Equity crowdfunding platform Quire partnered with mattermark a few weeks back on a survey asking individuals if they would be interested in investing in early stage companies. The results are telling.

Equity crowdfunding platform Quire partnered with mattermark a few weeks back on a survey asking individuals if they would be interested in investing in early stage companies. The results are telling.

Today, the vast majority of the population has been excluded from investing in startups or early stage companies. The definition of an accredited investor has disenfranchised millions of people as the rule qualifies acceptable investors based on the size of their bank account and not their ability. While this approach is hard to comprehend, there are still policy-makers who defend the decision to enforce these rules. The advent of investment crowdfunding may alleviate part of the issue by opening up the door – a bit. With final rule imminent on Title III of the JOBS Act, interest will only grow.

The Quire / mattermark partnership has just released the results of their survey and their findings indicate that people are very interested in backing startups. According to their results:

- 97% of US respondents would invest in startups given the opportunity

- 58% have never invested in startup

- 71% of respondents live, or work, in a major tech hub like San Francisco, NYC, LA, Boston etc.

- 63% of respondents don’t qualify as Accredited Investors ($200k/year in salary or $1 Million plus in the bank)

- 53% would invest $5000 or less

- 25% less than $1000

- 22% $15,000 or more

- 94% are seeking a financial return BUT

- 59% indicated it was important to support the company’s mission or founder

- Other reasons? 43% said job creation is important

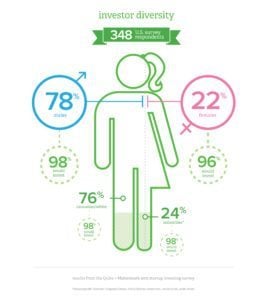

There is a profound lack of diversity in the startup ecosystem. Quire aptly points out; equity crowdfunding may be “the antidote” to the disease. Countless studies indicate little diversification, but much of the issue comes to access to capital and location. With investment crowdfunding, geographic and other handicaps need not diminish opportunity quite so much.

There is a profound lack of diversity in the startup ecosystem. Quire aptly points out; equity crowdfunding may be “the antidote” to the disease. Countless studies indicate little diversification, but much of the issue comes to access to capital and location. With investment crowdfunding, geographic and other handicaps need not diminish opportunity quite so much.

Sure. Investing in early stage companies is a risky endeavor. But risk is a vital portion of the value creation equation. Without risk our capitalist system simply does not work. As highlighted in an article earlier this month, if you had invested $1000 in small company listed on AngelList named a couple years back named Uber – you would be pretty happy right now.

Opportunity and access counts. Crowdfunding can provide it.

See the Quire Survey Findings below.

[scribd id=287295591 key=key-UFdEvM6PLVfkK6G84AQs mode=scroll]