Equity crowdfunding and its success will eventually be measured based off the returns generate for the investors. In the US ,equity crowdfunding is still in its infancy with only accredited crowdfunding having gained some minor traction. In the UK, which boasts a more enlightened regulatory regime, empirical information is more readily available. Granted it still is a very young industry and platforms and issuers continue to iterate and learn from experience. The UK also benefits by the fact that platforms have been allowed to experiment under the watchful eye of the FCA. But several years into the new form of finance AltFi, a data aggregator of equity crowdfunding, has published an interesting report and they are sharing what they have learned.

The research by AltFi is focusing on the “most significant” investment crowdfunding platforms so not all sites are part of the report. These include; Crowdcube, Seedrs, SyndicateRoom, CrowdBnk and Venture Funders. The authors have tracked every campaign from 2011 until September 2015. This includes 431 investment crowdfunding rounds from 367 companies. Note that in the UK, investors benefit from a subsidy in the form of tax breaks. The EIS and SEIS schemes give tax relief (30% and 50% respectively) on the amount invested – a significant governmental program to encourage innovation and job creation.

Some interesting facts:

- The average size of a successful funding round has increased since 2012

- Average company age was 3.32 years

- Companies that raised funding grew employee headcount by 83% thus increasing jobs

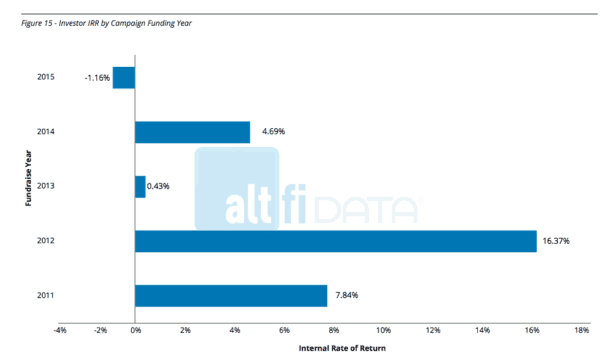

- An internal rate of return (IRR) was generated based of a portfolio date as of September 2015. This delivered a return of 2.17%

- Incorporating EIS & SEIS benefits, as most issuers qualify, boosts IRR to 33.79%

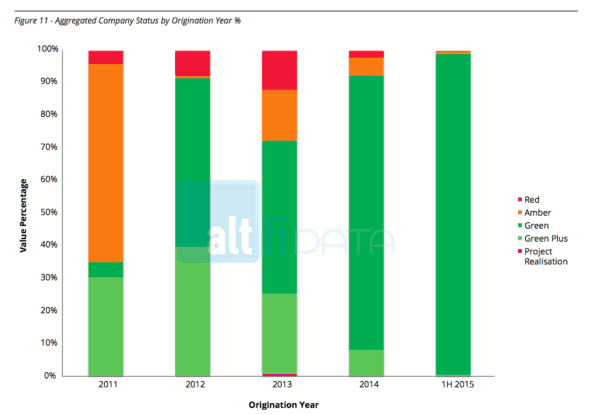

- Of the 367 companies 29 have clearly gone bust

- 41 additional companies have gone dark and assumed to be no longer in business

- The balance, 297, are still operational

Now most SMEs fail and investing in early stage companies is a risky business. While data varies, approximately half of startups are expected fail. A typical Angel or venture capitalist spreads its investment around into a diverse portfolio of educated investments. The few home runs make up for the dogs and the ones that fail. So what do we learn from the AltFi data? It is my opinion the jury is still out. Investing in early stage companies is not done with the expectations of achieving instantaneous returns. This is a marathon – not a sprint. Over the coming years we will start to see if the “crowd” exhibits collective

Now most SMEs fail and investing in early stage companies is a risky business. While data varies, approximately half of startups are expected fail. A typical Angel or venture capitalist spreads its investment around into a diverse portfolio of educated investments. The few home runs make up for the dogs and the ones that fail. So what do we learn from the AltFi data? It is my opinion the jury is still out. Investing in early stage companies is not done with the expectations of achieving instantaneous returns. This is a marathon – not a sprint. Over the coming years we will start to see if the “crowd” exhibits collective  wisdom. At the same time platforms will become better at providing a more efficient and effective investing process. AltFi admirable recommends some best practices for funding platforms. This includes a greater degree of transparency. There is really no need to shy away from the failures. That is how capitalism works. Some companies are going to fail so own it. SyndicateRoom was very forthcoming a few weeks back regarding their first failure. We wish all platforms would follow suit.

wisdom. At the same time platforms will become better at providing a more efficient and effective investing process. AltFi admirable recommends some best practices for funding platforms. This includes a greater degree of transparency. There is really no need to shy away from the failures. That is how capitalism works. Some companies are going to fail so own it. SyndicateRoom was very forthcoming a few weeks back regarding their first failure. We wish all platforms would follow suit.

Investment crowdfunding is still very new. The internet is generating efficiencies for young companies in need of capital and access to investors that were previously denied the opportunity to invest in SMEs. This is a good thing and we expect the industry will mature and improve going forward.