And Regulation A+’s Forgotten Crowdfunding Cousin Quietly Comes to Life in Congress

Some History Lessons

Though some may quibble over the details, June 19, 2015, was an historic day in U.S. regulatory history, at least as far as raising capital for small businesses is concerned – the first day that Regulation A+ became operable.

Though some may quibble over the details, June 19, 2015, was an historic day in U.S. regulatory history, at least as far as raising capital for small businesses is concerned – the first day that Regulation A+ became operable.

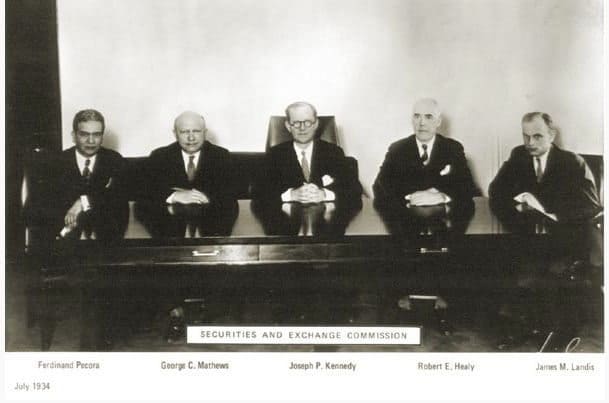

Ever since 1933, the only lawful way a company could sell a piece of the action to a would be shareholder has been to either register the offering with the SEC, or find a suitable exemption. For smaller companies this has proven to be a challenging task, especially if companies wanted to bring within its fold prospective investors who were not financially blessed to be considered “accredited investors”: those making at least $200k/yr, or millionaires.

Until recently the cost of a full blown IPO was simply out of reach for most smaller companies – with costs often running into the millions of dollars. Though there were some early attempts by the SEC to address this dilemma, until the passage of the JOBS Act of 2012 there were simply no good options. The SEC had the best of intentions when, back in 1936, it passed its very first regulation – appropriately tagged with the moniker “Regulation A”. Technically, an exemption from registration of an offering, it allowed small companies to sell their shares to the general public through an abbreviated SEC registration and review process which even dispensed with the need for audited financial statements and with no ongoing reporting obligations. Sounds good –right? Well, not so fast.

Until recently the cost of a full blown IPO was simply out of reach for most smaller companies – with costs often running into the millions of dollars. Though there were some early attempts by the SEC to address this dilemma, until the passage of the JOBS Act of 2012 there were simply no good options. The SEC had the best of intentions when, back in 1936, it passed its very first regulation – appropriately tagged with the moniker “Regulation A”. Technically, an exemption from registration of an offering, it allowed small companies to sell their shares to the general public through an abbreviated SEC registration and review process which even dispensed with the need for audited financial statements and with no ongoing reporting obligations. Sounds good –right? Well, not so fast.

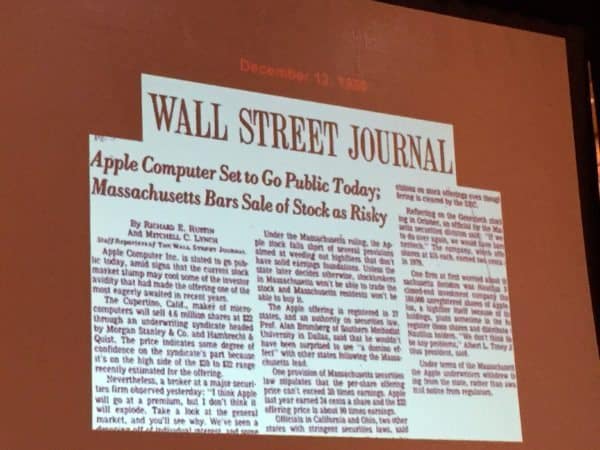

You see, the 50 states retained their ability to require these same companies to file their offering materials in their states – becoming subject to a multiple layers of regulatory review. And unlike an SEC review, which focuses only on assuring full disclosure to investors, the states retained the unfettered discretion to bar the offering in their respective states if it deemed the offering unsuitable for its residents or otherwise too risky.

In 1980 the Apple Computer IPO became the poster child for what was wrong with allowing an additional layer of so called state “Blue Sky” review. Massachusetts and more than a dozen other states barred non-institutional investors from participating in this IPO, viewing it as another “hot” IPO – too hot for the ordinary investor. State regulators are still blushing about this offering – seems that the only investors that got burned were the ones who didn’t participate, losing out on astronomical returns. Though Congress partially addressed this problem in 1996, by removing from the grasp of state regulators IPO’s listing directly to a national exchange, such as Nasdaq or the NYSE, no such luck for companies too small to meet national exchange standards – relegated to the over the counter market.

