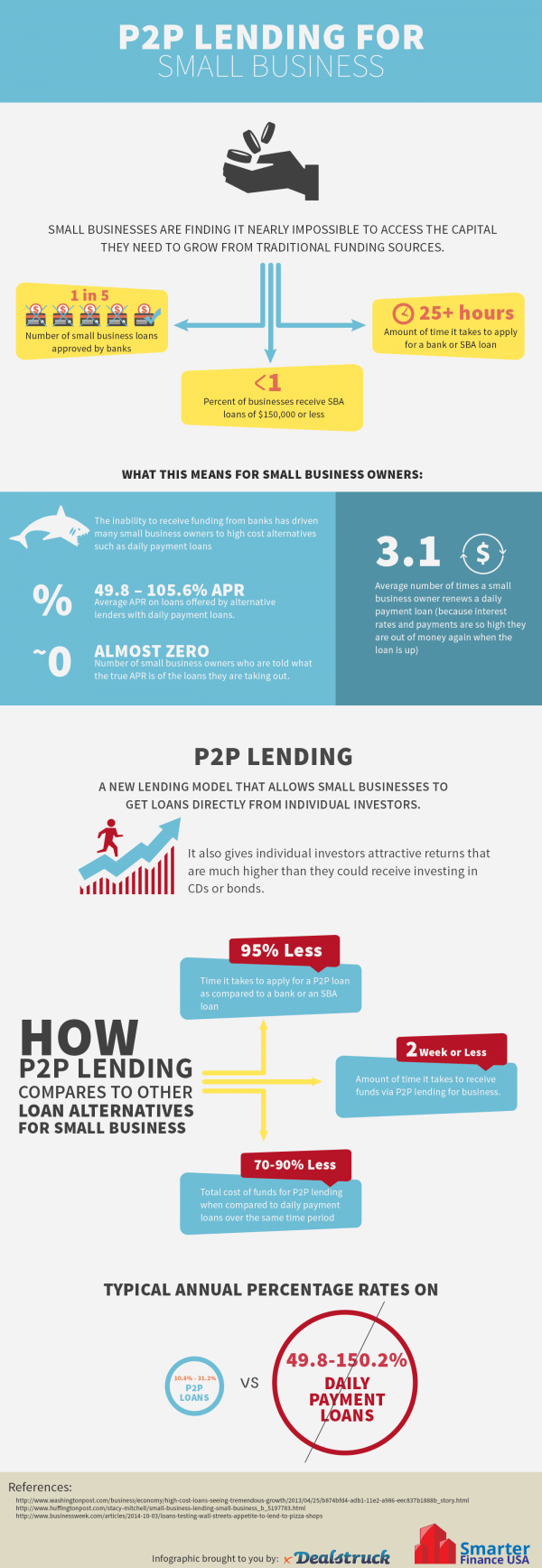

By now we all know banks are not necessarily the most expedient location to find capital to help fund your business. While small business is the engine of the economy they struggle to raise needed funds for growth when necessary. The painful process of driving to your local bank is quickly being replaced by peer to peer lending online. Better rates and better service. What more could you ask for? The guys at DealStruck have teamed up with SmarterFinance to create an infographic comparing bank loans to P2P. Some interesting bullet points include:

By now we all know banks are not necessarily the most expedient location to find capital to help fund your business. While small business is the engine of the economy they struggle to raise needed funds for growth when necessary. The painful process of driving to your local bank is quickly being replaced by peer to peer lending online. Better rates and better service. What more could you ask for? The guys at DealStruck have teamed up with SmarterFinance to create an infographic comparing bank loans to P2P. Some interesting bullet points include:

- Only 1 in 5 small business loans are approved

- Less than 1% of businesses are able to receive an SBA loan (of $150k or less)

- It takes on average 95% less time to apply for a P2P loan versus that trip to a bank

- 2 weeks or less to receive funds via P2P

- Lenders (investors) may capture a far superior risk adjusted return compared to other common options.

The efficacy and ease of access will make P2P lending the choice of most quite soon. Eventually this will all be normal -and the trip to the bank, well not so much.