Last week Crowdfund Insider shared a report by KPMB/CB Insights that quantified the rocketing venture capital sector – at least in part fueled by a growing population of Unicorns. Today Dow Jones VentureSource chimes in on Europe stating VC capital accumulation more than doubled in Q2 versus Q1 2015. This is a bit of an apples to oranges comparison but the trend is clear, a growing number of investors are on the hunt for the next big thing and it is a global phenomena.

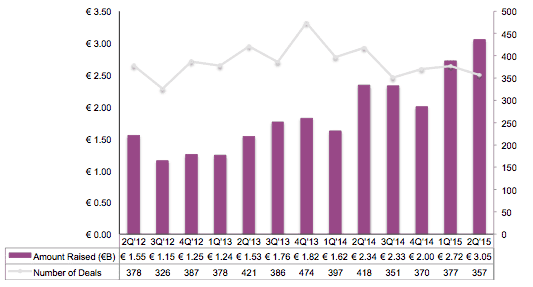

Overall European companies raised over €3 billion for 357 deals during the second quarter an increase of 12% but for fewer deals.

The UK held their most favored nation status for money finding deals. According to the report, 89 deals received €645 million during Q2. The UK took 21% of all equity financing in the quarter even as investment declined versus Q1 2015. Sweden was next on the list taking 19% of the action and raising €596 million getting a nice push from Spotify. German was in 3rd place with 17% and €508 million. France came in 4th with 15% and €449 million.

Most active investor? Bpifrance investment with 12 deals completed.

The report is embedded below.

[scribd id=272720191 key=key-9kpaFExo16gbris6mwUc mode=scroll]