In 1980 the Apple Computer IPO became the poster child for what was wrong with allowing an additional layer of so called state “Blue Sky” review. Massachusetts and more than a dozen other states barred non-institutional investors from participating in this IPO, viewing it as another “hot” IPO – too hot for the ordinary investor. State regulators are still blushing about this offering – seems that the only investors that got burned were the ones who didn’t participate, losing out on astronomical returns. Though Congress partially addressed this problem in 1996, by removing from the grasp of state regulators IPO’s listing directly to a national exchange, such as Nasdaq or the NYSE, no such luck for companies too small to meet national exchange standards – relegated to the over the counter market.

The picture for small investors and small companies changed dramatically in 2012, when Congress enacted Title IV of the JOBS Act, quickly nicknamed “Regulation A+, removing from state review small IPO’s, up to $50 million, so long as all of the investors were “qualified investors” – a determination Congress left to the SEC. To the shock and dismay of Massachusetts and many other state regulators, the SEC’s final implementing rules declared all investors to be “qualified”: for non-accredited investors this meant that their investment in a Regulation A+ IPO would be limited to the greater of 10% of their annual income, or their net worth, excluding their principal residence. While many small business and investor advocates cheered, others cried foul – most notably Massachusetts, who through its chief securities administrator, promptly filed a lawsuit to permanently block the implementation of Regulation A+.

The picture for small investors and small companies changed dramatically in 2012, when Congress enacted Title IV of the JOBS Act, quickly nicknamed “Regulation A+, removing from state review small IPO’s, up to $50 million, so long as all of the investors were “qualified investors” – a determination Congress left to the SEC. To the shock and dismay of Massachusetts and many other state regulators, the SEC’s final implementing rules declared all investors to be “qualified”: for non-accredited investors this meant that their investment in a Regulation A+ IPO would be limited to the greater of 10% of their annual income, or their net worth, excluding their principal residence. While many small business and investor advocates cheered, others cried foul – most notably Massachusetts, who through its chief securities administrator, promptly filed a lawsuit to permanently block the implementation of Regulation A+.

Los Angeles Grabs the Regulation A+ Opening Day Headlines

Though, predictably, the national media covered the Regulation A+ opening day with the usual array of stories, perhaps the industry participant grabbing the most headlines was a Santa Monica based JOBS Act intermediary – StartEngine, led by seasoned entrepreneur Ron Miller, boasting 4 companies “testing the waters” on the first day Regulation A+ went into effect, to gauge investor interest in their proposed upcoming Regulation A+ offerings. Included in the mix was a private company, Elio Motors. Elio says it’s hoping to manufacture and sell a new line of ultra high mileage vehicles.

Though, predictably, the national media covered the Regulation A+ opening day with the usual array of stories, perhaps the industry participant grabbing the most headlines was a Santa Monica based JOBS Act intermediary – StartEngine, led by seasoned entrepreneur Ron Miller, boasting 4 companies “testing the waters” on the first day Regulation A+ went into effect, to gauge investor interest in their proposed upcoming Regulation A+ offerings. Included in the mix was a private company, Elio Motors. Elio says it’s hoping to manufacture and sell a new line of ultra high mileage vehicles.

Seems that if Elio is successful in achieving its goals, it will be the poster child for what Congress envisioned when it passed the JOBS Act. Its proposed Regulation A+ offering follows on the heels of an earlier private placement, utilizing another JOBS Act provision, allowing companies to publicly offer their securities without SEC registration – but only if all investors were rich enough to be considered “accredited investors.”

According to Elio’s June 19 Press Release:

“Elio Motors will manufacture the vehicle in Shreveport, Louisiana, at a former General Motors facility that made vehicles such as the Hummer H3 and Chevy Colorado. When the Elio goes to market, it intends to create 1,500 jobs at the facility. In addition, the Elio is targeted to use 90 percent North American content, which could create another 1,500 jobs at its supplier partner companies. These manufacturing jobs will in turn create approximately 18,000 indirect jobs across the country.”

Imagine – jobs – U.S. jobs!

But the Biggest JOBS Act “Headlines” Were Made Before Reg A+ Opening Day

Ironically, what could have been the biggest JOBS Act headlines seemingly went entirely unnoticed by the mainstream press.

