The FCA takes responsibility for regulating consumer credit markets starting in April of 2014. This responsibility includes the peer-to-peer lending space. The FCA has announced plans to release guidance on lending-based crowdfunding and regulatory compliance later this month.

The FCA takes responsibility for regulating consumer credit markets starting in April of 2014. This responsibility includes the peer-to-peer lending space. The FCA has announced plans to release guidance on lending-based crowdfunding and regulatory compliance later this month.

In a recent release, the FCA detailed a small subset of expectations regarding steps the UK’s P2P lending platforms should take to protect borrowers…

Peer to peer lending platforms must give borrowers explanations of the key features of the loan – including the key risks – before an agreement is made, and assess the creditworthiness of borrowers before granting them credit. A 14 day cooling off period will allow the borrower to withdraw if they have a change of heart.

Much of the industry will be on the lookout for more detailed rules coming later this month.

The FCA has said that they will finalize rules in April of next year and give companies until October of next year before they begin stringent enforcement.

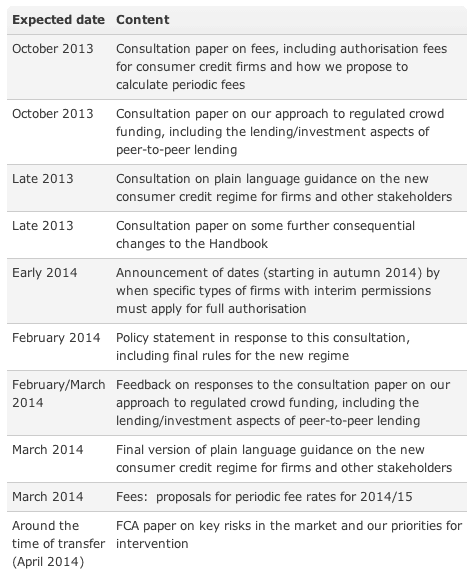

The FCA’s timeline is below.