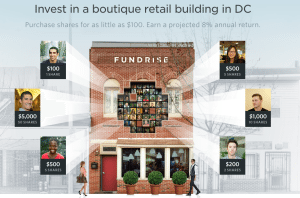

Real estate equity crowdfunding platform Fundrise has announced a new offering for a real estate investment in Washington, DC. The building located at 1539 7th Street, NW is available to any investor located in Virginia, Maryland and Washington, DC.

Real estate equity crowdfunding platform Fundrise has announced a new offering for a real estate investment in Washington, DC. The building located at 1539 7th Street, NW is available to any investor located in Virginia, Maryland and Washington, DC.

This offering highlights title IV of the JOBS Act which seeks to increase the small offerings exemptions from $5 to $50 million that can be raised publicly over a 12-month period. Fundrise has taken an old concept of Direct Public Offering of soliciting funding from the public to finance small business ventures and innovation, to property ownership. Investments can be made by both accredited and unaccredited investors — enabling community members to contribute to local development, no matter how small their investment.

The offering size is $350,000. There is currently a 21-day viewing period and the offering is expected to go live on March 26, 2014. Investors, accredited and unaccredited alike, will be able to participate in this offering by investing as little as $100. The returns on investment will yield between 8-12% and will be paid out in quarterly investments. This offering has a redemption period of five (5) years, after which investors will be entitled to a capital refund of their initial investment; those who opt against a refund will benefit from incremental increases of 2% on their annual returns for every year subsequent to the redemption year. The rent received from the property will not only be used as debt servicing, but will be paid out to investors as dividends and the remaining funds deposited in a capital reserve account.

The offering size is $350,000. There is currently a 21-day viewing period and the offering is expected to go live on March 26, 2014. Investors, accredited and unaccredited alike, will be able to participate in this offering by investing as little as $100. The returns on investment will yield between 8-12% and will be paid out in quarterly investments. This offering has a redemption period of five (5) years, after which investors will be entitled to a capital refund of their initial investment; those who opt against a refund will benefit from incremental increases of 2% on their annual returns for every year subsequent to the redemption year. The rent received from the property will not only be used as debt servicing, but will be paid out to investors as dividends and the remaining funds deposited in a capital reserve account.

Situated in the heart of the fast-growing Shaw neighborhood of Washington, DC, this large two-story, 3000 square foot building was built in 1900 and renovated in 2006. Surrounded by an abundance of new development and two blocks from the metro, the property will be leased by the owners, WestMill Capital Partners, to a restaurant or a retail store.

This represents the 18th project that Fundrise has launched thus far. With Ben Miller having to go state to state to enlist support for public offerings, it is no wonder that Fundrise is a leading trendsetter on the real estate radar. Last year the company ‘tested the waters’ by introducing this investment in theoretical form to gauge the interest of the public. The overwhelming positive response led Fundrise to make the property available for actual investment.

Fundrise is able to make the current offering available to residents of the three states in which the offering is registered. Regardless of what the SEC announces when deliberations are through, Fundrise has developed a model of raising funds that is unprecedented in real estate. With three successful Regulation A (and 18 total) offerings, and no doubt more in the wings, other states will soon be lining up behind DC, Maryland and Virginia to be a part of this growing phenomenon.

Fundrise is able to make the current offering available to residents of the three states in which the offering is registered. Regardless of what the SEC announces when deliberations are through, Fundrise has developed a model of raising funds that is unprecedented in real estate. With three successful Regulation A (and 18 total) offerings, and no doubt more in the wings, other states will soon be lining up behind DC, Maryland and Virginia to be a part of this growing phenomenon.

Founded by Ben and Dan Miller in 2012, Fundrise was the first to take commercial real estate investing to the online market. It has stayed true to form by being the only company to have successfully used Regulation A to make realty offerings to the public. “I’m excited to give people the chance to invest in their neighborhoods and have the same opportunities to participate financially in local development that was previously only available to real estate companies and investment funds,” said Fundrise’s Ben Miller.

Founded by Ben and Dan Miller in 2012, Fundrise was the first to take commercial real estate investing to the online market. It has stayed true to form by being the only company to have successfully used Regulation A to make realty offerings to the public. “I’m excited to give people the chance to invest in their neighborhoods and have the same opportunities to participate financially in local development that was previously only available to real estate companies and investment funds,” said Fundrise’s Ben Miller.

Have a crowdfunding offering you'd like to share? Submit an offering for consideration using our Submit a Tip form and we may share it on our site!