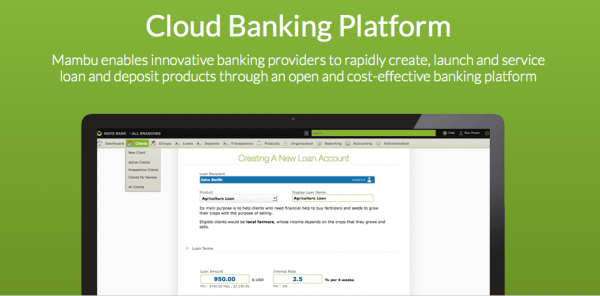

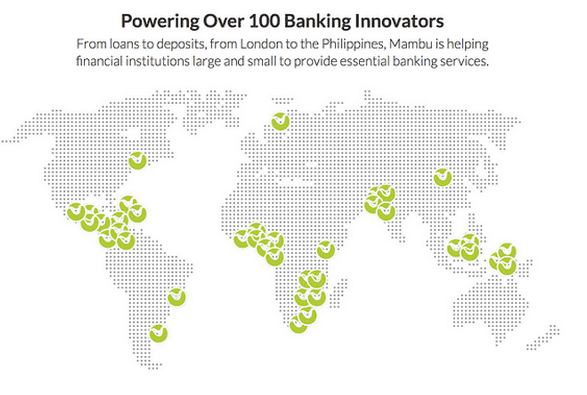

Mambu, a cloud banking technology platform provider that works with more than 100 financial innovators worldwide, including Banco Macro, Opportunity International, Mentors International, and Yale University, uniquely sits at the nexus of the transformation and financial inclusion markets, where new applications and the cloud’s agility offers a particularly compelling value proposition for both existing banking institutions looking to innovate and digital disruptors looking to enter the market. Mambu is named for the original Malaysian word for bamboo: “Bamboo is the fastest growing plant in the world, but only when all the conditions are right. Bamboo has been eaten, worn, used to build bicycles and homes. It is versatile and obtainable to all. We like how that sounds,” indicates the platform’s website. With offices in Berlin, London, Lausanne and Iași, Mambu is certainly growing quickly, currently counting clients in new banking service providers, microfinance organizations, credit cooperatives and innovative retail banks in nearly thirty countries.

Mambu, a cloud banking technology platform provider that works with more than 100 financial innovators worldwide, including Banco Macro, Opportunity International, Mentors International, and Yale University, uniquely sits at the nexus of the transformation and financial inclusion markets, where new applications and the cloud’s agility offers a particularly compelling value proposition for both existing banking institutions looking to innovate and digital disruptors looking to enter the market. Mambu is named for the original Malaysian word for bamboo: “Bamboo is the fastest growing plant in the world, but only when all the conditions are right. Bamboo has been eaten, worn, used to build bicycles and homes. It is versatile and obtainable to all. We like how that sounds,” indicates the platform’s website. With offices in Berlin, London, Lausanne and Iași, Mambu is certainly growing quickly, currently counting clients in new banking service providers, microfinance organizations, credit cooperatives and innovative retail banks in nearly thirty countries.

Mambu recently announced that its cloud banking technology is powering Savvy Loans’ new lending program for individuals and small businesses. Savvy Loans Ltd., is a new entrant into the U.K. consumer credit market. Mambu claims over 100 global clients today.

Co-Founded by Carnegie Mellon grads, CEO Eugene Danilkis, COO Frederik Pfisterer and Customer Success Manager Sofia Nunes, Mambu’s mission indicates the belief “that people and businesses should have ubiquitous access to financial services to help them pursue economic opportunities. [Mambu] does this by providing world-class banking technology built in and delivered via the cloud, that’s simple, affordable and flexible for any financial institution tackling any market opportunity.”

Co-Founded by Carnegie Mellon grads, CEO Eugene Danilkis, COO Frederik Pfisterer and Customer Success Manager Sofia Nunes, Mambu’s mission indicates the belief “that people and businesses should have ubiquitous access to financial services to help them pursue economic opportunities. [Mambu] does this by providing world-class banking technology built in and delivered via the cloud, that’s simple, affordable and flexible for any financial institution tackling any market opportunity.”

Prior to co-founding Mambu and its leading product development and strategy, Danilkis, with his background Computer Science and Design, led software engineering efforts for the robot control software on the International Space Station as well as a year-long microbanking research project in Africa. I recently caught up with Danilkis via email to discuss Mambu, financial disruption and the future of P2P lending. Our interview follows:

Erin: Please comment on how modern technology threatens traditional banking technology and the rise of digital disruptors.

Eugene: Banking used to hold many barriers to entry for new entrants due to regulatory, distribution and

technology challenges. But changes in the ecosystem are opening up opportunities for new players via additional competition and potential disruption. For instance, acquiring and installing the software required to launch a financial institution was previously a very expensive and slow process. Organizations would pour in millions of dollars before acquiring a single customer or testing out their product-brand-market fit in the real world. The new wave of disruptors is focusing on smaller subsets of products instead of trying to launch full-feature retail banking solutions and is able to leverage cloud infrastructure and flexible scalable platforms like Mambu through which their businesses can go to market quickly and more affordably. Their reduced costs and greater flexibility enable them to be more nimble in the market and eat away at banks’ traditionally high-margin businesses by providing better services at lower costs with more targeted marketing and messaging.