You see, one of the big benefits of Regulation A+ is that it allows a company to “test the waters” by publicly soliciting potential investor interest – before it hires a team of expensive lawyers, accountants and other professionals to prepare its Offering Circular filed with the SEC. There are only two simple rules to follow:

(1) be sure to include the required SEC legend on these materials, indicating that these indications of interest are non-binding – and

(2) file these testing the waters materials with the SEC if and when a company files a full blown offering statement with the SEC.

Seems that the first company to use the Regulation A+ testing the waters provisions may have been another LA area company – based in Compton, a city made legendary since the 1980’s in hip hop and rapper music, and home to some of Los Angeles’ most infamous gangs. According to a press release issued by Compton based Punch TV Studios:

Seems that the first company to use the Regulation A+ testing the waters provisions may have been another LA area company – based in Compton, a city made legendary since the 1980’s in hip hop and rapper music, and home to some of Los Angeles’ most infamous gangs. According to a press release issued by Compton based Punch TV Studios:

“The revolutionary multimedia conglomerate Punch TV Studios and URBT (OTC: URBT), today announced it will raise $50 Million dollars in the first round of seed funding. By utilizing President Barack Obama’s JOBS Act; Regulation A+, Punch TV Studios is poised to be one of the first companies to begin raising money with this funding mechanism. The company plans to offer 25 million shares of stock at $2.00 per share directly to the public.”

“By allowing the public to invest directly into Punch TV Studios, it is now possible for the little guy investor to become stockholders and active participants in our success. It is of the utmost importance, that we are able to empower the members of the urban community, who before the JOBS Act would not have had this opportunity,’ says CEO Joseph Collins.”

The Press Release was conveniently linked to Punch TV’s home page, where investors could indicate the amount of their interest in the proposed offering, with a minimum investment of $500.

“Potential investors may register at now ( Click Here To Register ), to be among the first to purchase Punch TV Studios stock, as the company begins to test the waters in states that are applicable.”

What caught my eye on the Punch TV Press Release was something that I thought could only happen in a Hollywood script: The Press Release was issued on June 11, eight days before Regulation A+ took effect! Seems that this company never got the memo advising that Regulation A+, including its testing the waters provisions for this proposed $50 Million offering, did not go into effect until June 19. I also couldn’t locate the new SEC testing the waters legends –advising the public about the non-binding nature of the solicitation. So I did some more digging to see if perhaps I should be one of the first to get in early to support a Los Angeles area business.

What caught my eye on the Punch TV Press Release was something that I thought could only happen in a Hollywood script: The Press Release was issued on June 11, eight days before Regulation A+ took effect! Seems that this company never got the memo advising that Regulation A+, including its testing the waters provisions for this proposed $50 Million offering, did not go into effect until June 19. I also couldn’t locate the new SEC testing the waters legends –advising the public about the non-binding nature of the solicitation. So I did some more digging to see if perhaps I should be one of the first to get in early to support a Los Angeles area business.

The first challenge I faced was to figure out exactly which company I would be investing in for the Reg A+ offering – was it Punch TV, presented on its website as a “startup,” or URBT – or were they one and the same? (the June 11 Press Release referred to “revolutionary multimedia conglomerate Punch TV Studios and URBT (OTC: URBT) will raise $50 Million Dollars”). So I wasn’t sure who would be issuing this Regulation A+ stock or how URBT fits into this “revolutionary multimedia conglomerate” or the Reg A+ raise. So I surfed over to the SEC website to see what I could find out about “URBT”.

Well it seems that URBT (shown on the SEC website as Urban Television Network Corp.) hasn’t filed anything with the SEC since December 2014. In fact, it stopped filing its quarterly and annual SEC reports altogether way back in 2007, though the SEC site reflects that URBT remains subject to SEC reporting obligations. My curiosity further piqued by this dearth of information, I then surfed over to the Nevada Secretary State to see what they had to say about URBT. Seems that according to the State of Nevada records, URBT doesn’t even legally exist anymore – the official records reflecting that its corporate charter had been revoked. Not quite what I expected to see, as a November 2014 SEC filing seemed to indicate that URBT was alive and well as a Nevada corporation.

