The Bank of England has released data on the UK Funding for Lending Scheme (FLS), a governmental program created to boost lending.

The Bank of England has released data on the UK Funding for Lending Scheme (FLS), a governmental program created to boost lending.

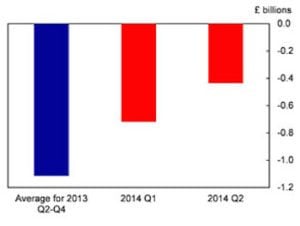

According to the report on 2014 Q2 data, “net lending by FLS Extension participants to small and medium-sized enterprises (SMEs) was slightly negative in the second quarter of 2014, but at -£0.4bn was less negative than in previous quarters. Net lending to large companies was -£3.5bn. Net lending to all businesses, including eligible non-bank credit providers, was -£3.9bn.”

The FLS was launched in July of 2012 and is designed to incentivize banks and mortgage lenders to boost lending . The FLS allows participants to borrow UK Treasury Bills in exchange for collateral. The program has been extended with participants to borrow up to 2015. The program was adjusted last year to be more targeted at supporting business lending. During the second quarter of 2014, 9 of the 36 groups participating in the FLS Extension made drawdowns of £3.2 billion. Participants also repaid £0.8 billion from the first stage of the FLS, taking total outstanding drawings to £45.7 billion.

The FLS was launched in July of 2012 and is designed to incentivize banks and mortgage lenders to boost lending . The FLS allows participants to borrow UK Treasury Bills in exchange for collateral. The program has been extended with participants to borrow up to 2015. The program was adjusted last year to be more targeted at supporting business lending. During the second quarter of 2014, 9 of the 36 groups participating in the FLS Extension made drawdowns of £3.2 billion. Participants also repaid £0.8 billion from the first stage of the FLS, taking total outstanding drawings to £45.7 billion.

The negative quarter contrasts to the dramatic growth in the peer to peer (P2P) lending sector. The new form of finance has experience a bit of a boom in utilization where funds flowing through P2P doubled during the first 6 months of 2014 according to the Peer-to-Peer Finance Association.

Anil Kapoor, director at BDO LLP, commented on the figures released today by the Bank;

Anil Kapoor, director at BDO LLP, commented on the figures released today by the Bank;

“The alternative finance sector is doing well in a market where bank business lending has slowed down substantially. Today’s Funding For Lending figures show that while the government initiative is well meaning, the big participants in the banking industry are not fulfilling market requirements. There is clearly more demand from businesses than is being serviced and this is where the alternative lending market is cementing its place as a legitimate solution to the liquidity shortage. However, these lenders must look to the future to ensure their own sustainability in an increasingly volatile environment.”

The Bank of England noted that bank funding costs have fallen significantly since the launch of FLS and thus has improved credit conditions.

The Federation of Small Businesses’ Voice of Small Business Index reported that loan application success rates continued to increase in 2014 Q2, and that the rates offered to successful businesses have fallen back over the past year. Some of the weakness in bank lending to smaller businesses, which has persisted despite the fall in bank funding costs, may reflect weaker demand.