By now, you’ve more than likely heard about Goldman Sachs’ plans to launch an online consumer lending unit as early as next year. Yes, Goldman Sachs, the 146-year-old Wall Street giant best known for focusing on the 1%, is making a bet on Main Street with plans to offer personal and small business loans over the Internet. In the process, the bank will compete with marketplace lenders such as Lending Club, Prosper and OnDeck.

I can’t say Goldman’s move surprised me. For a while, I’ve expressed that online lending platforms have been on to something that big banks were just not. More recently, however, established financial players have found fruitful opportunities in partnering with new players. Some of the best examples of this convergence of old finance with new finance are the partnerships between Citigroup and Lending Club and between RBS and Funding Circle. In each case, the big banks offer lower cost of capital and liquidity at scale (what I’ll call the “financial back-end”), whereas the marketplace lenders bring customized products, streamlined technology and responsive customer service (what I’ll call the “financial front-end”).

I can’t say Goldman’s move surprised me. For a while, I’ve expressed that online lending platforms have been on to something that big banks were just not. More recently, however, established financial players have found fruitful opportunities in partnering with new players. Some of the best examples of this convergence of old finance with new finance are the partnerships between Citigroup and Lending Club and between RBS and Funding Circle. In each case, the big banks offer lower cost of capital and liquidity at scale (what I’ll call the “financial back-end”), whereas the marketplace lenders bring customized products, streamlined technology and responsive customer service (what I’ll call the “financial front-end”).

What is perhaps most interesting about Goldman’s move is that, as far as we know now, the bank seems to be entering uncharted territory entirely on its own. Despite never having run a mainstream consumer-facing business as best we can tell, Goldman has several key factors working in its favor, not the least of which are their cost of capital, brand recognition, and ability to attract cream-of-the-crop talent. In May, the bank announced the hiring of Harit Talwar, the former head of Discover Financial Services’ U.S. cards division, to lead the planned online lending unit that is currently a team of six and is expected to have a team of about 100.

What is perhaps most interesting about Goldman’s move is that, as far as we know now, the bank seems to be entering uncharted territory entirely on its own. Despite never having run a mainstream consumer-facing business as best we can tell, Goldman has several key factors working in its favor, not the least of which are their cost of capital, brand recognition, and ability to attract cream-of-the-crop talent. In May, the bank announced the hiring of Harit Talwar, the former head of Discover Financial Services’ U.S. cards division, to lead the planned online lending unit that is currently a team of six and is expected to have a team of about 100.

Even with these factors at play, though, Goldman faces a crucial set of challenges that make many others wonder if they have what it takes to succeed in a space that is dominated by over 150 startups in the U.S. – two of which have recently gone public, with Goldman managing Lending Club’s IPO offering last December. For one, it will take massive effort to encourage everyday consumers to disassociate Goldman as one of the country’s most elite traditional financial institutions.

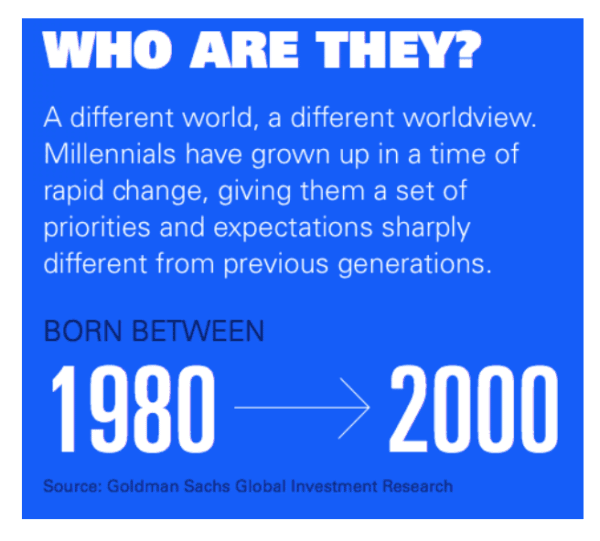

Goldman can – and most likely will – focus on a wide range of consumers, but if the bank is serious about building a sustainable platform over the long term, its online consumer lending effort will need to win with millennials, our country’s largest generation. There are over 80 million millennials in the U.S. alone, representing about a quarter of the entire population, with $200 billion in annual purchasing power. And that purchasing power is only expected to grow.

