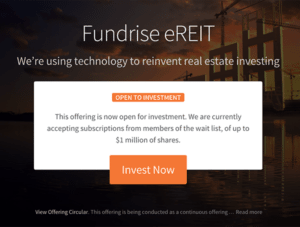

Just one day after announcing plans to open its next investment opportunity, Fundrise debuted what’s dubbed as the world’s first eREIT.

The crowdfunding platform shared:

“Commercial real estate has historically been one of the best performing investment assets. Investors whose portfolios have up to 20% allocated to real estate have outperformed those with only stocks and bonds. Until now, investing in commercial real estate has been restricted by either very large minimum investments or the need to go through middlemen who charge high fees, negatively impacting returns. The Fundrise eREIT has a minimum investment of $1,000 with approximately one-tenth the average fees of similar traditional channels.”

Fundrise noted that the eREIT uses the latest technology to offer investments directly, online. This increased efficiency allows us to reduce overall costs, and provide greater transparency. It is similar to an ETF or mutual fund but instead of investing in stocks, you are investing in what is intended to be a diversified pool of commercial real estate assets.

It was also revealed that the eREIT’s primary objective is to provide investors with a low-volatility income stream of consistent, attractive cash distributions generated from commercial real estate investments. Cash distributions are expected to be paid every quarter.

The eREIT is the sum of a half decade of learnings and includes:

- Radical accountability

- Access for every investor

- Fees roughly 1/10th of Wall Street’s

In regards to why there is a limited amount of investment available at this point in time, Fundrise added:

“This offering is being conducted as a continuous offering pursuant to Rule 251(d)(3) of the Securities Act, meaning that while the offering of securities is continuous, sales of securities may happen sporadically over the term of the offering as we are able to process subscriptions. As a result, the amount of investment the Fundrise eREIT accepts may be restricted at certain times depending on investor interest and the anticipated volume of real estate assets to be originated.

“We expect that this will reduce the amount of time in which investor funds will sit idle as a result of the inherent scarcity in the origination of quality real estate assets. We believe this ‘just in time’ investment model will optimize returns for investors, however it also reduces the window in which sales are occurring. We will notify interested investors prior to additional sales occurring.”

Update: Fundrise’s initial $1 million processing window has exceeded the subscription amount by 503%. As a result, the platform are currently restricting available investment while it complete the initial processing.

Co-founder and CEO of Fundrise, Ben Miller, explained in an email:

“While we are thrilled to see such strong demand, we also understand that this is frustrating for investors who weren’t able to review the eREIT immediately. We intend to resume sales shortly and will notify you before additional sales occur. As a reminder, investments are always accepted on a first-come,first-served basis.”