Erin: What concerns do you believe exist around secure banking transactions and why?

Eugene: For end-clients, anonymity and security are naturally key concerns as more and more of the process becomes digitized. Organizations need to ensure they can protect their clients’ privacy both from internal as well as external threats. Establishing security processes, internal controls and being able to

allocate top-level resources to ensure all reasonable measures are taken is necessary. When working with outsourced providers (both cloud software and infrastructure) those providers need to ensure they are clear of levels of responsibility and align their security protocols with internal processes all the way from the physical data infrastructure to governance controls.

Ensuring security is an ongoing process and institutions are pooling their resources into common providers, since the best people and best practices in physical data security give them the best chance to defend themselves from attackers. This is especially true for smaller and mid-sized institutions that don’t have the resources or experience to be able to do this in-house like their larger counterparts.

Erin: How can existing banks disrupt their own bank technology through innovative rollouts in emerging markets?

Eugene: Emerging markets provide two unique opportunities: first, they are a vastly underserved with a

robust demand to be met and second, they provide the opportunity to experiment with new technology and processes. By launching new products and services in these markets and rethinking the banking service experience to leverage new channels, banks have a chance to get away from their high internal cost base and complex IT infrastructure and start with a blank slate. Experiments and models which are successful here can then prove to be a strong case study for increased adoption within the existing business unit down the road.

Erin: How can Mambu help power the Peer to Peer lending industry? How does and will Mambu fill a needed niche in this market?

Eugene: P2P lenders have to deal with many of the same challenges as other lenders do, including being able to design and adjust their products, track customers, service loans, collect on outstanding repayments,

report on accounting, and so on. Choosing to build this part of the business in-house can be very time-consuming and costly to maintain. It also doesn’t add unique value to the business since computing interest rate tables, fee structure or tracking journal entries doesn’t differentiate one P2P lender from another. Mambu can help this industry by providing them the platform to manage their loan and deposit portfolios and allow them to use our APIs to build their unique P2P models on top while also integrating with other cloud products. This enables them to put their valuable engineer efforts into building our their lender and investor customer experiences while gaining a lot of flexibility in the sort of products they can offer to their borrowers and the workflows and automations supporting it.

Erin: What about Bitcoin? Are you moving into that space as well?

Eugene: Bitcoin is interesting in that it can be both a currency and a technology and we are starting to see

the first wave of bitcoin-based lending organizations emerge. From that perspective, bitcoin lenders will naturally be digital-only and, as their businesses become more complex, will need to manage their loan and deposit portfolios like other financial institutions.

Erin: Mambu is big in Microfinance; how easily can your platform scale? What about powering more “traditional” banks?

Eugene: Mambu works with both ‘traditional’ banks in emerging countries like Jamaica National and Banco Macro as well as smaller for- and non-profit microfinance institutions like Opportunity International and other new alternative, non-bank financial service providers like Savvy Loans, Kueski, and Lenddo. What they all have in common is that they are servicing the needs of the over two billion underbanked consumers and

over 250 million underserved micro, small and medium enterprises. In developed markets such as the United States and the United Kingdom you’re seeing this sector serviced more by P2P providers, however there’s an even larger opportunity in emerging economies who have weaker banking networks and infrastructure and more underserved businesses and individuals.

From a technology perspective, we are already active in thirty countries, including Mexico, China, the UK and the Philippines, where all of our clients are running on the same platform. With a multi-billion dollar market opportunity of lending we plan to be the service provider of choice for any organization that is either transforming their business to the digital era or launching innovative new products and services and wants to be unshackled from expensive and slow legacy technology. From this perspective, we are agnostic if the service providers are microfinance, startups, credit unions or banks as they address the same fundamental market needs.

Erin: Compliance and regulations are challenging in many different countries, how does Mambu manage a diverse and complicated global regulatory environment?

Eugene: Flexibility in our core product allows organizations to set up various products, internal controls, workflows, reports and accounting rules to comply with regulatory requirements. As we work with the ambiguous data sovereignty requirements on deposit-taking institutions we can also provide multiple cloud environments to meet specific regulatory requirements. We currently manage three such clouds and foresee supporting more in the future from the public cloud, to in-country community clouds to private clouds for larger financial institutions.

Erin: Can you really launch a bank in 7 minutes?

Eugene: Organizations using Mambu really can launch new loan and deposit products or modify existing

ones with new workflows in a fraction of the time it would have taken them with legacy technology. They can also integrate to new channels for origination, new data sources for underwriting and payment channels at a fraction of the cost and time it would have taken with traditional core banking solutions. Naturally, launching such services requires the appropriate level of planning, processes and workflows. With Mambu though, the technology is no longer a hurdle but instead an enabler of these new models and products.

