Fundrise Pushes Pause on Redemptions, Completes Stress Test on Property Portfolio

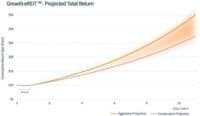

Earlier this month, Fundrise, a real estate investment platform using Reg A+ to provide access to “eREITs and eFunds”, has hit the pause button on redemptions to “maximize cash reserves and ensure the portfolio is in a position of strength.” The goal is to protect… Read More

Read more in: Investment Platforms and Marketplaces, Real Estate | Tagged coronavirus, covid-19, efund, ereit, fundrise