform. The move by Google may signal future dominance by peer-to-peer and peer-to-business lending in the crowdfunding space.

Candace Klein is founder and CEO of SoMoLend, a lending-based crowdfunding platform. She says the debt market in the US is four times the equity market and expects lending to lead the space in the future. “While debt may not be as sexy for the media, the debt market has the greatest opportunity for disruption,” she said.

Candace Klein is founder and CEO of SoMoLend, a lending-based crowdfunding platform. She says the debt market in the US is four times the equity market and expects lending to lead the space in the future. “While debt may not be as sexy for the media, the debt market has the greatest opportunity for disruption,” she said.

We are finding that our platform has been most helpful to consumer facing brick and mortar companies, with a focus on restaurants, retailers, salons, gyms and other similar industries.Candace Klein, SoMoLend

Klein points out that P2P and P2B lending solve many of the problems faced when seeking financing through bank loans or revolving credit. “We’ve learned recently that friends and family financing is faster and easier than traditional paths, and offers borrowers competitive (if not lower) interest rates that the traditional options,” she told Crowdfund Insider.

She also believes the debt market can provide benefits to businesses that have had a hard time finding capital in the past, and she has already seen this begin to play out on SoMoLend. “We are finding that our platform has been most helpful to consumer facing brick and mortar companies, with a focus on restaurants, retailers, salons, gyms and other similar industries,” she said. “These industries have had the most difficulty securing bank capital in the past, but have loyal customers that want to invest in the success of their favorite neighborhood businesses.”

Lending platforms are increasingly used as alternatives to high-interest revolving debt as well. Consumers and businesses with high amounts of revolving debt can turn to sites like Lending Club and SoMoLend to refinance their high interest debt, often times at reduced interest rates.

Debt “sidesteps many of the complexities of private equity, mainly valuation and secondary liquidity.”Jonathan Sandlund, The Crowd Cafe

Jonathan Sandlund writes about the crowdfunding space at The Crowd Cafe, and he believes the debt market provides a handful of beneficial functional benefits over equity crowdfunding. “Versus equity crowdfunding, this immediate scaleability is a unique characteristic of debt platforms, where many components of due diligence can be algorithmically automated,” he said. “This supports a much more transactional marketplace—even allowing individuals to auto-invest—which in return supports the participation of large investors and institutional capital (read: liquidity).”

Jonathan Sandlund writes about the crowdfunding space at The Crowd Cafe, and he believes the debt market provides a handful of beneficial functional benefits over equity crowdfunding. “Versus equity crowdfunding, this immediate scaleability is a unique characteristic of debt platforms, where many components of due diligence can be algorithmically automated,” he said. “This supports a much more transactional marketplace—even allowing individuals to auto-invest—which in return supports the participation of large investors and institutional capital (read: liquidity).”

“Both sides of the market, consumers and businesses, are familiar with it,” he continued. “It also sidesteps many of the complexities of private equity, mainly valuation and secondary liquidity.”

Google’s minority stake in Lending Club sent a shock wave through the crowdfunding industry and was hailed as vindication for an industry currently handcuffed by the SEC’s inaction in implementing the JOBS Act.

With endeavors like Google Glass, self-driving cars and now a minority stake in Lending Club, Google continues to chase disruption. As Candace Klein summarized, “We’ve known for some time now that banks have fallen short in consumer and small business lending. Now Google agrees.”

For more crowdfunding industry news and insight, consider joining our LinkedIn group.