Surprisingly, none of this seemed to dampen the enthusiasm for URBT stock the day the Press Release was issued, rising 250% on the day of the news, with volume of more than 24 million shares, closing out the trading day at $0.0027 (yes, for the cost of a Big Mac you could buy around 1,000 URBT shares). Punch TV Studios was so thrilled, it posted this on its website to mark the occasion:

Surprisingly, none of this seemed to dampen the enthusiasm for URBT stock the day the Press Release was issued, rising 250% on the day of the news, with volume of more than 24 million shares, closing out the trading day at $0.0027 (yes, for the cost of a Big Mac you could buy around 1,000 URBT shares). Punch TV Studios was so thrilled, it posted this on its website to mark the occasion:

In June Punch TV URBT Stock Rose 250%

“We are so excited that the invest community has taken a major interest in our company stock symbol “URBT” . After making the announcement that Punch TV Studios plans to raise $50 million in the third quarter of this year, the market got excited and traded more than 27 million shares of stock. In one call to our CEO Joseph Collins, from a long term URBT stockholder he was elated to see his invest account jump by more than $3,000.00.”

“The thing that surprised me the most,” says Mr. Collins, ” is that the average investment by the new investors was only around $50.00, this is so good to know because this is the type of in investors that we want.”

Thankfully, Congress provided that before any company can legally take your hard earned money into its coffers in a Regulation A+ offering, it will need to make a detailed informational filing with the SEC, replete with audited financial statements and descriptions of related party transactions, and then have it cleared by the SEC Staff and provide it to all prospective investors.

Thankfully, Congress provided that before any company can legally take your hard earned money into its coffers in a Regulation A+ offering, it will need to make a detailed informational filing with the SEC, replete with audited financial statements and descriptions of related party transactions, and then have it cleared by the SEC Staff and provide it to all prospective investors.

And thankfully, the SEC has the authority, if not the responsibility, to shut down SEC registered companies that do not meet their reporting obligations for extended periods of time. Seems by all appearances that URBT slipped through the cracks on that score.

And for the Biggest Missed Headline – Title III Investment Crowdfunding Shows Signs of Life In D.C.!

Though I am not planning to weigh in on the strength or merits of any Reg A+ security, I certainly want to weigh in on what should have been one of the biggest JOBS Act headlines last week!

Though I am not planning to weigh in on the strength or merits of any Reg A+ security, I certainly want to weigh in on what should have been one of the biggest JOBS Act headlines last week!

For those of you who follow my articles, and may sometimes conclude that I am being too harsh on the SEC – well, there are some folks in Washington, D.C. who can be even harsher. Pulling no punches, the House Appropriations Committee, the most powerful Committee in the House of Representatives, last week weighed in on what the SEC ought to be doing with those long overdue investment crowdfunding rules mandated by the JOBS Act – the rules that would make it possible for startups to raise up to $1 million from unaccredited investors without any SEC or state review whatsoever.

In what can fairly be described as one of the more powerful smack downs of the SEC since the JOBS Act was passed, last week the House Appropriations Committee voted out of Committee its 2016 federal budget appropriations bill – with a stern message to the SEC. Contained in the 168 page Report were 198 words – which undoubtedly will be music to the ears of investment crowdfunding supporters – chastising the SEC for not getting the JOBS Act Title III proposed crowdfunding rules right – declaring the proposed rules “inoperable.” Those of you who have been following SEC crowdfunding rulemaking closely will notice that the Appropriations Committee criticism bears a striking resemblance to points I made in an article which first appeared in CrowdfundInsider on January 9, 2014, entitled “SEC’s Proposed Crowdfunding Regulations: Six Deadly Sins,” an article cited with approval by SEC Commissioner Daniel Gallagher in a public address delivered on March 27, 2015.

And to show that the Appropriations Committee meant business, these official words of concern were prefaced by a denial of the more than $200 million budget increase requested by the SEC for fiscal 2016 – leaving the proposed SEC budget allocation unchanged from the prior year.

Following is the pertinent excerpt from the Appropriations Committee Report, voted out of Committee last week by a vote of 20-10 – now on its way to a vote on the House floor.