Erin: What do you consider the best practices for data security in the cloud that includes developing a robust development cycle that includes security analysis, performance measurement, data isolation and regular debugging? Which other platforms are leading this exploration?

Eugene: When it comes to data security in the cloud, isolation of client data between tenants is a must to allow for clear data and performance isolation and security. Our security protocol at Mambu includes everything from real-time data mirroring to 30-day transaction-based rollbacks and full audit and log trails on user actions. At Mambu, data isolation is ensured by tying a user’s requests to their organization’s

database. We then impose a two factor identification for our internal administrative actions and enable our organizations to do the same for their users and administrators. Performance reliability is then managed by scalable and real-time monitored load balancers and application and database servers in multiple distributed and redundant data centers. Security analysis is conducted on an ongoing basis alongside frequent data backups and virus scans as well as bi-annual external penetration testing (Mambu is Plynt Certified). Most of the security measures we have in place are commonly the adopted best practice across the industry, and we keep our customers at the leading edge and rapidly respond to publicly known vulnerabilities.

Erin: How would you define Mambu’s quality assurance process from automated testing to a sandbox environment?

Eugene: Mambu has multiple levels of quality assurance which starts from the early requirement definition and validation both internally as well as with various stakeholders including our partners, customers and

regulators. From there all issues are developed and reviewed by at least one software engineer in parallel to a suite of test cases being prepared and also peer reviewed. With every development cycle we run a suite of both automated unit tests as well as application-level manual and automated tests. Upon a release we re-run all the suites including a full regression, and release a preview version to a sandbox environment. In this environment our customers and partners can explore the latest changes before we release to their production environment. We take a snapshot of all data at various points in this cycle including right before the final release to ensure we could always roll back to a previous version if was ever required.

Erin: How does Mambu allow P2P lending platforms to build apps into Mambu, allowing them to integrate their P2P activity with their other financial services? How have you helped your P2P clients expand their services?

Eugene: We allow our customers to build apps on top of Mambu much like Salesforce or Facebook allow custom-build applications. The application developers register their applications with Mambu and leverage our various integration points, suite of APIs and Webhook notification for a tight integration into Mambu. This allows for easy extensibility of the platform and a streamlined and simple user experience.

Erin: P2P lending has its own unique challenges and opportunities in the wake of an environment increasingly focused on crowd finance; please elaborate on both as they relate to innovation and security.

Eugene: P2P lenders still hold the deposits (or investments) of clients and need to provide responsible lending to their borrowers. In this sense, they shouldn’t be seen above the regulatory framework. Also

because of the lower cost of capital and leveraging of digital technology we are quickly seeing many new entrants into the market. At the end, their biggest challenge will be marketing to and appropriately servicing their primary customers (the borrowers). They need to have the product mix and understanding of customers’ unique needs, especially for SME lending to be able to support their growth, service them and manage their portfolio risks. In this sense, their primary challenge is not so different from any other lender, be it a bank or microfinance organization. However they act with increased access to technology, usually with far more transparency and far better automation than the incumbents. Those that do a good job of providing responsible borrowing and secure investing/saving for their deposits will have no problem finding additional capital to grow their businesses.

Erin: Who are Mambu’s peers and how do you see Mambu as superior?

Eugene: Alternatives such as Cloud Lending, Five Degrees, Oradian and a few other cloud-based banking platform providers have begun emerging in the past couple of years. We are also increasingly competing with traditional core banking providers like Temenos, FIS and Oracle for various deals. Compared to other new providers, Mambu has a more flexible product, more flexibility in infrastructure and a unique business

model. Our product and platform has now been proven by nearly 110 organizations around the world and we continue to rapidly innovate and grow.

For the traditional core banking providers, Mambu is a true cloud-business which applies not only to our technology but our business model and service. We are not a piece of software to buy but work closely with our customers as partners. We assist with business analysis, implementation, support and collaborative product roadmapping all at a fraction of the time and cost of traditional providers. Importantly, we empower our customers to leverage the technology themselves, from changing workflows or product rules to leveraging developers to quickly build on top of Mambu without having to depend on expensive consultants or proprietary standards.

Erin: What are your thoughts on the next two or three years for P2P lending and digital disruption? How and where will Mambu further expand? Where do you see Mambu in five years? ten years?

Eugene: Although active in thirty countries, we see ourselves at just the start of our journey. Over the next few years we’ll have a deeper focus on a few specific geographies while making stronger partnerships with

other complementary service providers in the space who can help bring much-needed technology to emerging countries. In the western world I see us powering more and more new digital-first products coming from both new entrants as well as incumbents who are looking to grow and expand without the drag of legacy infrastructures.

In the next five to ten years we think we’ll see rapid growth in emerging economies and a need for new financial products provided via new channels. Existing institutions will launch their own new services or transform parts of their businesses to meet the market need and compete with their peers as well as the wave of new entrants. I see Mambu powering both sides of this transformation and digitization as the ‘missing middle’ of undeserved SMEs and consumers is addressed by the market.