New IR Site SymbidCorp.com & Collaboration with New York-Based Firm to Boost US Investor Base of Leading European Investment Crowdfunding Platform, as Industry Matures into Online Finance

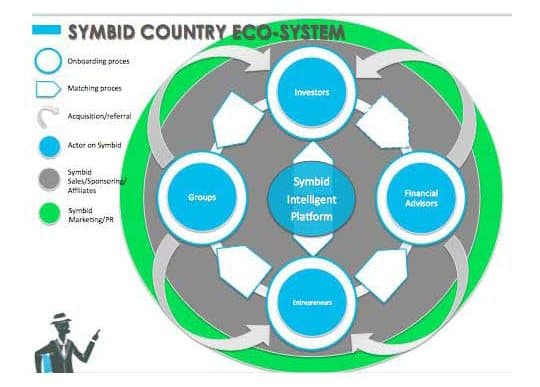

Symbid Corp., the Netherlands-based company behind one of the world’s first equity crowdfunding platforms, today  announced that they have engaged the services of Capital Markets Group LLC, a US investor relations firm specializing in emerging, high-growth, and global publicly traded companies. The partnership means Symbid Corp., the first publicly listed crowdfunding platform worldwide, enters the US market under the guidance of an IR firm with a proven track record of communicating promising European-based tech companies to US investors. The announcement came as the Dutch platform launched its dedicated investor relations site,www.symbidcorp.com, complementing the efforts of Amsterdam-based Sharpe Financial already underway across the European investment scene.

announced that they have engaged the services of Capital Markets Group LLC, a US investor relations firm specializing in emerging, high-growth, and global publicly traded companies. The partnership means Symbid Corp., the first publicly listed crowdfunding platform worldwide, enters the US market under the guidance of an IR firm with a proven track record of communicating promising European-based tech companies to US investors. The announcement came as the Dutch platform launched its dedicated investor relations site,www.symbidcorp.com, complementing the efforts of Amsterdam-based Sharpe Financial already underway across the European investment scene.

“We’re delighted to team up with Capital Markets Group as we look to increase awareness of our company’s offering within the US investment community,” said Korstiaan Zandvliet, CEO and co-founder of Symbid Corp. “Equity crowdfunding is increasingly seen as a serious, profit-generating system of investment throughout Europe and we believe CMG are well-positioned to communicate this same message to the US market, as our industry continues to grow exponentially.”

“We are excited to provide investor relations and strategic consulting to the Board and management team of Symbid,” commented Steve Gersten, Partner of Capital Markets Group. “We look forward to working with Symbid to continue to raise awareness of the Company among investors, increase value for its shareholders and help it meet its strategic goals.”

While equity crowdfunding remains unavailable to non-accredited investors in the US, Symbid enables all EU residents to invest in emerging companies with a minimum of $27. The platform has so far delivered over $6,625,000 in funding to businesses direct from the ‘crowd’, with an 860% growth in investments during Q2 2014 compared to 2013. Symbid’s collaboration with Capital Markets Group, a blue-chip New York-based investor relations practice, represents a crucial milestone for the crowdfunding industry generally. “Symbid’s acquisition of CMG’s market intelligence and corporate communications expertise is a big step forward in the maturing process,” continued Mr. Zandvliet. While delays with SEC regulations hold up equity crowdfunding legislation in the US, the Dutch market is predicted to more than double its funding volume this year, with Symbid leading the pack.1. “With CMG on board in the US, and Sharpe Financial successfully communicating our message in Europe, Symbid can now lead crowdfunding’s transition into something much more — online finance,” said Mr. Zandvliet.

to invest in emerging companies with a minimum of $27. The platform has so far delivered over $6,625,000 in funding to businesses direct from the ‘crowd’, with an 860% growth in investments during Q2 2014 compared to 2013. Symbid’s collaboration with Capital Markets Group, a blue-chip New York-based investor relations practice, represents a crucial milestone for the crowdfunding industry generally. “Symbid’s acquisition of CMG’s market intelligence and corporate communications expertise is a big step forward in the maturing process,” continued Mr. Zandvliet. While delays with SEC regulations hold up equity crowdfunding legislation in the US, the Dutch market is predicted to more than double its funding volume this year, with Symbid leading the pack.1. “With CMG on board in the US, and Sharpe Financial successfully communicating our message in Europe, Symbid can now lead crowdfunding’s transition into something much more — online finance,” said Mr. Zandvliet.