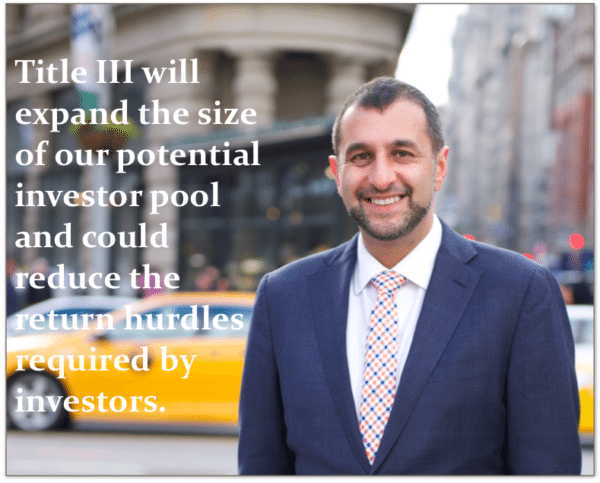

For David Behin, co-founder and CEO of CityFunders, proving real estate investment opportunities for accredited investors, his goal was to help bring real estate investing to the masses. Fast forward to now, and the pool of real estate investors has noticeably increased, with the passage of the JOBS Act, Title III. The new law contributes to CityFunders’ purpose: enabling the majority of people to invest in what was once only available to the elite.

With a potential outpouring of money coming into the marketplace–Title III just received the SEC’s approval in October–David believes that regulation will beneficial for the industry. But Title III’s benefits are, of course, not limited to the real estate crowdfunding; Pensco Trust Company’s CEO believes Title III retail crowdfunding may benefit from IRA money retail crowdfunding may also benefit from IRA money. Steve Wallman last month shared his thoughts on Title III’s equity crowdfunding rules, informed by his background as a former SEC Commissioner.

Recently, Crowdfund Insider caught up with David about his thoughts on what the passage of Title III means for the future of real estate investing and crowdfunding.

Midori Yoshimura: Following the recent passage of Title III, how do you see regulation as benefiting the crowdfunding industry?

David Behin: The new regulations will vastly expand the number of eligible investors.

Midori: What do you see as the short-term and long-term effects of Title III?

David: I don’t expect much to happen in the short term, as these regulations won’t become actionable until mid-2016. Further down the line, I do expect increased regulatory involvement on the industry at large.

Midori: Given the expansion of eligible investors, how much of a bump might we expect to see in funding in the equity crowdfunding marketplace?

David: I think a significant bump will come, but it’s important to remember there will be a learning curve which will affect adoption. On the platform side, this consists of new processes and paperwork, as well as significant fees associated with opening portals up to non-accredited investors. Investors will have to research the different platforms and deals available to find what works best for them.

Midori: In what areas of crowdfunding (ex. technology, real estate, etc.) are we likely to see the greatest increase in new investors? Or is the increase likely to be spread evenly across the board?

David: As a real estate crowdfunding site, we anticipate an influx of real estate investors. Since real estate investing has typically been for the elite, we’ll receive a lot of interest from non-accredited investors looking to invest in previously unavailable opportunities.

Midori: What ways, if any, do you expect Title III to particularly affect real estate crowdfunding?

David: Title III will expand the size of our potential investor pool and could reduce the return hurdles required by investors. It will probably reduce the minimum investments required to invest. Right now CityFunders accepts minimum investments of $5,000, which we will most likely decrease by at least half to accommodate the influx of investors.

Midori: How do you think the expansion of crowdfunding regulations will affect investors and potential investors’ awareness of equity crowdfunding?

David: Continued media coverage of the industry will increase the exposure and awareness, which in turn will lead to more people knowing about this as an investment option.

Midori: Title III will clearly have an impact here in America. What, if any, effects might the legislation have on a more global scale, in terms of influence?

David: I don’t believe Title III will have much of an impact on a global scale. We are already working with foreign investors on our platform, and Title III doesn’t impact our international efforts.

Midori: What rule change are you most pleased to see, and why? Least welcome?

David: We are most pleased with the ability to take investments from investors who are not accredited. We are less pleased with the added cost and paperwork associated with accepting funds from non-accredited investors. While we appreciate the rationale behind the new regulations, we’ll have to decide on a per-project basis if the costs and time associated with the filings are worth the returns.

Midori: Given the feedback on Title III, what crowdfunding-related regulation might we see next?

David: It’s hard to say. The current proposed regulation should satisfy the investment community. The SEC might eventually increase or decrease regulation depending on the experiences of individual investors.