Compared with many existing marketplace lending platforms, the jury is still out on whether Goldman can have the same level of success in earning the trust of millennials, who want to do business with companies whose values they share. A lot of this has to do with general mistrust of big banks following the financial crisis and the strong desire for alternative tech-enabled financial solutions. One of my favorite statistics, from the Millennial Disruption Index, says that 71% of millennials would rather go to the dentist than listen to what banks are saying. Further still, 33% believe they won’t need a bank at all. Also, just this week, the 2015 Makovsky Wall Street Reputation Study found that 49% of millennials said they would consider using financial services options from companies like Google, Apple or Amazon, compared to just 16% of older consumers.

Compared with many existing marketplace lending platforms, the jury is still out on whether Goldman can have the same level of success in earning the trust of millennials, who want to do business with companies whose values they share. A lot of this has to do with general mistrust of big banks following the financial crisis and the strong desire for alternative tech-enabled financial solutions. One of my favorite statistics, from the Millennial Disruption Index, says that 71% of millennials would rather go to the dentist than listen to what banks are saying. Further still, 33% believe they won’t need a bank at all. Also, just this week, the 2015 Makovsky Wall Street Reputation Study found that 49% of millennials said they would consider using financial services options from companies like Google, Apple or Amazon, compared to just 16% of older consumers.

To be sure, Goldman has been making a concerted effort to understand millennials with content such as this popular infographic. But when it comes to financial services, millennials are a tough crowd. They value speed, simplicity and transparency, which most marketplace lenders are successfully delivering and traditional financial institutions find hard to pull off with legacy technology, corporate malaise and regulatory overhang. And it’s these factors, in addition to others, that keep consumers coming back for more as their financial needs evolve over time. Regardless of the front-end experience that Goldman builds, they will still likely face an uphill battle in building genuine trust among a large number of millennials whose lives (and psyche) were impacted following the financial crisis.

To be sure, Goldman has been making a concerted effort to understand millennials with content such as this popular infographic. But when it comes to financial services, millennials are a tough crowd. They value speed, simplicity and transparency, which most marketplace lenders are successfully delivering and traditional financial institutions find hard to pull off with legacy technology, corporate malaise and regulatory overhang. And it’s these factors, in addition to others, that keep consumers coming back for more as their financial needs evolve over time. Regardless of the front-end experience that Goldman builds, they will still likely face an uphill battle in building genuine trust among a large number of millennials whose lives (and psyche) were impacted following the financial crisis.

It is still too early for anyone to know how this effort will turn out, especially since no one, including Goldman, fully knows the bank’s specific strategy for entering the online lending space. In entering the space, will they choose to build, buy or partner? The outcome will largely depend on how the industry evolves over the next several months and what Goldman learns along the way.

It is still too early for anyone to know how this effort will turn out, especially since no one, including Goldman, fully knows the bank’s specific strategy for entering the online lending space. In entering the space, will they choose to build, buy or partner? The outcome will largely depend on how the industry evolves over the next several months and what Goldman learns along the way.

They will have to translate their knowledge of the online lending space into operational acumen to be a winner. In the end, for any financial services company to be successful, it will come down to earning customers’ trust and serving them in the best possible way. Convincing millennials to trust Goldman will be a key factor in determining their success in the space over the long term.

David Klein is the CEO and co-founder of CommonBond, a student lending platform that lowers the cost of education for borrowers and provides financial returns to investors.

David Klein is the CEO and co-founder of CommonBond, a student lending platform that lowers the cost of education for borrowers and provides financial returns to investors.