“Crowdfunding.—The Committee is concerned that the SEC’s proposed crowdfunding rule by the SEC will be inoperable. The Committee believes that the Commission has an obligation to consider the effects of the proposed rule upon the efficiency, transparency, and affordability for small companies and investors seeking crowdfunding offerings. Impairing or restricting the use of crowdfunding offerings could potentially result in limiting small businesses from securing much needed, early-stage capital formation and liquidity. The Committee believes that before the final crowdfunding rule is promulgated, the Commission should ensure that the regulations neither disproportionately stifle small company growth, nor create barriers to entry for investors, thereby hindering diversified investment options. Specifically, the final rules should carefully consider how the proposed changes would affect the following:

“Crowdfunding.—The Committee is concerned that the SEC’s proposed crowdfunding rule by the SEC will be inoperable. The Committee believes that the Commission has an obligation to consider the effects of the proposed rule upon the efficiency, transparency, and affordability for small companies and investors seeking crowdfunding offerings. Impairing or restricting the use of crowdfunding offerings could potentially result in limiting small businesses from securing much needed, early-stage capital formation and liquidity. The Committee believes that before the final crowdfunding rule is promulgated, the Commission should ensure that the regulations neither disproportionately stifle small company growth, nor create barriers to entry for investors, thereby hindering diversified investment options. Specifically, the final rules should carefully consider how the proposed changes would affect the following:

(1) the burden and costs associated with providing audited or reviewed financial statements;

(2) the harm caused by increasing liability for the platforms, portals, and intermediaries’ and thereby their ability to curate and effectuate crowdfunding offerings;

(3) restricting the economic interests of the intermediaries from revenue derived from crowdfunding offerings;

(4) burdensome disclosure report requirements; and (5) the investors and companies’ capacity to aggregate and diversify through investment vehicles to heighten investor and issuer protections.”

My takeaway on this: I would be most surprised if we do not see final, (more) user friendly Title III investment crowdfunding rules by year end.

Samuel S. Guzik, a Senior Contributor to Crowdfund Insider, is a corporate and securities attorney and business advisor with the law firm of Guzik & Associates, with more than 30 years of experience in private practice. Guzik is also the President and Board Chairof the Crowdfunding Professional Association. A nationally recognized authority on the JOBS Act, including Regulation D private placements, investment crowdfunding and Regulation A+, he is and an advisor to legislators, researchers and private businesses, including crowdfunding issuers, service providers and platforms, on matters relating to the JOBS Act. As an advocate for small and medium sized business he has engaged with major stakeholders in the ongoing post-JOBS Act reform, including legislators, industry advocates and federal and state securities regulators. In 2014, some of his speaking engagements have included leading a Crowdfunding Roundtable in Washington, DC sponsored by the U.S. Small Business Administration Office of Advocacy, a panelist at the MIT Sloan School of Business 2014 Crowdfunding Roundtable, and a panelist at a national bar association event which included private practitioners, investor advocates and officials of NASAA. His articles on JOBS Act issues, including two published in the Harvard Law School Forum on Corporate Governance and Financial Regulation, have also served as a basis for post-JOBS Act proposed legislation. Recently he was cited by SEC Commissioner Daniel M. Gallagher in a public address for his advocacy on SEC regulatory reform for small business. He is admitted to practice before the SEC and in New York and California. Guzik has represented a number of public and privately held businesses, from startup to exit, concentrating in financing startups and emerging growth companies. He also frequent blogger on securities and corporate law issues at The Corporate Securities Lawyer Blog.

Samuel S. Guzik, a Senior Contributor to Crowdfund Insider, is a corporate and securities attorney and business advisor with the law firm of Guzik & Associates, with more than 30 years of experience in private practice. Guzik is also the President and Board Chairof the Crowdfunding Professional Association. A nationally recognized authority on the JOBS Act, including Regulation D private placements, investment crowdfunding and Regulation A+, he is and an advisor to legislators, researchers and private businesses, including crowdfunding issuers, service providers and platforms, on matters relating to the JOBS Act. As an advocate for small and medium sized business he has engaged with major stakeholders in the ongoing post-JOBS Act reform, including legislators, industry advocates and federal and state securities regulators. In 2014, some of his speaking engagements have included leading a Crowdfunding Roundtable in Washington, DC sponsored by the U.S. Small Business Administration Office of Advocacy, a panelist at the MIT Sloan School of Business 2014 Crowdfunding Roundtable, and a panelist at a national bar association event which included private practitioners, investor advocates and officials of NASAA. His articles on JOBS Act issues, including two published in the Harvard Law School Forum on Corporate Governance and Financial Regulation, have also served as a basis for post-JOBS Act proposed legislation. Recently he was cited by SEC Commissioner Daniel M. Gallagher in a public address for his advocacy on SEC regulatory reform for small business. He is admitted to practice before the SEC and in New York and California. Guzik has represented a number of public and privately held businesses, from startup to exit, concentrating in financing startups and emerging growth companies. He also frequent blogger on securities and corporate law issues at The Corporate Securities Lawyer Blog.